Alcidion Group Ltd has landed one of its most strategically significant wins to date, securing preferred supplier status for a new Electronic Patient Record system at University Hospitals Sussex NHS Foundation Trust. The selection follows a competitive tender process and positions the Australian healthcare technology group at the centre of one of the UK’s largest and most complex hospital networks.

The Trust, known as UHSx, provides hospital and community healthcare services to around one million people across the south of England. It operates seven hospitals, delivers more than 1.5 million outpatient appointments, emergency department visits and surgical procedures each year, and employs close to 20,000 staff. That scale matters. In the UK’s NHS ecosystem, securing a system-wide EPR rollout is not just a contract win. It is a validation of capability, resilience, and clinical credibility.

According to Alcidion’s ASX announcement dated January 8, 2026, the total contract value is still under negotiation but is anticipated to be in excess of A$35 million, depending on the number of modules included, over a minimum seven-year period .

This deal is not a cold start. UHSx is already an Alcidion customer, using the company’s Patientrack solution for observations and assessments. That existing footprint appears to have played a meaningful role in the Trust’s decision to expand the relationship.

Under the proposed agreement, Alcidion will deploy its flagship Miya Precision platform, incorporating Miya Observations and Assessments, which is already live across parts of the Trust. The broader EPR system is designed to give clinicians real-time access to patient records, while improving patient flow and supporting faster, more informed clinical decision-making.

The move reflects a wider NHS push toward unified digital platforms that reduce fragmentation across departments and sites. In large hospital networks like UHSx, multiple disconnected systems can slow care delivery and increase clinical risk. Integrated EPR systems aim to solve that problem.

The purpose behind the EPR procurement is clear and ambitious. UHSx is seeking to implement a single, integrated digital platform that improves patient care, supports regional integration, drives operational efficiency, and delivers long-term social and research benefits.

Those objectives align closely with Alcidion’s core proposition. The Miya Precision platform aggregates meaningful clinical information into centralised dashboards, supports interoperability across systems, and delivers decision support at the point of care.

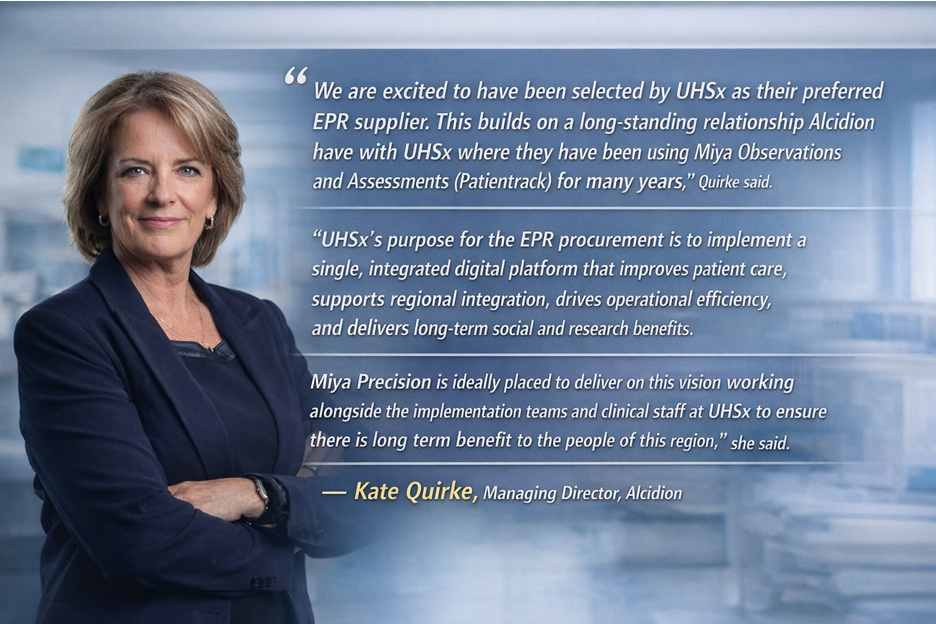

Alcidion Managing Director Kate Quirke said the selection builds on a long-standing relationship between the two organisations.

Source: Alcidion ASX Annoucement

While Alcidion has been selected as preferred supplier, the contract is not yet finalised. The company said it will now move to complete contractual negotiations before commencing deployment.

If finalised as planned, Alcidion is targeting deployment commencement in the fourth quarter of FY26. For large NHS trusts, EPR rollouts are typically multi-year programs, involving staged deployments, clinician training, system integrations and workflow redesign.

That long runway matters. It provides Alcidion with recurring revenue visibility and deep operational embedding within the Trust, making future module expansions and contract extensions more likely over time.

Strategically, the UHSx win strengthens Alcidion’s position in the UK, which has become its most important offshore growth market. The company already services more than 400 hospitals and 87 healthcare organisations across the UK, Australia and New Zealand.

The UK NHS market, in particular, is undergoing an accelerated phase of digital transformation, driven by funding reform, workforce pressures, and the need to improve patient flow across integrated care systems. Trusts are increasingly moving away from fragmented, department-specific tools toward enterprise-wide platforms.

Winning preferred supplier status at one of the UK’s largest acute trusts sends a strong signal to the broader market. NHS procurement decisions are closely watched by peer organisations, and successful implementations often lead to follow-on opportunities elsewhere.

From a financial perspective, a contract anticipated to exceed A$35 million over seven years would represent a material uplift relative to Alcidion’s current market capitalisation of approximately A$154 million. While revenue recognition will be spread over time, the scale and duration of the agreement add meaningful depth to the company’s contracted revenue base.

Shares in Alcidion were trading at 11.5 cents on Thursday afternoon, up 16.16 percent on the day, with more than 12.6 million shares changing hands. Over the past year, the stock has delivered a return of around 91.7 percent, reflecting renewed market confidence following a period of restructuring and refocus.

The company now carries a market capitalisation of about A$154.4 million, with 1.34 billion shares on issue. The stock has traded between 6 cents and 14.5 cents over the past 12 months.

While short-term share price movements can be volatile, the underlying story here is one of strategic execution. Alcidion has spent years positioning itself as a specialist provider of clinically focused digital platforms rather than a generic hospital IT vendor. The UHSx decision suggests that approach is resonating.

Beyond the immediate contract, the announcement highlights a broader trend in global healthcare. Hospitals are no longer just digitising for compliance or record-keeping. They are investing in systems that actively support clinical decisions, improve patient flow, and reduce administrative burden on staff.

Alcidion’s pitch is that smarter, more intuitive software can help clinicians spend less time navigating systems and more time delivering care. In overstretched health systems like the NHS, that promise carries real weight.

As healthcare systems worldwide grapple with ageing populations, staff shortages, and rising costs, demand for platforms that improve efficiency without compromising care quality is likely to remain strong.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles