The Australian share market pushed higher on Wednesday, quietly defying a bruising night on Wall Street as strength in miners, energy producers and gold stocks more than offset a sharp technology sell off.

By late afternoon, the S&P/ASX 200 (^XJO) was up 66 points or 0.75% to 8,923.4, while the All Ordinaries (^XAO) gained 0.54%. It was not a runaway rally, but rather a steady grind higher driven by old economy sectors that stepped in where tech faltered.

The session felt like a market rotating rather than retreating.

When one group stumbled, another took the baton.

Technology was the clear weak spot.

The ASX All Technology Index (^XTX) sank 7.11%, mirroring the overnight weakness in US AI and software giants. Heavyweights across cloud, fintech and enterprise software names fell sharply, with several losing double digits.

But the damage stayed largely contained within the sector.

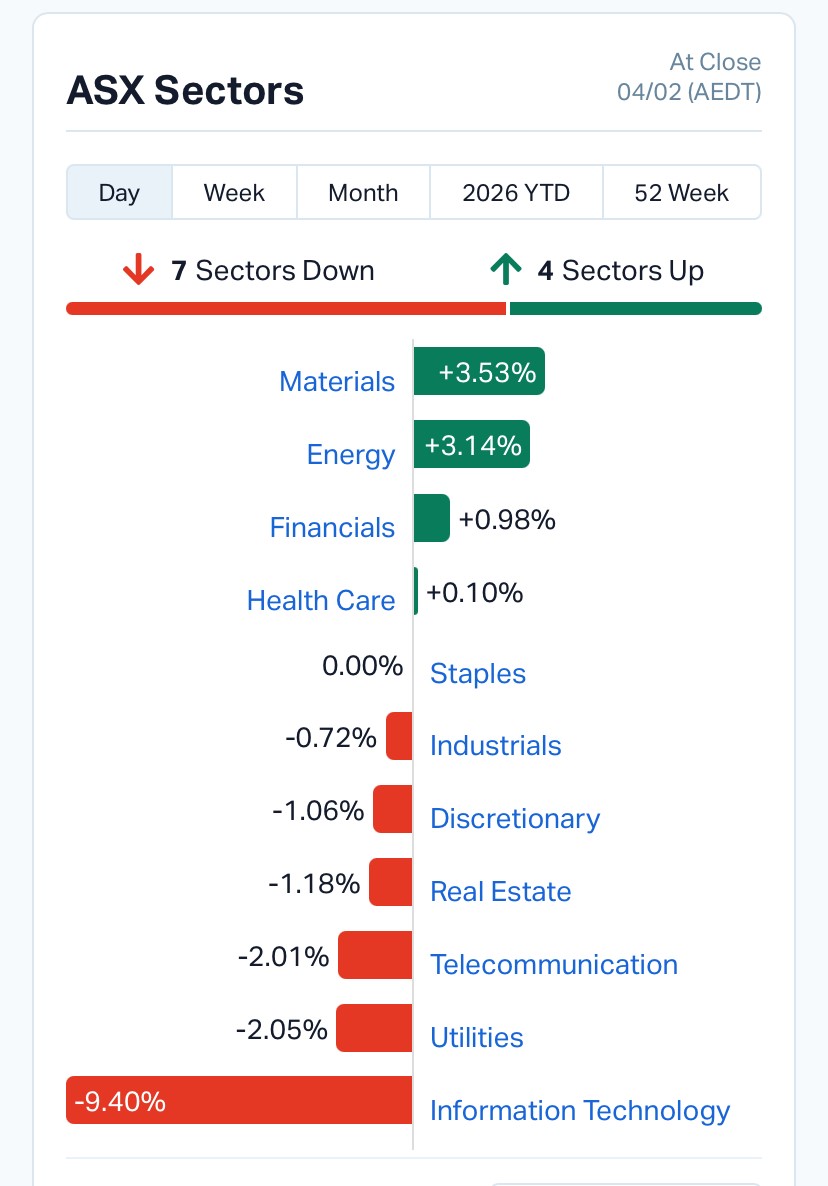

Elsewhere, materials and energy provided ballast.

The ASX 200 Resources Index (^XJR) jumped 3.67%, while energy climbed 3.05%. Gold stocks also came roaring back, with the All Ordinaries Gold Index (^XGD) up 4.23%.

That rebound followed a sharp lift in bullion prices.

Spot gold rose 2.7% to US$5,080 an ounce, and silver gained almost 4%, giving miners breathing room after recent volatility.

Money flowed out of growth and back into tangible assets.

Source: MarketIndex

Strength was concentrated among miners, coal producers and battery metals names.

Top gainers included:

| Code | Company | Move |

| PSC | Prospect Resources | +13.9% |

| ASM | Australian Strategic Materials | +12.5% |

| WWI | West Wits Mining | +12.2% |

| STK | Strickland Metals | +10.5% |

| YAL | Yancoal Australia | +9.1% |

Coal producer Yancoal Australia Ltd stood out, buoyed by firmer energy sentiment and rising commodity prices.

Battery and rare earth developers also enjoyed renewed interest as commodity linked trades returned.

Losses were dominated by technology and growth stocks.

| Code | Company | Move |

| ERA | Energy Resources of Australia | -25.0% |

| XRO | Xero | -15.6% |

| SM1 | Synlait Milk | -15.4% |

| TNE | Technology One | -10.4% |

| WTC | WiseTech Global | -10.0% |

Accounting software group Xero Ltd led the declines, sliding more than 15%, while logistics tech player WiseTech Global Ltd and enterprise software provider TechnologyOne Ltd also suffered heavy selling.

It was a reminder that when global tech sentiment turns, local names rarely escape unscathed.

The cautious start came from the United States.

Overnight, the Nasdaq Composite fell 1.43%, dragged lower by weakness in AI and chip stocks. The S&P 500 slipped 0.84%, while the Dow Jones Industrial Average edged down 0.34%.

It was a reversal from recent optimism, with traders trimming exposure to richly valued tech names.

The global technology slump appeared to be triggered by fresh competition fears in the artificial intelligence space.

Analysts pointed to a newly enhanced AI chatbot from US start-up Anthropic, which has upgraded its Claude platform with tools that can automate routine professional work such as contract reviews, compliance checks and document processing. Tasks that once required teams of lawyers, consultants or back-office software are increasingly being handled by machines.

That shift has rattled the market’s confidence in traditional software providers, which rely heavily on subscription fees for exactly those services. As one strategist noted, the worry is simple: smarter AI could squeeze margins and disrupt entire business models.

The reaction overseas was swift, with names like Salesforce, Adobe and Atlassian selling off sharply, and the weakness spilled into Australia where local tech leaders such as Xero Ltd and WiseTech Global Ltd also faced heavy pressure.

Asia was more mixed.

Japan’s Nikkei rallied strongly, up almost 4%, while Hong Kong and Shanghai posted modest gains.

Commodities provided the real story.

Gold, silver and oil all moved higher through the day. Brent crude ticked up near US$68 a barrel, and iron ore held above US$100 a tonne.

When resources and energy lift together, the ASX often finds support, given how heavily the index leans toward miners and producers.

The Australian dollar stayed broadly steady near US 70 cents, suggesting currency markets remain calm.

Meanwhile, bitcoin hovered around US$76,000, stabilising after a sharp recent sell off.

Despite the cross currents, the market mood stayed composed.

The ASX volatility gauge sat near 11.4, well inside the low risk range. That indicates traders expect relatively smooth conditions ahead rather than sharp swings.

It fits the pattern of rotation rather than panic.

Wednesday’s trade was a classic case of the ASX doing its own thing.

While Wall Street wrestled with tech weakness, Australia’s resource heavy market leaned into rising commodity prices.

Gold miners rallied. Coal and energy stocks strengthened. Financials held steady.

Tech suffered, but the broader market stayed resilient.

The market is not moving as one block. It is shifting from one pocket of strength to another.

And right now, hard assets are back in favour.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles