Australian shares closed the first full trading session of 2026 largely unchanged, with investors adopting a cautious tone as global markets digested fresh geopolitical developments and conflicting signals from commodity markets.

The S&P/ASX 200 finished the session up just 0.01 percent at 8,728.6, while the All Ordinaries slipped 0.02 percent. The lack of direction reflected a tug-of-war between stronger commodity prices and weakness across growth-oriented sectors.

At the centre of global market attention was oil, which moved lower despite heightened tensions following the United States’ strike on Venezuela over the weekend. Normally, such an escalation would lift crude prices. This time, the reaction was muted.

Brent crude ended the session down 0.9 percent at US$60.18 a barrel, while WTI slipped 1 percent to US$56.74, confounding expectations of a geopolitical risk premium.

The key reason lies in supply dynamics rather than headlines.

While the US action raised geopolitical temperature, traders quickly assessed that Venezuela’s oil industry no longer carries the same weight it once did. Years of underinvestment and sanctions have reduced the country’s output to well below one million barrels per day, sharply limiting its influence on global supply.

At the same time, global oil markets remain well supplied. US production is hovering near record highs, OPEC+ spare capacity remains significant, and global demand growth is showing signs of slowing as economic momentum cools in parts of Europe and Asia.

In short, markets are treating the Venezuela situation as a political shock with limited physical impact on oil flows.

This explains why energy stocks underperformed locally, with the ASX Energy sector falling 0.49 percent despite the geopolitical escalation.

While oil slipped, other commodities moved decisively higher.

Gold surged 2.1 percent to US$4,421 an ounce, while silver jumped nearly 4 percent, continuing its strong start to the year. Copper also advanced more than 3 percent, reflecting improving sentiment around industrial metals.

Analysts point to a classic risk rotation. When geopolitical risk rises but growth expectations soften, investors tend to favour precious metals over energy, especially when oil markets remain structurally oversupplied.

That dynamic played out clearly on the ASX.

The Materials sector rose 1.74 percent, making it the day’s standout performer. Gold miners and uranium stocks attracted strong buying as investors leaned into hard assets.

The ASX All Ordinaries Gold Index climbed 1.54 percent, reflecting strength across mid-cap and large-cap producers.

In contrast, risk-sensitive sectors struggled. Information Technology fell 2.35 percent, while Consumer Discretionary dropped 2.58 percent. Real Estate and Telecommunications also finished sharply lower.

The divergence underscores a broader theme emerging early in 2026: capital rotating away from high-growth names toward real assets and defensives.

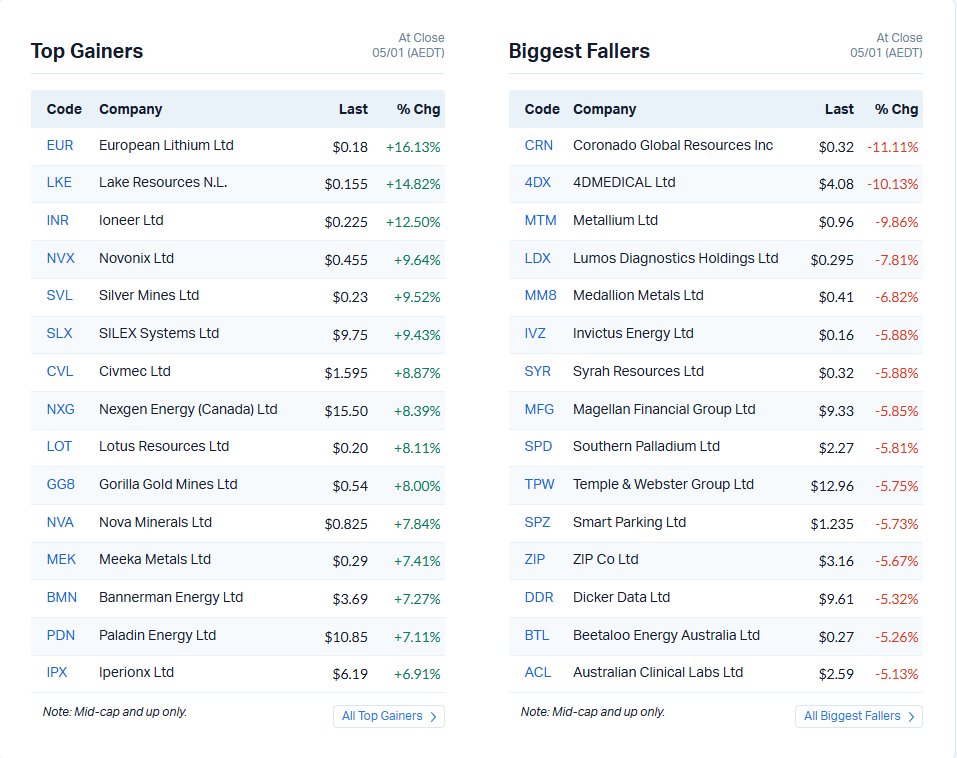

Resource stocks featured prominently among the session’s top performers.

(Source: MarketIndex)

European Lithium, Lake Resources, and Ioneer all posted double-digit gains, buoyed by renewed optimism around battery metals and supply discipline. Uranium names such as Paladin Energy and Bannerman Energy also advanced as the nuclear fuel narrative regained traction.

Silver Mines climbed nearly 10 percent, extending its strong run amid elevated silver prices and growing investor interest in precious metals exposure.

The strength across lithium, uranium, and precious metals highlights how investors are positioning for structural supply constraints rather than short-term growth trades.

On the downside, the day’s biggest losers were clustered in healthcare, technology, and consumer-facing names.

Coronado Global Resources fell more than 11 percent, while healthcare names such as 4DMedical and Lumos Diagnostics also sold off sharply. Consumer-facing stocks including Temple and Webster and ZIP Co retreated as investors pared back exposure to discretionary spending themes.

The selling pressure reflects early signs of profit-taking and repositioning after a volatile end to 2025.

US markets ended last week on a mixed note.

The Dow Jones Industrial Average rose 0.7 percent, supported by industrials and energy-adjacent stocks. The S&P 500 added 0.2 percent, while the NASDAQ finished flat as tech stocks lost momentum.

Investors remain caught between geopolitical uncertainty and expectations that US interest rates are close to peaking. Markets are increasingly sensitive to incoming inflation and labour data, which will shape the Federal Reserve’s next move.

In Asia, markets were more constructive.

Hong Kong’s Hang Seng surged 2.8 percent, while Shanghai edged higher. Japan’s Nikkei slipped modestly after a strong rally late last year.

European markets ended the previous session higher, with the FTSE and EuroStoxx both gaining as investors rotated into defensive sectors and exporters.

The Australian dollar weakened to around 66.7 US cents, reflecting a stronger US dollar and cautious risk sentiment. Currency moves remain closely tied to commodity prices and expectations around global growth.

Meanwhile, market volatility remains subdued. The ASX volatility index sits near 10, signalling low near-term stress and suggesting investors are cautious but not fearful.

The first trading session of 2026 delivered a clear message. Headlines alone are no longer enough to move markets.

Oil’s failure to rally despite geopolitical escalation shows that fundamentals matter more than ever. Supply, demand, and spare capacity are overriding fear-driven trading.

At the same time, the strength in gold, silver, uranium, and materials points to a market quietly positioning for longer-term structural themes, including resource scarcity, energy transition, and geopolitical fragmentation.

For Australian investors, the early signs suggest a year where selectivity will matter more than broad market exposure.

As we move into 2026, attention will turn to US inflation data, central bank guidance, and how geopolitical tensions translate into real economic impacts rather than market noise.

If this wrap added value to your investing journey, consider subscribing to our newsletter. We will be bringing you sharp, data-driven market insights throughout the year ahead.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles