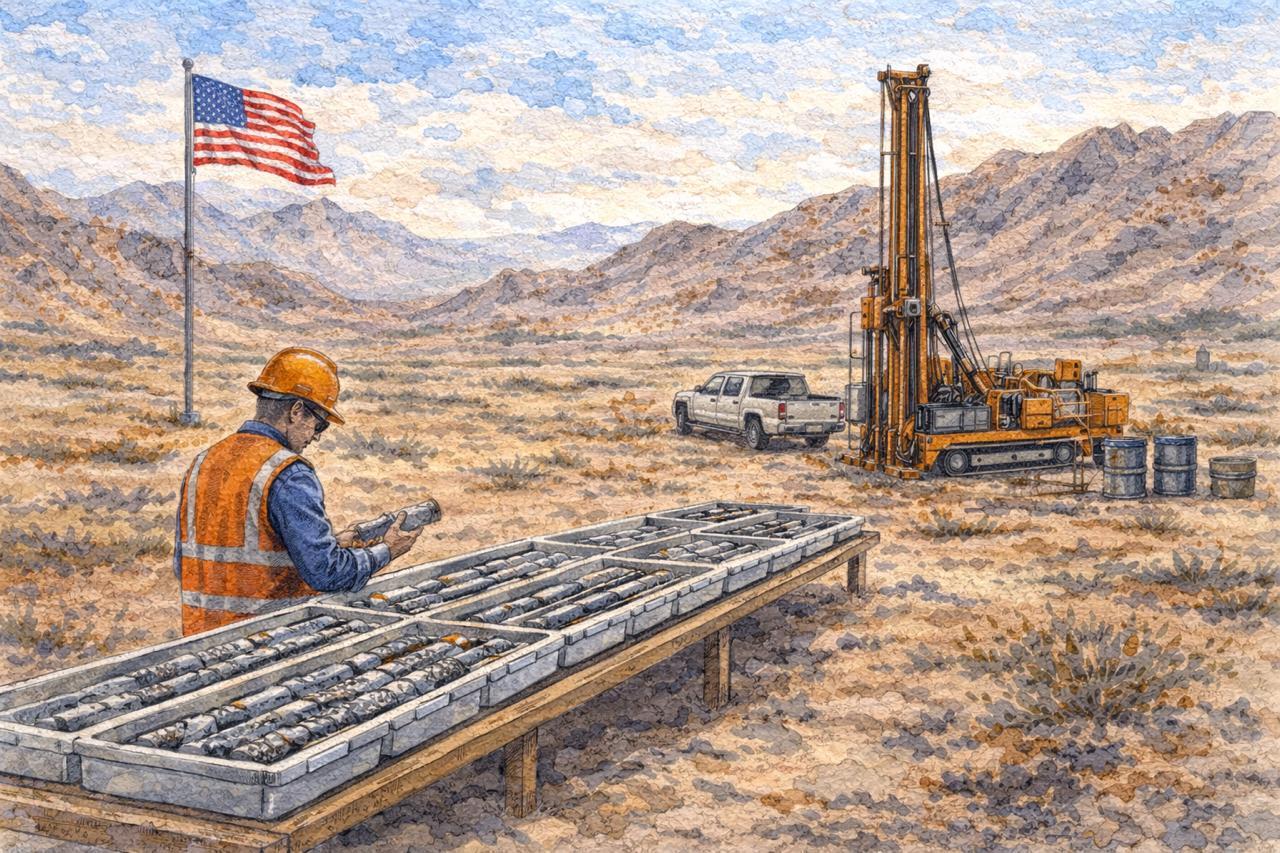

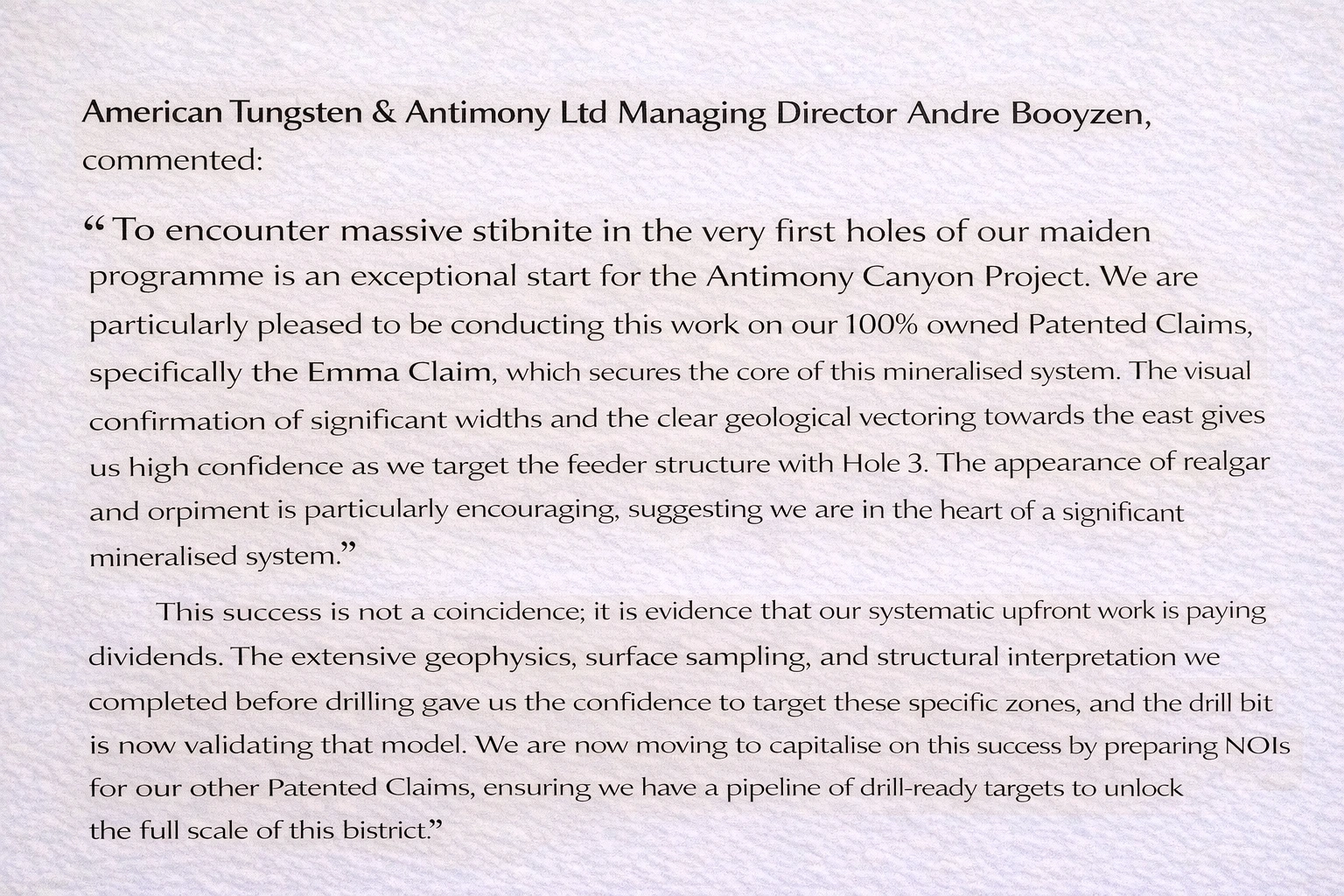

American Tungsten and Antimony Ltd (ASX: AT4) put a sharper spotlight on its Utah-based Antimony Canyon Project on Wednesday after early drilling delivered what explorers like to see first: visible mineralisation in the core, including zones the company describes as massive stibnite, the primary antimony sulphide mineral.

The market responded quickly. AT4 last traded at $0.165, up $0.025 or 17.86%, with 24.43 million shares changing hands by early afternoon (AEDT). The move adds to a longer-running run in the stock, with the company data showing a one-year return of 230% and a 52-week range of $0.025 to $0.230.

In its ASX update, AT4 said the first two HQ diamond drill holes of its maiden program, ACP26DD001 and ACP26DD002, both hit substantial mineralised zones at the Emma historical working, inside the company’s 100% owned patented claims.

The headline numbers are not assay grades. These are visual geological observations while the core is logged and processed, and the company is explicit that assays are pending and visual estimates should not be treated as a substitute for laboratory results.

Source: AT4 ASX Announcement

Still, the intercept descriptions are material because they speak to geometry, continuity and potential scale, which are often the first questions in any maiden drill campaign:

The announcement also includes a table of visual stibnite estimates along the hole trace for ACP26DD001, showing multiple intervals logged as massive stibnite and semi-massive stibnite through the broader mineralised package.

AT4 repeatedly emphasises it is drilling on patented claims, which in the US context typically means the company holds secure tenure covering both surface and mineral rights. The company frames this as an advantage for operating and permitting efficiency while it advances exploration across multiple historical workings on its claim area.

That matters in a practical way: early exploration programs can lose momentum if access, approvals, or land rights become a bottleneck. AT4’s messaging suggests it wants the market to understand that the Emma area sits on a land package where it can move quickly from geological concept to drill testing.

The second pillar of the update is geological direction. AT4 says alteration intensity increases to the east, which supports its model that drilling is moving toward a major feeder structure.

In simple terms: a feeder structure is the pathway that mineralising fluids used to move through the rocks. Finding it can matter because feeder zones can be associated with thicker mineralisation, higher grades, or improved continuity. None of that is guaranteed, but it is often what explorers are trying to map early.

The company adds that ACP26DD002 hit a short zone containing minor orpiment and realgar, and early inspection of Hole 3 shows “notably stronger” zones of these minerals plus significant sulphide intercepts. In many hydrothermal systems, these arsenic sulphides can act as pathfinder minerals that help geologists determine proximity to certain parts of the mineralising system.

With holes 1 and 2 designed to establish stratigraphic control at a steep dip of -80 degrees, AT4 has now shifted to a more direct test of its feeder concept.

The near-term flow from here is straightforward: logging, sampling, and then assays. AT4 says core is being processed and dispatched for expedited lab analysis.

Source: AT4 ASX Announcement

AT4’s price action fits a familiar pattern in early-stage critical minerals exploration: markets often react to credible early indications that a target is “real” and continuous, even before assays.

In this case, the drivers were:

This update is not reporting grades. AT4 states clearly that visual estimates are qualitative and should not be treated as a proxy for laboratory assays, and that assays are pending.

That is important because the economic value of antimony mineralisation ultimately comes down to assay-confirmed grade, continuity, metallurgy and potential scale, not just visible sulphides.

Over the coming updates, the practical milestones are:

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles