Australian shares traded modestly higher on Tuesday, supported by strength in mining and select consumer names, even as technology stocks and parts of the small-cap sector struggled to keep pace. The S&P/ASX 200 climbed 0.42% to 8,974.5, while the broader All Ordinaries added 0.33%, reflecting a cautiously constructive session shaped by commodity movements and mixed global cues.

The rebound comes after last week’s volatility, suggesting investors are gradually rotating back into resources and value-oriented sectors, particularly as global growth expectations stabilise and inflation concerns ease slightly.

Source: MarketIndex

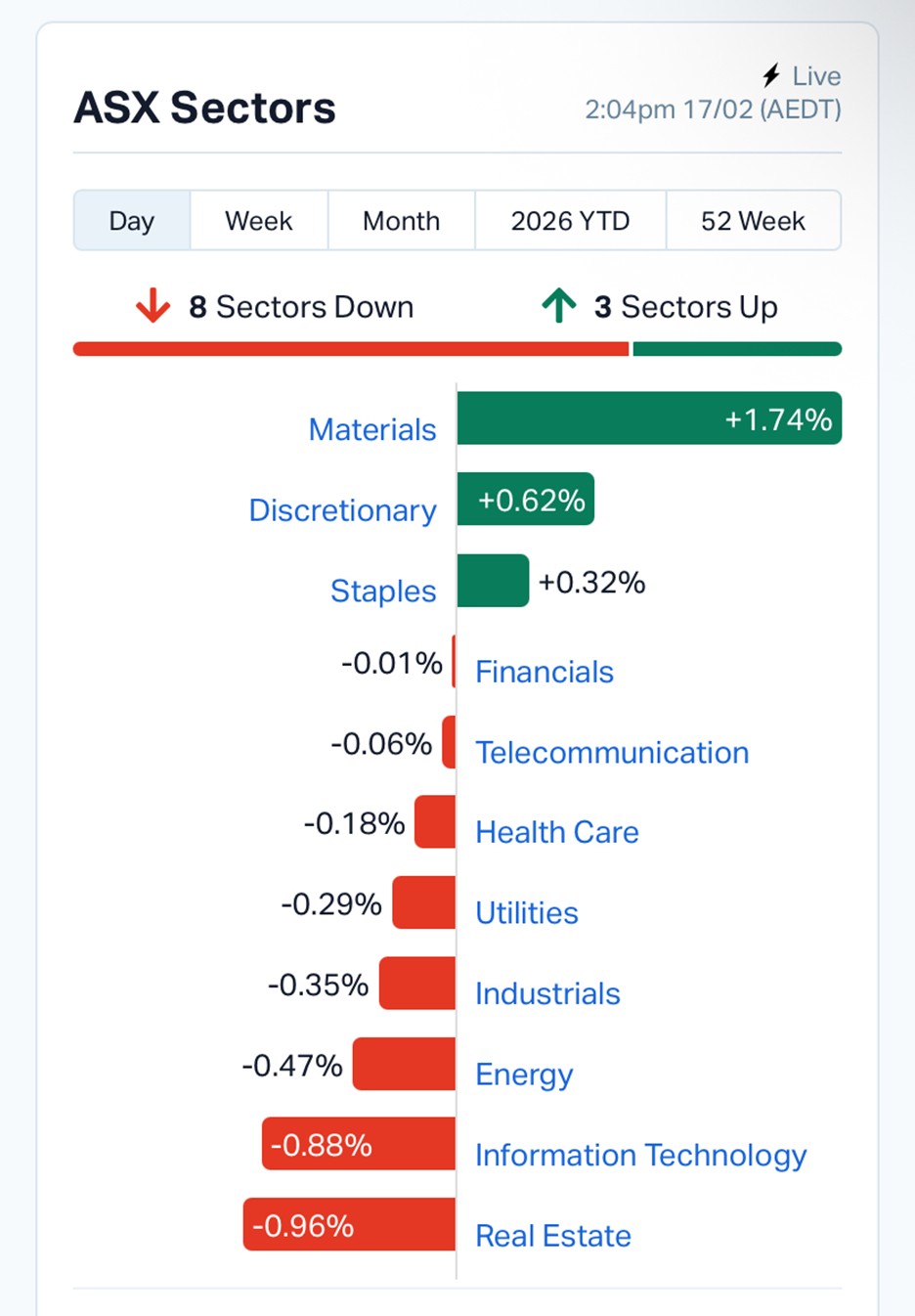

Mining and materials companies provided the backbone of the market’s advance, with the materials sector rising 1.86% and the ASX 200 Resources Index gaining 1.67%. Large-cap miners drove much of the momentum, helped by relatively stable iron ore and base metals pricing, even though gold prices softened slightly during the session.

Shares of BHP Group climbed nearly 6%, emerging as one of the day’s most influential contributors to the index’s upward move. Gains were also supported by improved sentiment across exploration and development names, with Terra Metals and Toubani Resources posting strong percentage gains.

Retail and discretionary stocks also contributed to the positive tone, with JB Hi-Fi surging more than 8% as consumer-facing companies continued to benefit from resilient spending trends despite ongoing interest-rate pressures.

Financials added modest support, rising 0.10%, though the banking index remained largely flat, indicating that investors remain cautious about margin pressures and regulatory uncertainty facing the sector.

Not all sectors shared the upbeat mood. Technology stocks declined 0.60%, with semiconductor, software and advanced technology names such as Weebit Nano and Calix among the session’s notable laggards. Weakness in the technology segment reflects ongoing global repositioning away from high-growth valuations following recent volatility in US tech markets.

Rare earths and critical minerals names also came under pressure, with Lynas Rare Earths and Brazilian Rare Earths posting notable declines as commodity traders adjusted positions amid fluctuating demand expectations.

The broader small-cap segment remained softer, with the Small Ordinaries index slipping 0.47%, suggesting that institutional flows continue to favour larger, more liquid resource companies over speculative exploration names.

Among the session’s strongest performers were Terra Metals, Praemium and Vista Group International, each recording double-digit gains, alongside defence-linked Electro Optic Systems and audio technology company Audinate Group.

On the downside, Santana Minerals led the declines, followed by Southern Palladium and Synlait Milk. Treasury Wine Estates and Reliance Worldwide also retreated, reflecting mixed earnings reactions and sector-specific pressures.

International markets offered a mixed picture heading into the Australian session. On Wall Street, the Dow Jones Industrial Average edged up 0.10% and the S&P 500 gained 0.05%, while the technology-heavy Nasdaq slipped 0.22%, highlighting continued investor caution around high-growth technology names.

Asian markets were similarly uneven. Hong Kong’s Hang Seng rose 0.52%, while Japan’s Nikkei and China’s Shanghai Composite both declined modestly, reflecting ongoing uncertainty around regional growth and trade dynamics.

Commodity markets also showed limited direction. Gold eased 0.49% to around US$4,966 per ounce, while copper slipped slightly and crude oil prices edged lower. The pullback in precious metals partly explains the weaker performance among gold and related mining stocks earlier in the session.

Currency markets were relatively stable, with the Australian dollar trading near US$0.706, showing only modest movement against major peers.

Market volatility expectations remain subdued, with the ASX volatility index sitting near 12.3, a level typically associated with stable trading conditions and relatively strong investor confidence. Low volatility often indicates a consolidation phase rather than a decisive directional shift, suggesting markets may continue to trade within a narrow range in the near term.

Overall, Tuesday’s session highlighted a familiar pattern seen in recent months: capital rotating toward resource-heavy sectors and companies delivering tangible earnings growth, while high-valuation technology stocks face periodic bouts of selling pressure.

The market’s ability to maintain gains despite mixed global signals points to underlying resilience, though upcoming earnings releases, commodity price movements and central bank commentary are likely to remain key drivers in the weeks ahead.

Source: ASX market data, 17 February 2026

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles