Australian shares eased slightly on Friday, closing out a volatile January with a cautious tone as investors weighed interest rate risks against selective pockets of strength across the market.

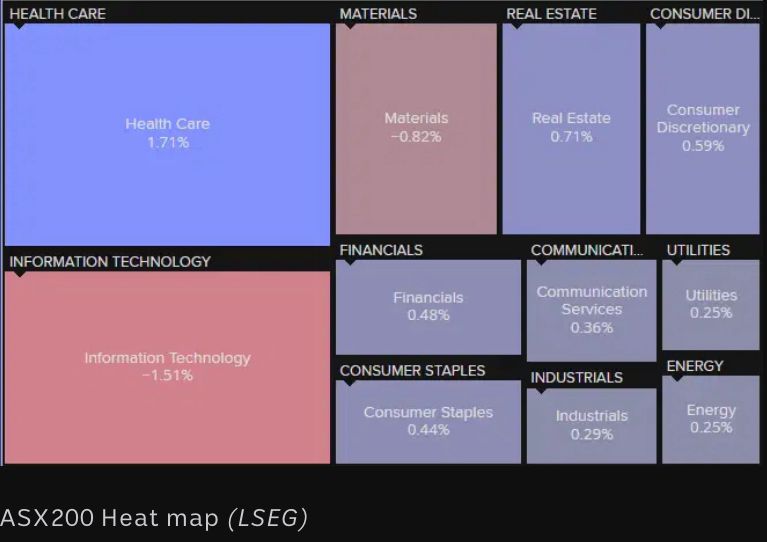

By early afternoon, the S&P/ASX 200 was down 0.16% at 8,913 points, while the broader All Ordinaries slipped 0.27%. The modest decline masked a clear split beneath the surface, with defensive sectors and banks finding support, while resources and technology stocks came under renewed pressure.

Financials were among the brighter spots, with the ASX 200 Banks Index up 0.4%, reflecting steady buying in the major lenders as expectations grow that any upcoming rate hike from the Reserve Bank of Australia is likely to be limited in scale.

Healthcare stocks also stood out. The sector rose more than 1.5%, helped by strong company updates and a search for earnings stability in an uncertain rate environment.

Energy and consumer staples posted modest gains, while telecommunications and real estate edged higher, suggesting investors were leaning toward more defensive parts of the market as January volatility lingered.

Technology stocks continued to lag, with the ASX All Technology Index down just over 1%, extending a tough week for the sector.

That said, Appen Ltd again defied the trend, jumping 23% to $1.74 to lead the day’s gainers. The rally followed Thursday’s strong quarterly update, which showed December quarter revenue up 10% year on year and underlying earnings more than doubling.

The sharp rebound has caught attention, particularly given Appen’s prolonged share price slump over recent years. Still, outside of Appen, sentiment toward tech remains cautious as global markets reassess the cost and payoff of heavy investment in artificial intelligence.

After weeks of relentless gains, gold finally paused. Spot prices fell nearly 2% to around US$5,330 an ounce, triggering a sharp pullback in gold equities.

The ASX All Ordinaries Gold Index slid 3.8%, making it one of the worst-performing sub-sectors of the day. Several mid-cap and small-cap gold names posted steep losses, reflecting how sensitive the sector has become to even modest moves in bullion prices.

Analysts note that while gold remains up around 25% year to date, equity valuations had run well ahead of fundamentals, leaving miners vulnerable to profit-taking.

Despite the softer market, a handful of stocks stood out on the upside:

The list reflected a mix of earnings-driven moves, healthcare strength and selective buying in education and resources.

Losses were concentrated in resources and small-cap miners:

The selling underlined ongoing caution toward higher-risk names as funding conditions tighten.

Overnight, Wall Street delivered a mixed lead. The S&P 500 slipped 0.1%, while the Dow Jones edged higher and the Nasdaq fell 0.7%, dragged down by weakness in large-cap technology stocks.

According to Reuters, recent earnings have sharpened investor focus on execution. Companies that demonstrate clear returns from AI investment are being rewarded, while those falling short are being punished swiftly.

In Asia, markets were steadier. Hong Kong’s Hang Seng rose 0.5%, Japan’s Nikkei 225 added marginally and China’s Shanghai Composite finished slightly higher.

European markets were mixed, reflecting similar concerns around rates and growth.

Commodity prices broadly eased. Oil slipped around 1%, copper fell just over 1%, and silver tracked gold lower.

The Australian dollar weakened to around US 70.2 cents, reflecting softer commodity prices and lingering uncertainty around domestic monetary policy.

Interest rates continue to loom large. HSBC chief economist Paul Bloxham warned this week that the RBA may have “little choice” but to lift rates as inflation proves stickier than expected, describing a potential February hike as a “painful” but necessary step.

That outlook has kept markets on edge, particularly rate-sensitive sectors and smaller companies reliant on funding.

Friday’s session summed up the market mood. Cautious, selective and highly sensitive to data. While banks and defensives are providing stability, resources and technology remain volatile, and sharp stock-specific moves continue to define daily trading.

As January closes, the ASX appears to be settling into a wait-and-see mode, with the next move likely to hinge on central bank decisions and the next round of earnings updates.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles