Australian shares were softer again by lunchtime, but it was not a uniform retreat. The market’s mood split neatly down the middle: hard assets were in fashion, growth stocks were not.

By 12:11pm AEDT, the S&P/ASX 200 was down 0.37% to 8,783.5, while the All Ordinaries slipped 0.40% to 9,102.0. The pain was concentrated in growth-heavy areas, with the All Technology index down 2.51% to 3,211.0.

That divergence tells you what kind of day this is. When tech is falling hard while miners are rising, it is usually less about local earnings and more about global risk appetite, rates, and where money wants to hide.

The sector board made the theme hard to miss. Materials (+1.52%), Utilities (+1.39%), and Energy (+1.07%) were the only bright spots by midday, while Information Technology (-2.65%) was the biggest drag. Financials (-1.40%) and real estate (-1.37%) were also under pressure.

Source: Bloomberg

Behind that is a simple mix of forces:

ASX Sector Chart | Source: LSEG

The global tone set the table. At the close on 20 January, the Dow fell 1.76%, the S&P 500 dropped 2.06%, and the Nasdaq slid 2.39%. Japan’s Nikkei also fell 1.11%.

when the US market takes a broad-based hit like that, the ASX typically opens with less confidence, especially in sectors priced on future growth. That is exactly where today’s selling is landing, with tech wearing the brunt.

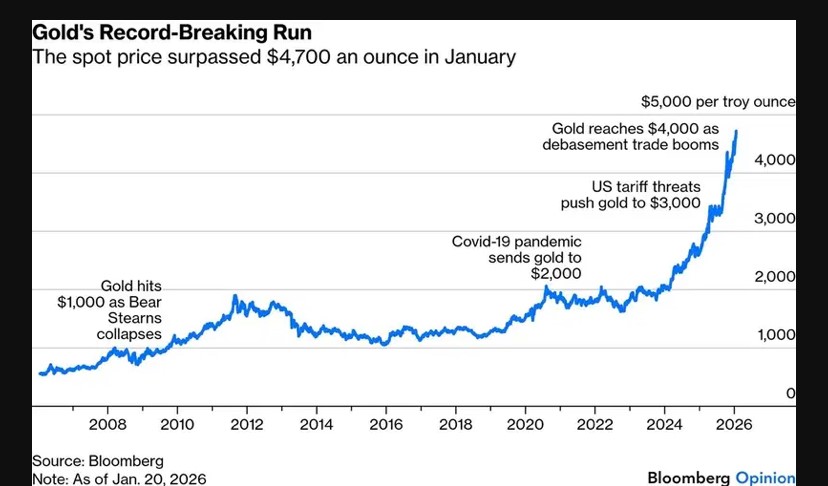

A widening sell off mood swing tied to geopolitics, a weaker US dollar and a rush toward haven assets. ANZ’s economics team summed up the gold impulse as classic “risk-off”, noting that haven buying picked up as tensions between the US and Europe stayed elevated, adding fuel to gold’s record run.

The lead was dominated by miners, especially gold-linked names and a handful of battery-material plays.

By late morning, the biggest movers included:

This is the “gold is a currency” day, not the “gold is a commodity” day. When bullion pushes higher alongside weaker equity sentiment, gold producers become a liquid proxy for safety, and the whole complex can rise even while the main index falls.

29Metals (29M) fell 33.07% to $0.415, far and away the steepest drop among mid-caps and up on the board.

Other notable fallers included:

A key local headline was Rio Tinto’s record iron ore quarter and strong copper output, which helped support the broader resources complex even as banks and tech dragged the index lower.

Rio shipped 91.3 million tonnes of iron ore in the fourth quarter, up 7% on a year earlier, and produced 240,000 tonnes of copper, up 5% for the quarter. It also flagged that Rio was in early takeover talks with Glencore, a storyline tied to copper’s growing strategic value in AI and the energy transition.

The market relevance is straightforward: iron ore still pays most of the bills for Australia’s mega-miners, but copper is increasingly the “growth metal”. When a giant like Rio is showing both volume strength and copper momentum, it cushions resources on an otherwise soft macro day.

At midday, the Australian dollar bought about US$0.6731.

The market’s expected volatility gauge stayed subdued, with the ASX 200 VIX around 10.9, still firmly in the “low” zone.

That combination can look odd: big swings in US equities, record highs in gold, and yet volatility measures that suggest the local market expects relatively contained turbulence. One way to read it is that investors are hedging through rotation (gold, defensives) rather than through panic selling.

Three themes stood out by lunchtime:

The haven bid is real

Gold and silver are high, and miners are responding. Materials is leading while the index falls, which is a classic risk-off tell.

Tech is still the pressure point

The All Tech index down 2.51% is not subtle. This is where global rate expectations and risk appetite show up first.

Big-picture geopolitics is bleeding into markets

Renewed US-Europe tensions and a “Sell off in markets explain why gold is strong even when some commodity prices (like oil) are easing. ANZ’s economists linked the surge in gold to a broader risk-off tone and haven buying.

If you are tracking where the next move could come from, there are a few practical markers:

For now, the market feels like it is choosing caution, but doing it quietly: selling growth, buying safety, and keeping one eye on the US.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles