Australian shares spent Monday moving in a familiar rhythm: a cautious open, a softening through the session, and a market that looked increasingly selective about what it wanted to own. By mid afternoon, the S&P/ASX 200 was down 0.49% to 8,860.6, with the All Ordinaries off 0.50% to 9,180.4.

The Small Ordinaries barely budged (down 0.02%), a sign the day’s mood was less about a broad capitulation and more about sector rotation and headline risk.

If there was a single theme, it was this: when global politics turns noisy, markets tend to default to the basics. On Monday, that meant precious metals and defensive pockets found bids, while high valuation growth stocks and parts of the consumer complex wore the pressure.

The lead into Australia was not dramatic on paper. On Friday, Wall Street finished only marginally lower: the S&P 500 slipped 0.06%, the Nasdaq edged down 0.06%, and the Dow fell 0.17%. In other words, not a panic.

But markets are rarely just about the last close. The bigger swing factor was the return of trade and geopolitical uncertainty. The latest headlines included a White House threat to revive punitive tariffs against European nations over Greenland, and the market treated that as a reminder that trade policy can shift quickly and without much warning. That kind of instability typically pushes money toward assets that do not need a strong growth story to justify their price.

It also helped explain why Bitcoin was weaker on the day, sliding about 3.3% to US$92,222 in the live market snapshot, while traditional havens did the opposite.

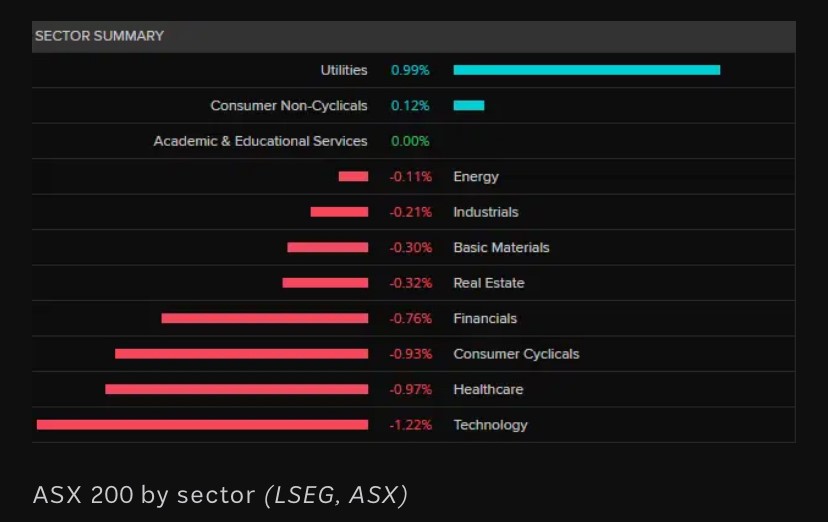

The sector tape told the story clearly.

Source: ASX, LSEG

The divergence was sharp enough to show up in the indices. The ASX All Technology Index fell 2.55% to 3,283.2, a meaningful move for a single session. Meanwhile, the ASX All Ordinaries Gold index jumped 2.91% to 20,420.5, reflecting how aggressively the market leaned into the gold bid.

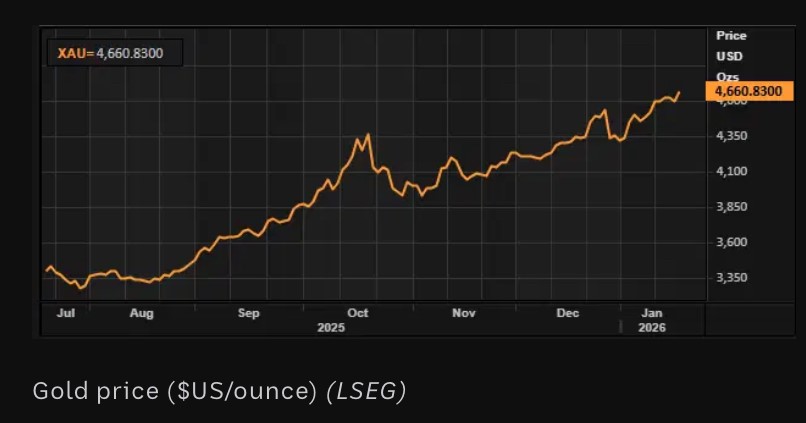

That gold strength had a clear macro driver. Spot gold rose 1.44% to about US$4,661/oz, and spot silver surged 3.40% to around US$93/oz in afternoon pricing. When both metals are breaking records on the same day, it usually signals something deeper than simple jewellery demand. It is a price response to uncertainty, and a market trying to hedge the edges of geopolitical risk.

Source: LSEG

The best performers list looked like a snapshot of where momentum is living right now: energy transition themes, miners, and anything tethered to hard assets.

Among the day’s top gainers:

It is worth noting what sits behind those names. Uranium exposures like Boss and Lotus tend to move quickly when macro risk re-enters the conversation, partly because the sector attracts thematic flows and partly because investors look for supply constrained commodities with strategic importance. Silver linked names benefited from the metal’s sharp jump, while Calix and Energy Transition Minerals sit inside the broader decarbonisation narrative that still attracts capital even when equities wobble.

Losses were concentrated in a few large, widely held names and a cluster of tech exposures. The biggest fallers list included:

A2 Milk’s move was the day’s standout. The company requested a trading halt after a sharp afternoon fall, and the timing coincided with new Chinese demographic data. According to China’s National Bureau of Statistics, births fell to 7.92 million in 2025, down from 9.54 million in 2024, the lowest level in decades. It is the kind of data point that hits consumer facing businesses hardest when their growth thesis relies on long term demand in China. A2 Milk is due to release interim results on February 26, and Monday’s price action underscored how quickly macro data can re-price a story when the market is already nervous.

Meanwhile, the slump in tech names echoed the broader rotation away from expensive growth stocks on days when safe haven assets are rallying. It is not necessarily a verdict on earnings. It is often a simple risk management response.

A big part of the day’s macro conversation centred on China. The headline was neat: China’s economy grew 5% in 2025, right on Beijing’s target. Quarterly growth was 1.2%, translating to 4.5% year on year.

But the details were mixed, and that is where markets live:

The interpretation offered in the live coverage was blunt: China’s external economy is strong, highlighted by a record US$1.2 trillion trade surplus in 2025, but domestic demand remains under pressure. For Australian markets, that tension matters because it influences commodity demand, export volumes, and confidence around the growth outlook for China exposed sectors.

Source: ABC-Reuters

Outside equities, Monday looked like a standard day in a market that is quietly hedging.

The metals move was the headline. Gold pushing through US$4,600/oz and silver through the low US$90s at the same time is not subtle. It implies investors want protection, and they are prepared to pay for it.

One of the more interesting cross-currents was the volatility read. The ASX 200 VIX index sat around 10.7, which is considered low and typically suggests calm conditions over the next 30 days.

The catch is that low volatility can sometimes hide an uneasy market. When volatility is cheap, hedging is also cheap. And when geopolitics starts driving headlines again, it does not take much for risk pricing to re-set. Monday’s action, with tech selling off and gold rallying hard, looked like a market quietly buying insurance.

A few narratives stood out as “today’s conversation” across markets:

Monday’s market did not feel like a panic. It felt like a market that is listening carefully, and choosing its exposure with more intention. Gold miners and defensive sectors found support. High multiple growth names were trimmed. China delivered the headline number, but the detail still looked like an economy searching for its next clean growth engine.

That combination can produce choppy days like this. Not dramatic, but meaningful.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles