Australian shares finished slightly higher on Tuesday, with strength in technology, mining and energy stocks helping the market maintain positive territory despite weakness in the banking and financial sectors. The S&P/ASX 200 rose 0.17% to 8,885.3, while the All Ordinaries added 0.24%, reflecting a steady but cautious session shaped largely by global market momentum and selective sector buying.

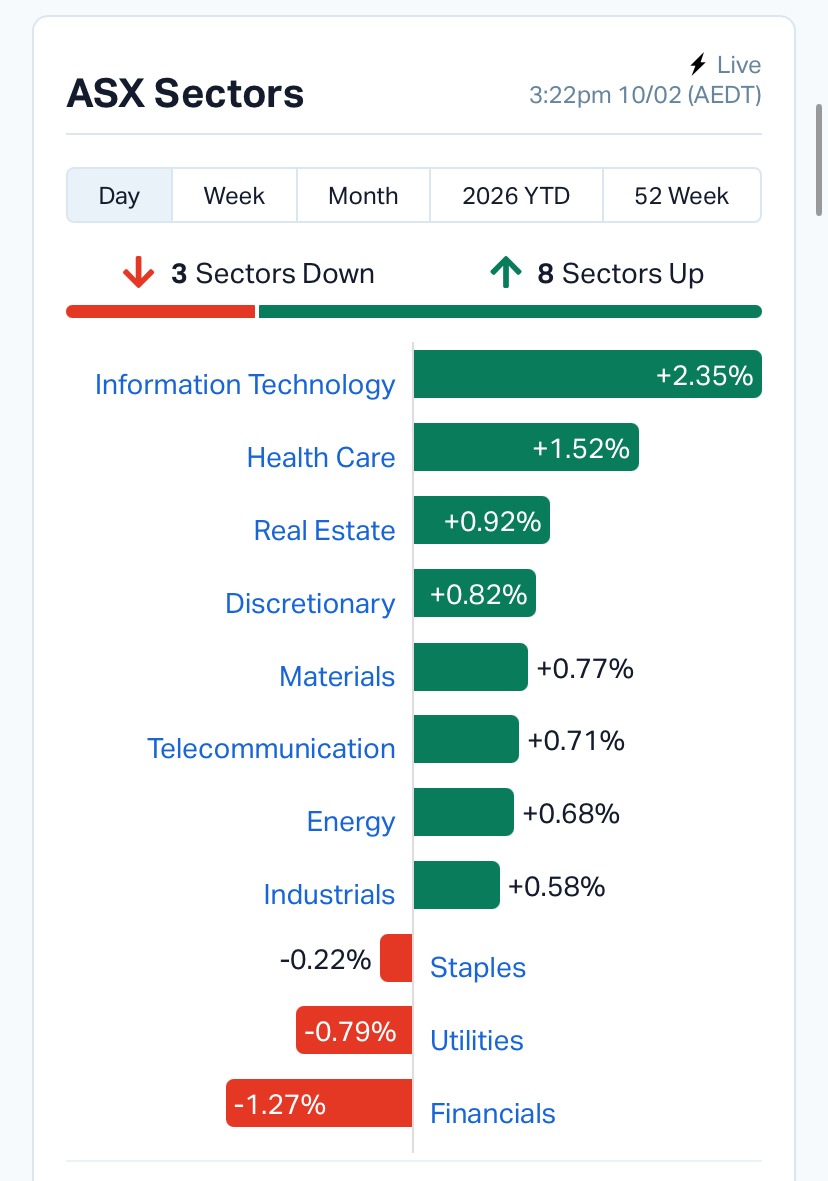

The technology sector provided the strongest support, with the All Technology Index climbing 1.79%, continuing its rebound after recent volatility. Healthcare, discretionary and materials stocks also contributed to the upside, while financials slipped 0.93%, acting as the main drag on the broader index. Banks, which have been strong performers in recent months, saw some profit-taking, a pattern traders often describe as sector rotation rather than a shift in broader market sentiment.

Source: MarketIndex

Resource stocks were among the session’s key drivers, supported by steady iron ore prices near US$100 per tonne and renewed optimism in the battery-materials space. Shares of PLS Group Ltd (PLS) gained after the company confirmed a two-year offtake agreement with Canmax Technologies for the supply of 150,000 tonnes per year of lithium spodumene concentrate, including a floor price of US$1,000 per tonne, providing downside protection to earnings. The agreement is subject to a US$100 million prepayment, reinforcing near-term funding visibility.

Gold stocks also remained firm, with the ASX All Ordinaries Gold Index rising 1.01%, even as spot gold prices eased slightly to around US$5,023 per ounce, highlighting continued demand for defensive exposures amid global geopolitical uncertainty.

Among individual stocks, Sunrise Energy Metals Ltd (SRL) led the gains with an 18.1% surge, followed by Calix Ltd (CXL) up 14.9%, and Electro Optic Systems Holdings Ltd (EOS) rising 14.5%. Battery-materials and advanced manufacturing names featured prominently across the winners list, reflecting renewed interest in energy transition themes.

Other notable gainers included European Lithium Ltd (EUR), Boss Energy Ltd (BOE) and Clarity Pharmaceuticals Ltd (CU6), all posting double-digit advances.

On the downside, Amplitude Energy Ltd (AEL) fell 21.5%, marking the largest decline of the day, followed by G8 Education Ltd (GEM) down 19.8%, and Orion Minerals Ltd (ORN) slipping 12.8%. Weakness across several industrial, insurance and diversified financial names contributed to the softer tone in the financials segment.

International markets offered a supportive backdrop to the local session. On Wall Street, the Nasdaq gained 0.9%, the S&P 500 rose 0.47%, and the Dow Jones finished broadly flat, reflecting continued resilience in U.S. technology stocks. In Asia, equity markets recorded strong gains, with Japan’s Nikkei 225 climbing 3.89%, while China’s Shanghai Composite and Hong Kong’s Hang Seng also advanced, indicating improving regional sentiment.

European markets similarly traded higher, with the EuroStoxx 50 rising 0.7% and the FTSE 100 up 0.2%, suggesting global investors remain cautiously optimistic despite ongoing geopolitical and policy uncertainties.

Corporate news flow also shaped trading sentiment. Treasury Wine Estates (TWE) moved higher after announcing a settlement agreement with U.S. distributor Republic National Distributing Company relating to the closure of its California operations. The company indicated a net cash outflow of approximately US$65 million in the second half of FY26 but expects to resell inventory through alternative channels, signalling operational continuity.

Meanwhile, global macro developments remained in focus, including reports that the U.S. administration is considering changes to greenhouse-gas regulatory frameworks, a move that could influence energy and industrial sectors globally if implemented.

Commodity markets were mixed during the session. Brent crude slipped slightly to around US$68.9 per barrel, while copper edged lower, reflecting ongoing concerns about global industrial demand. Precious metals also softened modestly, with gold and silver both declining, though remaining near historically elevated levels.

The Australian dollar traded slightly weaker at around US70.8 cents, reflecting modest currency volatility amid shifting global interest rate expectations and commodity price movements.

Overall, Tuesday’s session highlighted a market still supported by global liquidity and improving international sentiment, but also increasingly shaped by sector-specific dynamics rather than broad-based rallies. Strength in technology, mining and battery-materials stocks continues to offset periodic weakness in banks and insurers, suggesting the market remains in a phase of internal rotation rather than directional change.

With reporting season approaching and several macroeconomic developments unfolding globally, including policy shifts in major economies and ongoing geopolitical tensions affecting energy markets, investors are likely to remain selective in positioning.

For now, the combination of resilient global equity markets, stable commodity prices and continued demand for growth sectors appears sufficient to keep the ASX anchored near record levels, even as volatility in individual sectors persists.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles