Australian shares found their footing on Tuesday, shaking off early uncertainty to post a steady, broad based advance as strength in technology, resources and gold stocks helped offset the reality of higher interest rates.

By late afternoon trade, the S&P/ASX 200 was up 87 points or 0.99% to 8,865.8, while the All Ordinaries added 0.97%. The All Technology Index outperformed with a 1.43% gain, reflecting renewed appetite for growth names after several choppy sessions.

It was one of those sessions where the market quietly stitched together gains sector by sector rather than surging on one big headline.

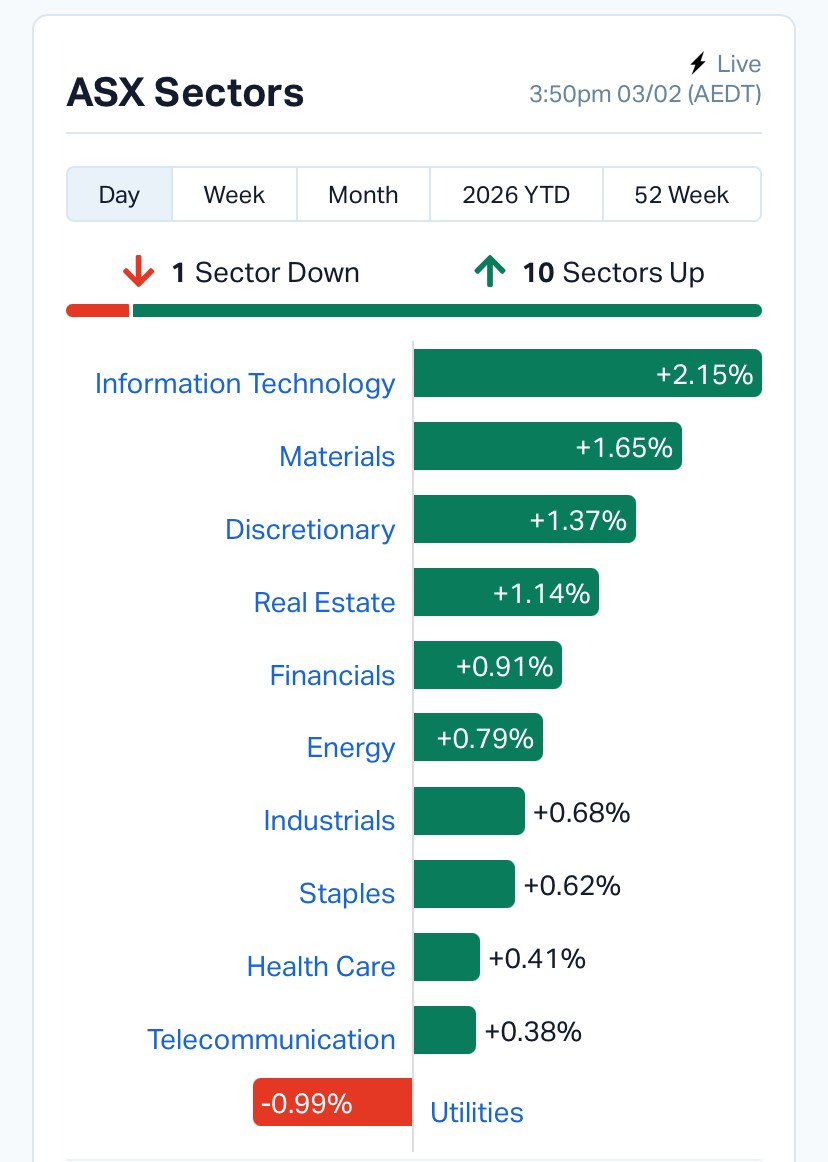

Ten of eleven sectors finished higher.

Technology led, materials followed, and even energy and financials edged up. Utilities were the only soft spot.

Source: MarketIndex

The biggest macro development came from Martin Place, where the Reserve Bank of Australia lifted the cash rate by 25 basis points to 3.85%, its first hike in more than two years.

Governor Michele Bullock struck a firm tone.

“The board now thinks it will take longer for inflation to return to target and this is not an acceptable outcome,” she said, pointing to stronger private demand and lingering capacity pressures.

In simple terms, the economy is still running hotter than expected.

Economists at Capital Economics described it as a “hawkish hike”, warning another increase could follow if inflation proves sticky.

Despite that, equities held up. That resilience suggests traders had already priced in the move.

After last week’s heavy selling in precious metals, gold staged a solid rebound.

Spot gold rose 3.25% to US$4,811/oz, while silver jumped 5.08%. That recovery filtered quickly into local miners, with the ASX Gold index up 2.38%.

Broader resources stocks also strengthened, supported by firmer copper prices and a softer oil backdrop. The ASX 200 Resources index gained 1.63%.

In recent sessions, miners had been under pressure from falling commodity prices. Tuesday felt more like a reset than a breakout, but the tone was noticeably steadier.

Gains were concentrated in small and mid caps, where momentum remains strong.

| Code | Company | Price | Move |

| TM1 | Terra Metals | $0.39 | +20.0% |

| QOR | Qoria | $0.395 | +17.9% |

| BML | Boab Metals | $0.555 | +15.6% |

| 4DX | 4DMedical | $3.68 | +14.6% |

| CXL | Calix | $1.505 | +13.6% |

| APX | Appen | $1.8925 | +13.0% |

Appen’s bounce stood out, extending a volatile run for the AI data services group as traders continue to reassess beaten down tech names.

Losses were sharper but less widespread, mostly tied to company specific news and profit taking.

| Code | Company | Price | Move |

| CCP | Credit Corp | $12.06 | -15.6% |

| KPG | Kelly Partners | $6.20 | -12.1% |

| NEU | Neuren Pharma | $14.63 | -10.0% |

| CEN | Contact Energy | $8.00 | -5.9% |

| PEN | Peninsula Energy | $0.79 | -5.4% |

Credit Corp’s double digit fall weighed on financial sub sectors, while healthcare names like Neuren gave back earlier gains.

Overnight, Wall Street delivered a modestly positive handover.

Asian markets were less convincing, with Hong Kong and Shanghai weaker and Japan sliding.

Commodities painted a split picture. Gold and silver rallied sharply, copper improved, while oil eased.

The Australian dollar strengthened to US 70.25 cents, helped by the rate hike.

One notable signal came from the volatility index.

The ASX VIX sat near 11.6, a low reading that suggests traders expect relatively stable conditions over the next month.

In other words, fewer fireworks and more measured moves.

Tuesday’s session felt like quiet confidence returning.

Despite tighter monetary policy, equities absorbed the rate hike and rotated into tech and resources. Gold’s recovery added support, while global markets offered a steady backdrop.

Higher rates may slow parts of the economy, but earnings and sector specific stories still matter more day to day.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles