Australian shares were weaker into lunchtime, with the S&P/ASX 200 at 8,828.7, down 0.52%, and the All Ordinaries off 0.54% to 9,145.6 around 12:00pm AEDT. The story of the session was not panic, but rotation: traders leaned toward parts of the market that feel steadier and trimmed exposure where macro uncertainty bites hardest.

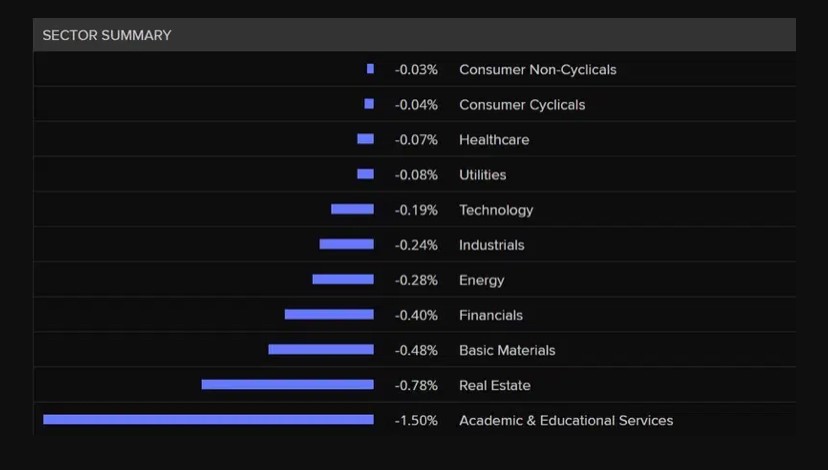

ASX Sector Summary, Source: LSEG

Sector moves tell that story cleanly. Utilities led (+1.15%), followed by Information Technology (+1.04%) and Health Care (+0.35%). On the other side, Materials (-0.97%), Financials (-0.85%) and Energy (-0.74%) pulled back.

That mix matters. When utilities and tech outperform on a down day, it usually says the market is being selective rather than broadly risk-on. It is also consistent with the bigger backdrop: global policy headlines remain noisy, and positioning is tighter when the headlines can move faster than earnings.

The most consequential corporate update on the tape came from BHP, which reported record first-half iron ore production but also acknowledged something markets had been watching closely: it has accepted lower prices for some iron ore during annual contract negotiations with China.

BHP noted it is negotiating annual terms with China’s state buyer China Mineral Resources Group (CMRG) and said it is seeking to sell more product into other markets. The company described the negotiation impact plainly:

“During negotiations, we continue to optimise product placement distribution channels and take actions within our operations to preserve operational flexibility and productivity,” BHP said. “This has seen some impact to realised price.”

That matters beyond one stock because iron ore still underwrites a meaningful slice of Australia’s earnings engine. BHP’s update also flagged a 20% increase in costs for its Jansen potash project in Canada, another reminder that big projects are being built in a world where cost inflation and supply chain friction never fully left the room.

A notable counterpoint came from RBC Capital Markets analyst Kaan Peker, who said CMRG restrictions were likely to tighten spot market availability and support the headline index price, offsetting the higher discounts BHP faces. It is a useful framing: price negotiations may squeeze realised prices for certain products, even while benchmark dynamics can remain supported if spot liquidity tightens.

BHP shares were down 1.1% late morning.

If BHP was the macro headline, Origin Energy’s Eraring decision was the policy storyline with real-world consequences.

Origin confirmed an almost two-year extension for Eraring, Australia’s largest coal-fired power station, now expected to operate until 30 April 2029. It is the second extension after a prior plan that pointed to 2027.

The explanation offered was practical, not ideological: the rollout of renewables and firming capacity has been slower than forecast, with large projects such as Snowy Hydro 2.0 taking longer. There is also a plain market logic here. A major baseload plant staying online longer can reduce the risk of supply gaps and may soften the “scarcity premium” that can build into forward power prices when closures approach.

From government, NSW Environment Minister Penny Sharpe said the decision provided “certainty to workers, the market and energy consumers across the state,” and added projections suggested NSW should have sufficient supply when Eraring closes in 2029 as renewables and storage come online.

Origin was up 0.2% in morning trade.

Source: ABC, MarketIndex, ASX

On days when the index drifts lower, the best clues often sit in the extremes.

Top gainers (mid-cap and up, 11:40am AEDT delayed):

It is a mixed list, but a couple of themes stand out. One is selective strength in gold and resources names even as Materials overall was down. Another is the market’s continued appetite for high-quality platform businesses such as HUB24, where operational updates can matter more than broad macro swings.

Telix also stood out, with the data noting Chinese NMPA acceptance of an NDA, the kind of regulatory milestone that can shift the probability curve for revenue expansion. These are the moments biotech traders watch closely.

Biggest fallers (mid-cap and up, 11:40am AEDT delayed):

The standout is QORIA’s drop, which is the kind of move that typically reflects either a fresh company-specific update or a sharp reset in expectations. ARB’s fall is notable because it sits closer to consumer and discretionary sentiment, a reminder that “household-facing” exposures can reprice quickly when outlook narratives shift.

Overnight leads were muted. As of the latest global close shown in your data (16/01), US indices were marginally lower: the Dow -0.17%, S&P 500 -0.06%, Nasdaq -0.06%. In Asia, Shanghai was up (+0.29%) while Nikkei (-0.65%) and Hang Seng (-1.05%) were weaker.

The more immediate tone-setter this morning was US futures, which were pointing lower: Dow futures -0.8% and S&P 500 futures -0.9%. That matters because it tends to drag on early risk appetite in Australia, particularly in banks and high multiple growth names.

One of the key drivers behind the defensive tilt is still the same: policy and geopolitics. As one market analyst put it, “US futures are also lower, pointing to a drop when Wall Street re-opens on Tuesday,” adding that instability is keeping a strong bid under precious metals, with the US dollar softer amid renewed “sell America” sentiment.

In commodities, Brent crude was slightly higher at $US64.17 and WTI around $US59.45 in your ASX screen snapshot. However, the more interesting colour came from IG market analyst Tony Sycamore, who said WTI was finding modest support from China’s better-than-expected Q4 GDP at 4.5% year-on-year, with full-year growth hitting 5.0%, meeting Beijing’s target.

Sycamore’s broader point is worth quoting because it captures where oil is sitting technically and psychologically:

“Following last week’s rejection of the upside, crude oil is likely to remain range-bound: trading below the 200-day moving average (currently hovering around $US62.20) … and above medium-term support at $US55.00 … for the foreseeable future.”

That is a concise way of saying oil has support, but it is not breaking out. And for the ASX, that often translates into energy stocks needing company-specific catalysts rather than relying on a broad crude surge.

Gold was a touch softer in the screen snapshot, around $US4,663/oz, but still near record territory, which helps explain why gold producers keep showing up in “top movers” lists even when broader indices wobble.

One of the more closely watched stock-specific sagas today is A2 Milk, which is still digesting Monday’s sharp move. The company appointed Helena He as Chief Marketing Officer, and CEO David Bortolussi said her China experience and knowledge of Chinese consumers made her “an excellent fit,” adding: “Helena will have a significant impact on our future brand development, innovation and growth.”

The timing is not accidental. The recent share price volatility coincided with fresh data showing China births fell to 7.92 million in 2025, the lowest in decades, down from 9.54 million in 2024. For companies with material China infant formula exposure, this is not just a macro statistic; it is demand math.

A2 shares were indicated down 1.3% at $8.2 late morning.

If there is a single thread running through the session, it is a low tolerance for uncertainty. You can see it in three places:

By lunchtime, the ASX was not in crisis mode. But it was clearly in “evidence mode”, rewarding tangible updates and punishing uncertainty quickly.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles