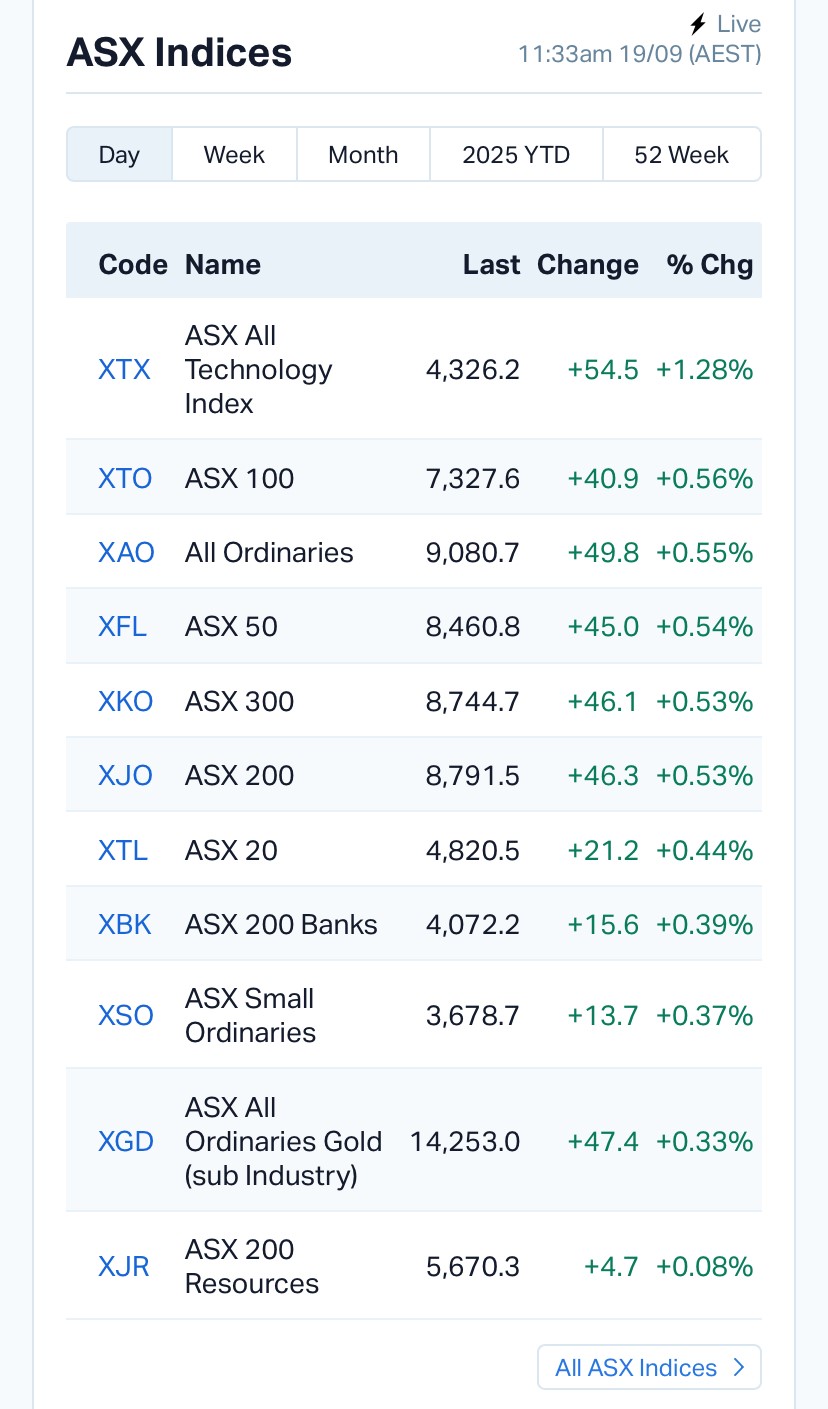

The ASX pushed higher into Friday, tracking a global upswing after the Federal Reserve’s quarter-point rate cut and a powerful tech rally on Wall Street. By late morning, the S&P/ASX 200 added 0.52% to 8,790, with breadth firmly positive and leadership from defensive growth (health care) and rate-sensitive pockets (utilities, tech). The ASX All Technology Index climbed 1.28%, mirroring U.S. momentum where chips and AI beneficiaries set the tone overnight.

Gains were broad but orderly. Health Care (+1.94%) outperformed as Telix (+6.26%), Clarity (+5.95%), Pro Medicus (+5.15%), and Clinuvel (+4.43%) extended this week’s strength. Utilities (+1.66%) joined the bid—typical when rates ease and volatility is subdued. Information Technology (+0.97%) rallied with Weebit Nano (+9.34%) and Qoria (+5.2%) among notable risers.

Financials (+0.49%) and the ASX 200 Banks (+0.40%) advanced in line with the index, while Industrials (+0.42%), Real Estate (+0.33%) and Staples (+0.23%) added incremental points. On the other side, Materials (−0.27%) edged lower despite firmer gold and copper, reflecting stock-specific drags: Mineral Resources (−3.35%), Iluka (−3.00%), and Resolute (−2.66%) were among the heavier weights. Energy (+0.91%) outperformed the commodities tape, with Strike Energy (+4.76%) and select mid-caps firmer even as Brent/WTI were essentially flat.

At the single-name level, Race Oncology (+22.57%) and Weebit Nano (+9.34%) led mid-cap gainers, while Sunrise Energy Metals (−7.46%) and Wildcat Resources (−4.44%) paced the fallers. The ASX VIX at 10.8 underscores a market leaning constructive into the weekend: options pricing implies low expected volatility over the next month.

Wall Street closed at fresh records after the Fed delivered a widely expected 25 bp cut and indicated more easing is likely this year. The tone shift was amplified by NVIDIA’s US$5 billion investment in Intel, which sent Intel up 23% and NVIDIA up ~3.5%, and revived the “re-shoring/semis” narrative. All major U.S. averages—S&P 500 (+0.48%), Nasdaq (+0.94%), Dow (+0.27%)—set record closes, and the Russell 2000 finally joined with a 2% surge.

Still, the Fed’s message was measured. Chair Jerome Powell warned there is “no risk-free path” as the central bank navigates elevated inflation alongside labour-market softening. Weekly jobless claims eased from the prior week’s jump, but hiring remains sluggish, fitting the Fed’s risk-management rationale for a gradual easing cycle. The policy mix—a gentle rate path with record-high equities—has historically favoured quality growth and cash-generative cyclicals, and that’s what Australia is seeing today.

Gold hovered near US$3,649/oz as real yields stabilised post-Fed; silver was marginally higher. Copper ticked up to US$4.54/lb, a modest positive for base-metal names, though Materials underperformed on stock specifics. Brent and WTI were little changed around US$67.5/US$63.6, providing cost relief to energy-intensive sectors even as Energy equities posted gains. The AUD held near US$0.661, reflecting improved risk appetite and a softer U.S. dollar, while Asian equities were mixed—Nikkei +1.15% versus Hang Seng −1.35%—signalling idiosyncratic drivers at work across the region.

Ex-dividend activity adds noise to intraday moves. Stocks going ex today include Latitude, Vita Life Sciences, and WAM Income Maximiser, with more to follow early next week (Bisalloy, New Hope, IMDEX, and others). On the primary calendar, Revolution Private Credit Income Trust (REV) targets a 22 Sept debut, followed by Golden Globe Resources and Temas Resources on 30 Sept, and PC Gold/Nexsen on 7 Oct. A functioning IPO window is constructive for risk sentiment and secondary capital needs heading into Q4.

From a drawdown-risk perspective, rallies near highs can be fragile if macro surprises hit—an insight echoed by sell-side models that track equity drawdown probability. The Fed’s pivot reduces tail risk, but Powell’s “no risk-free path” is a timely reminder: policy, growth, and inflation are still in a three-way tug-of-war. In practice, that argues for barbell positioning—quality defensives (health care, utilities) on one side, and select cyclicals (banks, energy transition plays, high-quality tech) on the other—while avoiding crowded single-factor bets.

The ASX is higher on the back of Wall Street records, a Fed cut, and a low-volatility backdrop that favours defensive growth and quality tech. The near-term story is benign—steady commodities, firm AUD, constructive breadth. But as Powell put it, there’s “no risk-free path.” For investors, that means stay balanced, focus on cash flow and balance sheets, and let earnings—not just policy hopes—validate the rally into Q4.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles