Australia’s share market navigated another reporting-season-driven session on Wednesday, with the S&P/ASX 200 trading modestly higher as investors balanced strong corporate earnings against macroeconomic uncertainty.

The broader tone was one of cautious optimism, where positive earnings surprises lifted select sectors while profit-taking in commodities capped broader gains.

The index hovered near the psychological 9,000 level, a range that has increasingly become a battleground between buyers encouraged by resilient corporate profits and sellers wary of global growth risks and commodity volatility.

According to Convera’s head of market insights Steven Dooley, the data suggests the Reserve Bank has room to wait for further inflation readings before making policy changes, while the Australian dollar remains one of the strongest performing G10 currencies this year, supported by relatively firm economic fundamentals.

Market volatility remained subdued, with the ASX VIX holding near historically low levels, indicating that traders are still broadly comfortable with the near-term outlook despite headline risks.

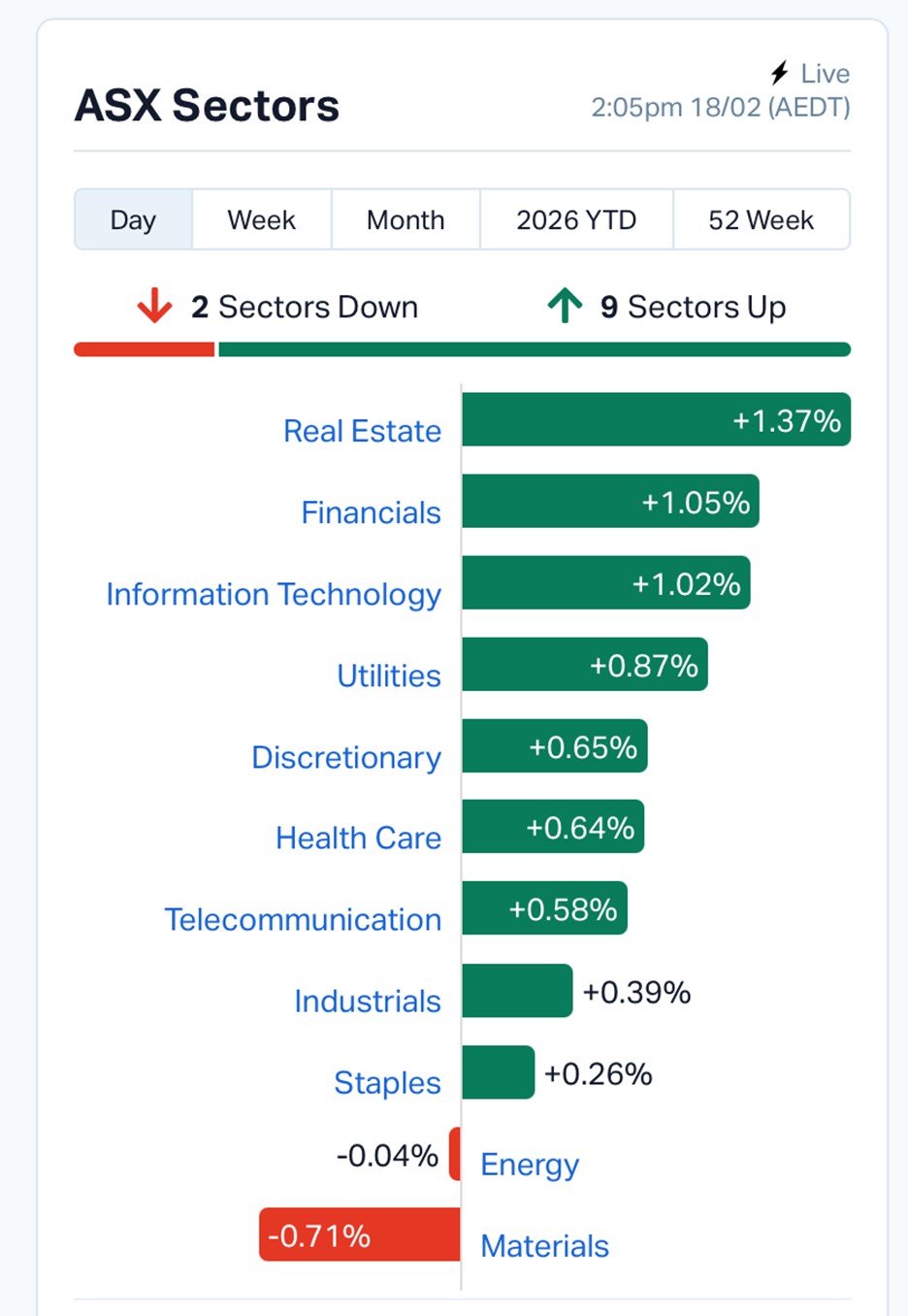

Today’s Sector Snapshot | Source: MarketIndex

The defining feature of the session was the strong divergence between companies delivering earnings upgrades and those disappointing markets.

Telecommunications infrastructure firm Superloop emerged as one of the standout performers, surging more than 16% after announcing a return to profitability, a strategic acquisition worth $165 million, and upgraded guidance.

The move reflected continued investor appetite for scalable digital infrastructure businesses that demonstrate clear growth visibility.

Technology and enterprise software names also gained momentum, with Appen and Hansen Technologies posting strong double-digit gains following encouraging earnings updates. The technology sector’s resilience highlights that, despite global concerns about AI-driven disruption, companies showing measurable revenue growth and operational discipline continue to attract capital.

On the downside, Capstone Copper led losses, falling roughly 17% to 19% after disappointing 2026 production guidance and highlighting near-term capital expenditure pressures. The sell-off underscores a broader theme emerging across global mining equities: markets are increasingly rewarding immediate cash flow certainty rather than long-dated growth promises.

Sector performance revealed a market shifting toward earnings visibility rather than cyclical exposure. The All Technology Index and Real Estate sector were among the day’s strongest performers, supported by upbeat earnings from property giant Dexus, whose statutory profit surged sharply year-on-year, suggesting the commercial property cycle may be stabilising after a prolonged downturn.

Financial stocks also showed resilience, with banking and wealth-management companies benefiting from continued inflows linked to dividend rotations and improving asset values. The renewed interest in financials reflects a broader market narrative: income-generating companies are regaining favour as interest-rate expectations begin to stabilise.

In contrast, the resources sector underperformed, dragged lower by profit-taking in gold and diversified mining stocks after recent rallies. With gold prices hovering near historic highs, some investors appeared to be locking in gains rather than chasing further upside, a pattern often seen during late-stage commodity rallies.

Beyond earnings, corporate developments added further texture to the trading session. A regulatory lawsuit against supermarket chain Coles over discount pricing practices became a major domestic economic talking point, reinforcing concerns about cost-of-living pressures even as corporate earnings remain robust.

At the same time, the government’s approval of roughly 5% health insurance premium increases triggered rallies in insurance stocks such as Medibank and NIB, which gained strongly on expectations of stable revenue growth. The move also highlighted the broader “yield rotation” theme, where companies with predictable cash flows are increasingly viewed as defensive holdings.

Meanwhile, banking giant National Australia Bank reported a strong earnings performance, delivering a 30% rise in net profit to $2.21 billion, reinforcing the strength of Australia’s banking sector despite persistent mortgage-rate pressures. Analysts noted that business lending growth continues to support bank earnings even as retail lending slows.

Overnight in the United States, major indices remained close to record territory but traded cautiously ahead of key macroeconomic releases. S&P 500 futures slipped slightly, while the Nasdaq remained under pressure amid concerns that rapid advances in artificial intelligence could disrupt traditional software business models.

Investor attention remains focused on the upcoming Federal Reserve meeting minutes and the PCE inflation report, both of which could shape expectations for the timing of the first US interest-rate cuts later this year. Markets currently anticipate potential easing beginning around mid-2026, though uncertainty remains.

Across Asia, trading was mixed. Hong Kong equities edged higher while mainland Chinese markets weakened modestly, reflecting ongoing concerns around domestic growth momentum. Japanese markets were largely flat as currency movements dominated investor sentiment.

Top Performers

Major Laggards

Source: ASX market data, reporting season disclosures.

Several structural themes are becoming increasingly visible in the market’s behaviour:

With the ASX 200 trading just below the 9,000 threshold, markets appear to be entering a consolidation phase where corporate earnings and global monetary policy expectations will determine the next major move. The remainder of the reporting season, alongside signals from the US Federal Reserve, is likely to shape investor sentiment over the coming weeks.

For now, the market’s tone remains cautiously constructive. Strong earnings surprises continue to push select stocks sharply higher, while macroeconomic uncertainties ensure that broader index gains remain measured rather than exuberant.

Source: ASX, Markets Live, global market data.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles