By early afternoon on Friday, the ASX was wearing a calmer face after a busy week of geopolitical headlines and big swings in safe haven trades. The S&P/ASX 200 rose 0.34% to 8,878.7, while the All Ordinaries gained 0.40% to 9,208.7 (1:26pm AEDT). The market’s message was simple: the week’s nerves have not disappeared, but the panic has eased.

Overnight, Wall Street helped set the tone. The Dow added 0.63%, the S&P 500 rose 0.55%, and the Nasdaq climbed 0.91% at Thursday’s US close, a lift that filtered into local trading and gave growth names room to breathe again. In Asia, Japan’s Nikkei jumped 1.73%, while China and Hong Kong posted modest gains.

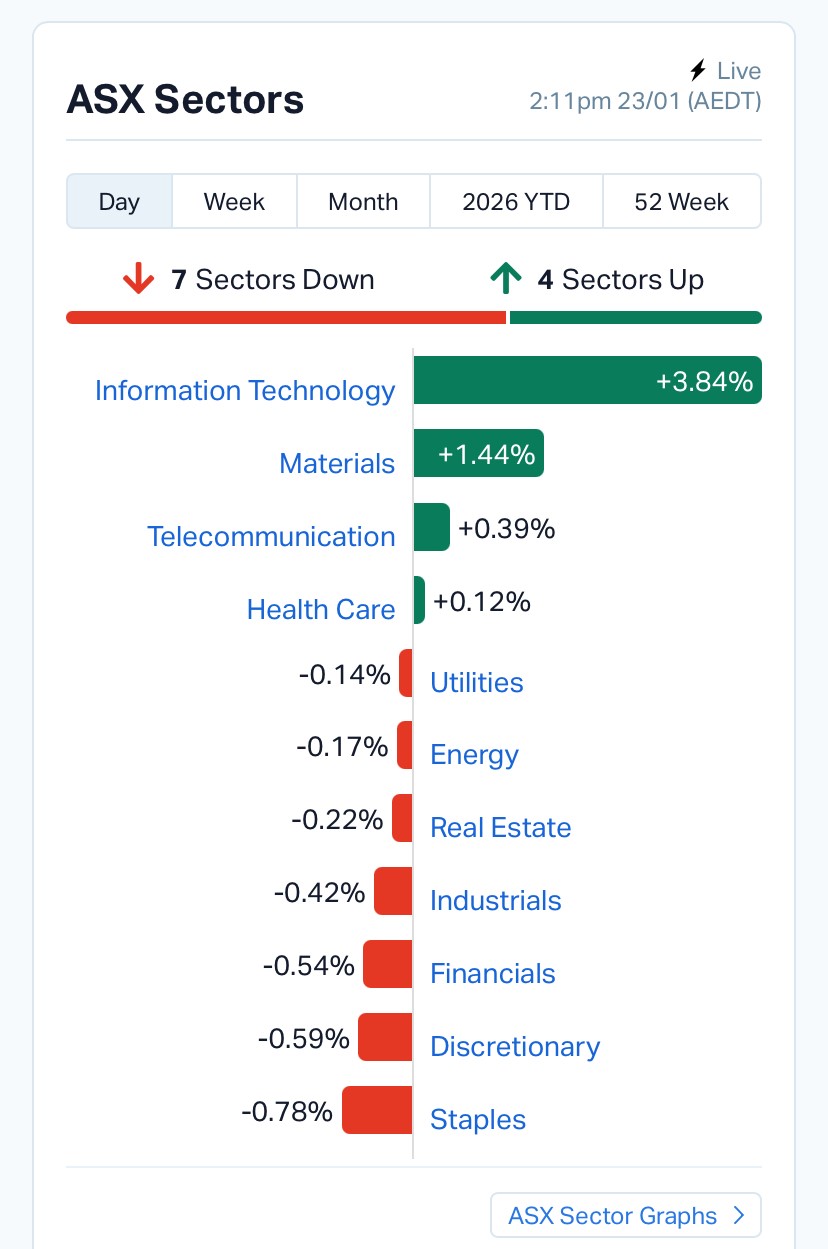

The most visible shift on the ASX was the sharp rotation back into technology. After a patch where high valuation names had been treated with suspicion, the sector came roaring back. The Information Technology sector was up 4.56%, and the ASX All Technology Index rose 2.74% to 3,323.7.

That surge is also reflected in the winners’ list, which had a distinctly tech flavour.

Life360 (ASX: 360) was the headline act, up 28.16% to $34.00. The company’s update landed cleanly: it pointed to full year revenue guidance of US$486 million to US$489 million, roughly 31% to 32% higher than last year, and said its fourth quarter monthly active users hit 95.8 million, a record for the period. In a market that has been craving clear, measurable growth, those numbers did the job.

Elsewhere in the sector, familiar tech movers were back in motion. Weebit Nano (ASX: WBT) rose 12.85%, Appen (ASX: APX) gained 8.37%, and Nuix (ASX: NXL) added 7.80%. Taken together, it looked less like a single stock story and more like a sector wide exhale.

Source: MarketIndex

If Thursday belonged to risk assets, Friday’s session had a second theme: gold stocks, once again, moving like a crowd.

The ASX All Ordinaries Gold sub index jumped 5.18%, a sharp reversal after recent weakness. The metals tape was supportive. Gold edged up 0.28% to US$4,949.49/oz, while silver surged 2.55% to US$98.62/oz. Copper also pushed higher, up 0.92%, reinforcing the broader “metals are alive” mood.

In the small and mid cap space, the rebound was visible in individual names too. Regis Resources (ASX: RRL) climbed 8.05%, while several previously battered gold names were also prominent in the session’s big moves. At the same time, the market was still punishing laggards in the same theme, showing just how stock specific the trade remains.

The day’s biggest fallers list had plenty of resource names, including gold exposures, suggesting traders were still rotating quickly between “best in class” stories and those carrying more operational or market risk.

At a sector level, the ASX looked like it was trading two different commodity markets at once.

On the surface, energy’s dip looks odd given crude was firmer. Brent was up 0.67% to US$64.49/bbl, and WTI rose 0.69% to US$59.77/bbl. But energy equities often trade on expectations and positioning, not just the spot print. After a week where markets have been digesting shifting geopolitical risk and currency swings, the sector’s softness reads like profit taking and caution rather than a rejection of the oil price.

The market’s rally was not evenly shared. The ASX 200 Banks index slipped 0.32%, and Financials were down 0.31%. That matters because banks often dictate whether an ASX move has real breadth. Today’s gains were more concentrated in tech and select resources rather than a full market surge.

The leaderboard on Friday showed a market that was happy to reward strong updates and clear momentum, but equally quick to punish softness.

Top gainers (1:06pm AEDT, delayed):

Biggest fallers (1:06pm AEDT, delayed):

A quick read of those lists suggests two live currents. First, tech and growth names with fresh catalysts are being chased again. Second, resources remain volatile and selective, with sharp rises and sharp drops sitting side by side.

Another important background driver on Friday was the currency. In your market wrap text, the Australian dollar was described as pushing toward 15 month highs, and your FX table showed one AUD buying US$0.6844, a touch higher on the day.

A stronger Aussie dollar can be a double edged sword. It tends to ease imported inflation pressures, but it can also take the edge off earnings for exporters and global commodity producers when revenues are priced in US dollars. On a day where resources were still rising, it suggests the commodity price strength was doing enough to offset the currency headwind.

The offshore lead was more supportive than it has been at points this week. Your supplied summary notes markets showed signs of relief after US President Donald Trump dropped tariff threats against eight European countries and ruled out seizing Greenland by force. That de escalation tone matters because it cools the “risk off” impulse that has been pushing money into havens and away from growth.

The mood shift also showed up in broader assets:

Tech rebound: the market is once again paying up for growth when guidance and user metrics are clear.

Gold bounce: bullion and silver strength is pulling gold equities higher, even after a week of whipsaws.

A calmer global lead: Wall Street’s bounce and a softer geopolitical tone is helping local risk appetite.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles