Anteris Technologies (ASX: AVR | Nasdaq: AVR) has pulled off a strategic investment from Medtronic, the world’s largest medical technology company, and stitched it into a broader capital raise that totals roughly US$320 million in gross proceeds.

On the surface, it reads like a single line item: US$90 million from Medtronic, closing immediately after an underwritten offering of common stock. But in medtech, the identity of the cheque writer matters almost as much as the cheque itself. When a global incumbent takes an equity position, it is not just capital. It is a signal, sometimes cautious and sometimes deliberate, that a technology has earned serious attention inside a business that already sells into the same operating theatres and heart teams.

Anteris is positioning the funding as fuel for one task that tends to define the destiny of device developers: a pivotal trial. The company says the proceeds support execution of the global pivotal PARADIGM trial and push the business toward global commercialisation of its DurAVR Transcatheter Heart Valve (THV).

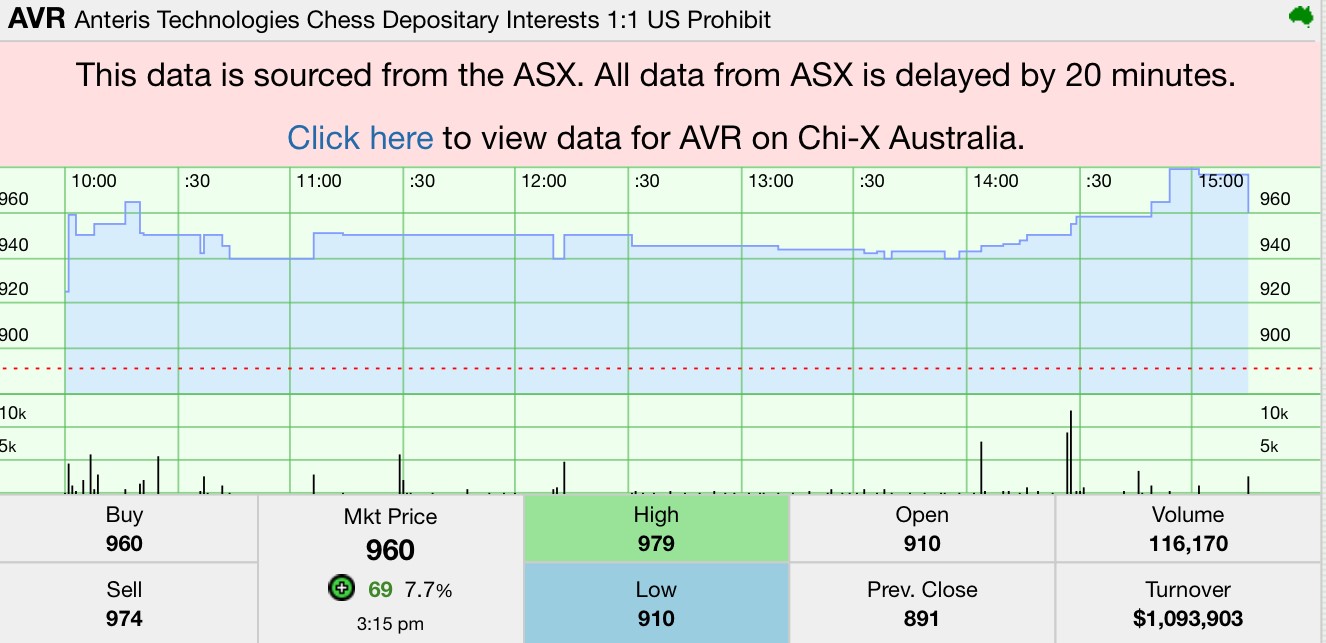

Stock snapshot (ASX: AVR)

Source: Stocknessmonster

Anteris is trying to solve a familiar clinical problem with a fresh design philosophy. Aortic stenosis is the progressive narrowing of the aortic valve, restricting blood flow and forcing the heart to work harder. Untreated, it can become life threatening. The modern standard of care increasingly includes TAVR (transcatheter aortic valve replacement), where doctors thread a replacement valve to the heart via blood vessels rather than opening the chest.

DurAVR is Anteris’ attempt to make a replacement valve behave more like the original. The company describes it as the first biomimetic valve, shaped to mimic a healthy human aortic valve, aiming to replicate normal blood flow. The valve is made using a single piece of molded ADAPT tissue, based on Anteris’ anti calcification tissue technology. The company notes ADAPT tissue is FDA cleared and has been used clinically for more than a decade, with distribution into more than 55,000 patients worldwide.

If that reads technical, here is the practical translation: Anteris is betting that better design and better materials can translate into better long term outcomes, and it has to prove that in a head to head trial.

In its announcement, Anteris Vice Chairman and CEO Wayne Paterson described the Medtronic investment, alongside the underwritten offering, as an important milestone and a validation moment.

“This strategic investment, along with our underwritten offering of common stock, represent an important milestone for our company. It also provides strong validation of our program from the capital markets and a major strategic innovator,” Paterson said. “The investment is one aspect of a collaboration that may expand into other strategic areas in the future. Anteris has developed a clinically important, evidence-supported product designed to improve the lives of patients with aortic stenosis as we advance toward regulatory approval.”

That quote does a few jobs at once. It highlights credibility, it keeps the door open to deeper partnership, and it anchors the company to a patient outcome narrative rather than a stock market one. For early stage medtech, that mix is deliberate: markets can fund the story, but regulators and clinicians decide whether it becomes care.

Medtronic’s commentary is equally revealing, because it focuses on platform level value: performance and portfolio.

“Medtronic is a pioneer in TAVR innovation and evidence,” said Jorie Soskin, Vice President and General Manager of the Structural Heart business in Medtronic’s Cardiovascular portfolio. “Our investment in differentiated innovation like the DurAVR THV technology which has the potential to offer improved valve performance in a balloon-expandable platform is core to our commitment to define and drive the future of TAVR, meeting the needs of more aortic stenosis patients and heart teams with a comprehensive portfolio.”

The phrase to notice is “potential.” Medtronic is not certifying outcomes, but it is signalling DurAVR may fit strategically into how TAVR evolves, especially if performance claims hold up in pivotal data.

Anteris’ board chair John Seaberg also framed the relationship as a shared focus on discipline and patient benefit: “This investment aligns two organizations in their commitment to advancing valve science in a way that is disciplined and focused on long term patient benefit.”

For readers new to clinical trials, the pivotal study is essentially the audition that decides whether a device can be sold widely.

Anteris says the PARADIGM Trial is a prospective randomized controlled trial that will evaluate the safety and effectiveness of DurAVR against commercially available TAVRs. The study is designed as a head to head comparison, enrolling about 1,000 patients in an “all comers” randomized cohort, with 1:1 randomisation to DurAVR or an approved transcatheter valve.

The primary endpoint is a composite of all cause mortality, all stroke and cardiovascular hospitalisation at one year post procedure, assessed for non inferiority. In plain terms: the trial is built to test whether DurAVR performs at least as well as established alternatives on outcomes that matter to patients and clinicians.

Importantly, the company says recruitment has commenced, and the first patients were enrolled and implanted in Q4 2025.

The company’s U.S. filing (Form 8-K referenced in its ASX announcement) provides additional clarity on the capital structure and intended use.

Anteris disclosed an underwritten offering of 34,782,609 shares with an additional 5,217,391 shares under an exercised option, at US$5.75 per share. In parallel, a Medtronic subsidiary agreed to purchase 15,652,173 shares in a private placement at the same price, for about US$90 million.

The company states it intends to use net proceeds to support growth and advance the clinical strategy, including ongoing recruitment and execution of PARADIGM and expansion of manufacturing capabilities. It also notes part of proceeds are expected to fund R&D for v2vmedtech, inc., with the remainder to working capital and general corporate purposes.

There is also a governance and relationship framework embedded in the deal, including participation rights for the investor under certain conditions, transfer restrictions for a defined period, and a commitment to engage in good faith discussions on potential collaboration opportunities such as manufacturing, co development and co commercialisation.

That structure matters because it suggests the deal is designed to be more than passive capital. It is a strategic foothold with guardrails.

For Anteris, the next chapter is less about headlines and more about execution milestones:

The interesting part of this story is not just that Anteris raised money. Plenty of companies do. It is that in a sector where credibility is built slowly and tested publicly, a global incumbent has decided the risk is worth taking alongside it. The rest will be decided in cath labs, trial sites, and data readouts.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles