Australian shares closed higher on Wednesday, extending the early January recovery as optimism around global growth, cooling inflation data and renewed strength in commodities offset weakness in financials and energy.

The S&P/ASX 200 added 0.15 percent to finish at 8,695.6 points, while the broader All Ordinaries rose 0.24 percent to 9,018. Small caps outperformed, with the Small Ordinaries climbing 0.74 percent, reflecting renewed appetite for risk in select growth and resource names.

It was a session shaped by a mix of macro calm and micro momentum, with traders balancing improving domestic inflation signals against ongoing geopolitical developments abroad.

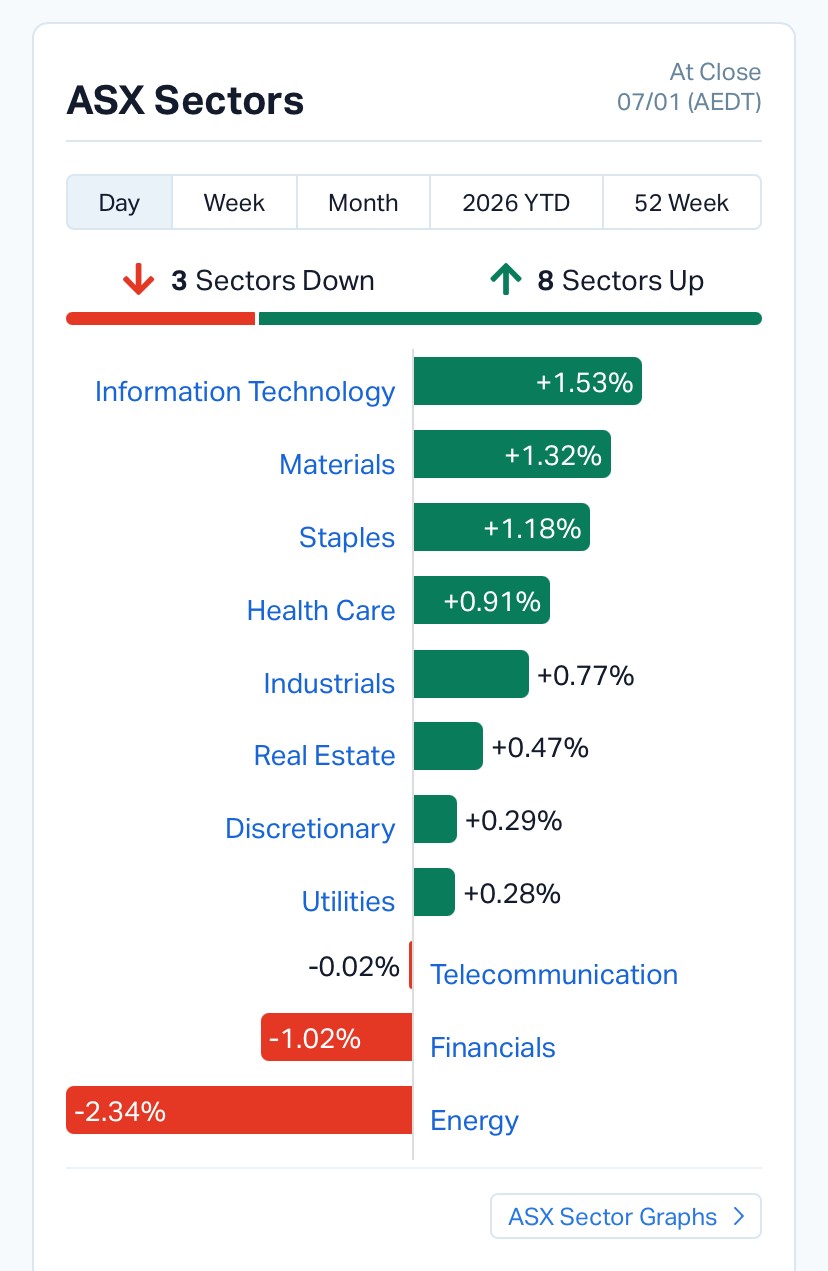

Source: MarketIndex

At a macro level, sentiment was supported by signs that inflation pressures are easing both locally and offshore. Fresh data showing inflation slowing to 3.4 percent helped reinforce expectations that policy tightening may be nearing its peak, even as the Reserve Bank of Australia remains cautious about declaring victory too early.

That backdrop helped lift rate-sensitive sectors such as technology and real estate, while also underpinning demand for commodities tied to longer-term structural themes, including electrification and supply chain security.

At the same time, global markets provided a steady lead. On Wall Street, the Dow Jones Industrial Average rose 0.66 percent, while the S&P 500 added 0.19 percent. The Nasdaq was flat, reflecting ongoing rotation within the tech sector rather than a broad pullback.

In Asia, Hong Kong stood out, with the Hang Seng jumping 2.76 percent, while Japan’s Nikkei eased modestly. European markets closed mostly higher, reinforcing the sense of stability across global risk assets.

Eight of the ASX’s eleven sectors finished higher, led by Information Technology, which rose 1.53 percent. The rebound followed a choppy start to the year for tech stocks, with sentiment improving as global bond yields stabilised and earnings expectations remained intact.

Materials also delivered a solid session, climbing 1.32 percent. The standout theme within the sector was rare earths, which surged after reports that China may tighten export licensing to Japan following renewed diplomatic friction. That prospect reignited concerns about supply security and sent Australian producers sharply higher.

Staples and healthcare also found support, while industrials and real estate posted moderate gains.

On the downside, financials were the clear laggard, falling 2.34 percent. The weakness reflected profit-taking after a strong 2025 run and lingering uncertainty around the timing of future rate cuts. Energy stocks also slipped as oil prices fell, with Brent crude down 1.36 percent to just under US$60 a barrel.

The day’s strongest gains were clustered around resources and healthcare, driven by both macro tailwinds and company-specific updates.

European Lithium surged more than 30 percent, while Dateline Resources and Amaero each posted gains above 15 percent. Rare earths leader Lynas Rare Earths Ltd jumped more than 14 percent, riding the wave of renewed focus on non-Chinese supply chains.

Healthcare was another bright spot. 4DMedical Ltd rose nearly 12 percent, extending its strong momentum following recent US hospital adoption of its lung imaging technology.

Lithium names also featured prominently among the gainers, with strength driven by speculation that prices may be bottoming after a prolonged downturn.

On the flip side, several energy names came under pressure as oil prices softened. Beach Energy and Karoon Energy both slid close to 5 percent, reflecting concerns that increased global supply could cap near-term price upside.

Gold stocks also retreated, with Bellevue Gold down more than 6 percent as bullion eased slightly after recent record highs. Consumer-facing stocks such as Harvey Norman also fell, highlighting the uneven nature of the session.

Commodity markets were mixed. Brent crude fell to US$59.88 a barrel, while WTI dropped 1.71 percent to US$56.15, weighing on energy stocks. Copper also eased, reflecting some caution around near-term industrial demand.

Gold slipped 0.73 percent to US$4,463.50 an ounce but remained near historic highs, supported by ongoing geopolitical uncertainty and central bank demand. Silver was flat on the day.

The Australian dollar strengthened, rising to around 67.6 US cents, helped by improved risk sentiment and softer US dollar momentum.

Overnight moves in global markets reinforced the idea that investors are becoming more selective rather than broadly risk-averse. Strong gains in Hong Kong contrasted with modest declines in Japan, while Europe continued to grind higher.

Volatility remains low, with the ASX VIX sitting at 10.3, well below levels typically associated with market stress. That suggests confidence remains intact, even as headlines around geopolitics and central bank policy continue to shift.

Wednesday’s session highlighted a market that is comfortable taking risk, but increasingly focused on themes with clear structural support. Rare earths, healthcare innovation and selective technology names continue to attract attention, while traditional defensives such as banks and energy face near-term headwinds.

With more economic data due in coming weeks, including commentary from the RBA and updates on global growth, the balance between optimism and caution is likely to remain finely poised.

If this wrap added value to your investing journey, consider subscribing to our newsletter. We will be bringing you sharp, data-driven market insights throughout the year ahead.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles