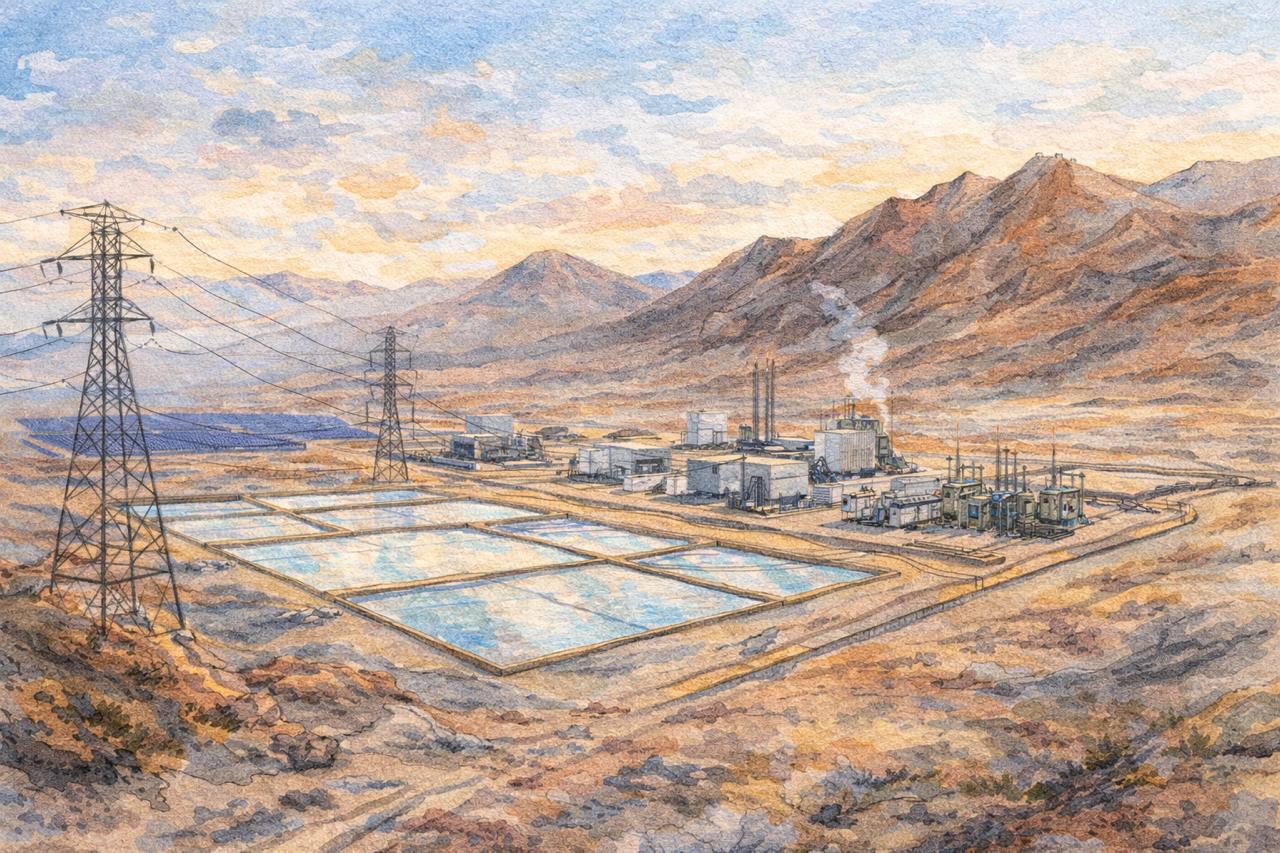

Argosy Minerals Ltd (ASX: AGY) has taken a meaningful step forward in the development of its flagship Rincon Lithium Project in Argentina, announcing significant progress on a 40-megawatt energy infrastructure solution designed to support current production plans and future growth.

The update, released on Monday, confirms that detailed engineering and feasibility works have been completed for a Medium Voltage Line project that will connect the Rincon operation to Argentina’s national power grid. While infrastructure updates rarely grab headlines, this development addresses one of the most persistent challenges facing lithium brine projects in northern Argentina: reliable, scalable and cost-effective energy access.

Lithium projects in Argentina’s north west region often struggle with power supply constraints, forcing operators to rely on diesel generation or expensive temporary solutions. Argosy’s announcement directly tackles this risk.

According to the company, the completed engineering works confirm the feasibility of delivering up to 40MW of grid-supplied electricity to Rincon via a 33kV transmission line spanning approximately 8.6 kilometres. The line will connect through a substation adjacent to the 208MW Altiplano Solar Facility before linking into the national grid.

This level of power capacity is sufficient to support Argosy’s planned 12,000 tonnes per annum lithium carbonate operation and leaves room for future expansion without requiring a major redesign of the energy system.

Source: AGY ASX Announcement

With the design and feasibility phase complete, the project now moves into a competitive tender process for construction of the transmission line and associated transformer infrastructure. Cost estimates and delivery schedules have been prepared by EDESA, Salta Province’s electricity distribution company, and will be refined as contractors are appointed.

In parallel, Argosy is engaging with renewable energy providers to negotiate power purchase agreements that would allow the project to draw clean energy through the grid. This approach aligns with Argentina’s broader renewable energy transition while potentially lowering long-term operating costs and reducing exposure to fuel price volatility.

The company noted that grid access is expected to materially reduce reliance on diesel generation, improving both operating economics and environmental performance at Rincon.

Rincon sits within Argentina’s Lithium Triangle, one of the most prospective lithium brine regions globally. However, infrastructure gaps have historically slowed development timelines across the region.

Argosy’s proximity to existing energy infrastructure is emerging as a competitive advantage. Being located roughly eight kilometres from a major substation allows the company to progress with a grid-connected solution that many peers lack.

Importantly, the infrastructure program is being coordinated alongside the neighbouring Rio Tinto Rincon Project, which is pursuing similar grid access through EDESA. The two projects are expected to build transmission lines in parallel, connecting into the same substation before feeding into the national grid .

This shared infrastructure approach not only improves efficiency but also reinforces the region’s long-term viability as a lithium production hub.

Argosy Managing Director Jerko Zuvela described the completion of detailed engineering as a key milestone in moving the project toward commercial readiness.

Source: AGY ASX Announcement

The market responded positively to the update. Argosy shares traded higher during Monday’s session, reaching an intraday high of 13.5 cents from an opening price of 13.0 cents. The stock closed near 12.5 cents, with more than 11 million shares changing hands and turnover exceeding $1.4 million.

The elevated volume suggests the announcement resonated with the market, particularly given the broader focus on project de-risking and capital discipline across the lithium sector.

Energy access is often an overlooked but decisive factor in project viability. By securing a clear pathway to grid power, Argosy reduces several layers of risk simultaneously.

Operational costs become more predictable. Environmental performance improves through reduced diesel usage. Expansion scenarios can be evaluated without needing to redesign energy systems. Together, these factors materially strengthen the investment case for Rincon as it advances through feasibility and development stages.

The company also noted that sustainable energy infrastructure is a key component of completing feasibility and engineering works, reinforcing the importance of this milestone within the broader project timeline.

While construction contracts and power purchase agreements are still to be finalised, the completion of detailed engineering provides a solid foundation for the next phase of development.

With grid access now clearly mapped, Argosy can focus on advancing feasibility, optimising operating costs and positioning Rincon as a low-carbon lithium asset aligned with global battery supply chain requirements.

In a lithium market increasingly focused on cost, sustainability and execution certainty, infrastructure milestones like this may prove just as important as resource size or grade.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles