By mid-afternoon on Monday, the Australian share market looked like it had walked into a stiff headwind.

The S&P/ASX 200 slid 97.8 points, or 1.10%, to 8,771.3, with selling broad and persistent across resources, energy and technology names. The All Ordinaries lost 1.11% and the All Technology Index eased 1.17%, reinforcing a simple message that risk appetite was thin.

The weight on the market was not a mystery. Commodities cracked again overnight and into Asian trade. Gold, silver, oil and copper all weakened at the same time. When metals and energy fall together, the ASX usually feels it quickly because miners and producers make up such a large slice of the index.

By early afternoon, the ASX 200 Resources index was down nearly 3%, easily the worst-performing pocket of the market.

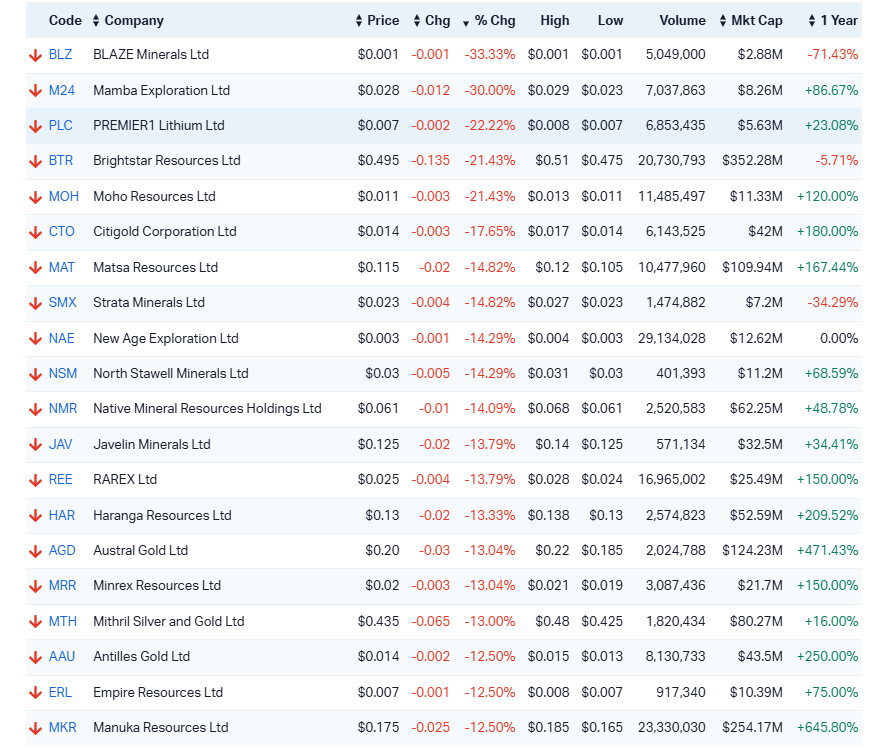

The sharpest damage came from precious metals.

Gold stocks came under heavy selling pressure early in the session, with several names plunging close to 10% at the open, before trimming some of those sharper losses as the day progressed.

Lithium and rare earth stocks remained firmly on the back foot as well, facing persistent selling through the session amid ongoing weakness across the broader battery metals and critical minerals space.

Gold Miners suffered heavy losses today. Source: MarketIndex

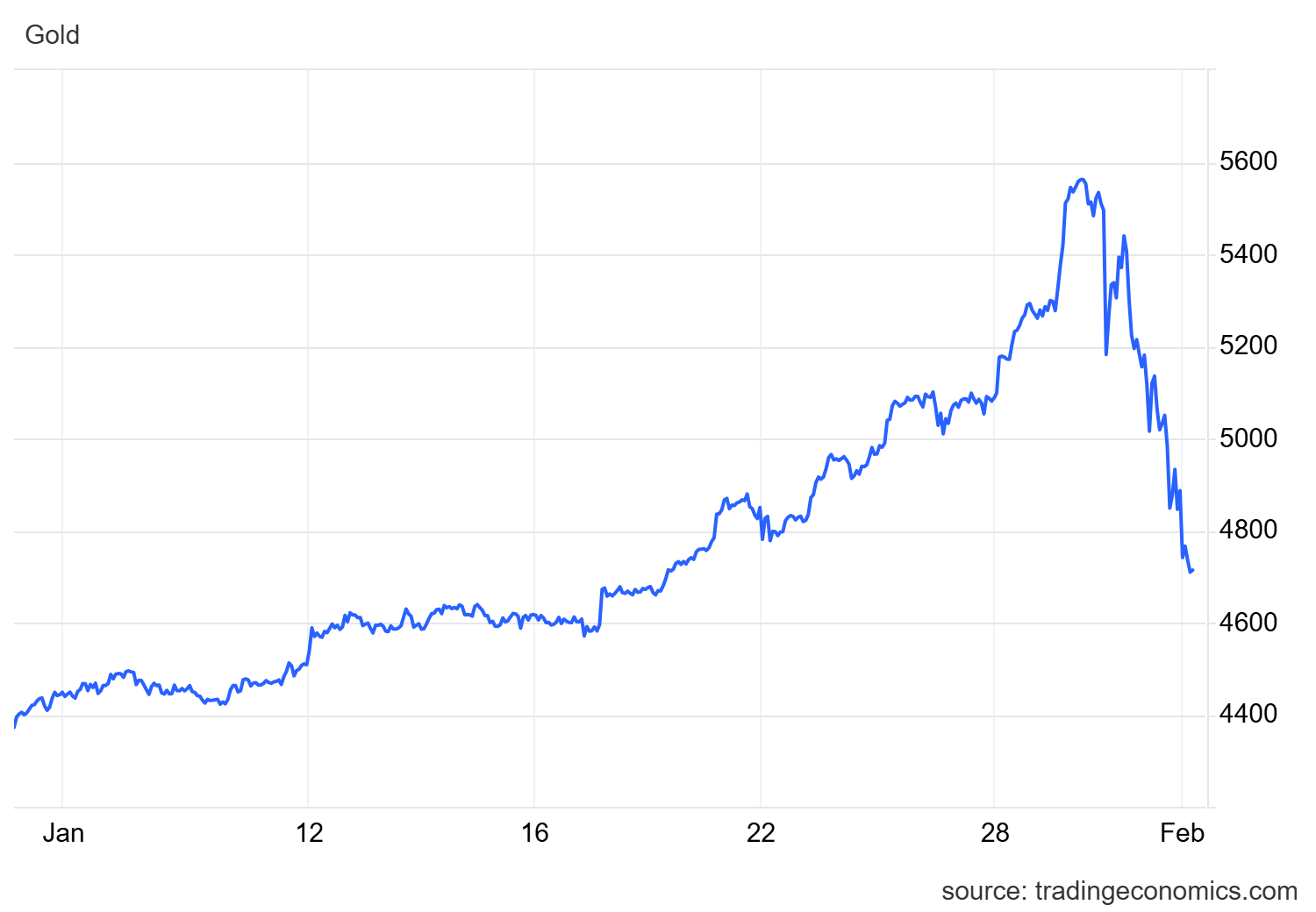

Spot gold slid about 2.9% to US$4,747 an ounce, extending a pullback that began late last week. Silver and copper were also softer. For a sector that had run hard through much of last year, the reversal was swift and uncomfortable.

GOLD 1-Month Price Chart | Source: TradingEconomics

Fund manager Mike Mangan said the recent slide was “not unexpected after a greater than 100% rise in 13 months,” adding that the market was reacting to changing expectations around US monetary policy and the nomination of a new Federal Reserve chair.

If policy looks more deflationary or less supportive of easy money, gold tends to cool.

On the ASX, that logic translated into heavy selling. The ASX All Ordinaries Gold index dropped 6.77%, and most local producers opened down as much as 10% before trimming some losses.

It was one of those sessions where even solid operators struggled to find bids.

Gold was not alone.

Oil prices slipped sharply as well, with Brent crude down around 3.8% to US$66.72 a barrel and WTI down 3.9%. That dragged local energy stocks lower and contributed to a broader risk-off tone.

Materials names were also pressured as copper fell 2.4% and iron ore eased. Heavyweights across the big miners complex traded weaker through the day, amplifying the index decline.

When both energy and materials move together like this, they tend to overwhelm gains elsewhere. That is exactly what played out.

Still, not everything was red.

Telecommunications rose 0.62% and Utilities gained 0.51%, suggesting money rotated toward more defensive, steady earners.

Financials were mixed but relatively resilient. The ASX 200 Banks index edged up about 0.10%, showing that investors were comfortable parking funds in dividend-paying blue chips while waiting for clearer signals on rates and growth.

The volatility gauge also hinted at calm beneath the surface. The ASX VIX sat near 12, a low reading that implies expectations of limited short-term turbulence despite the day’s decline.

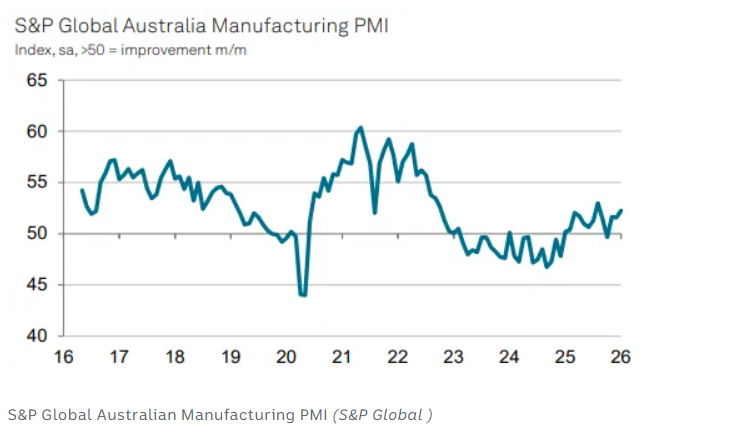

Away from the share price volatility, there was a quietly encouraging read on the real economy.

Fresh data from S&P Global showed Australian manufacturing activity is gaining momentum, not slowing.

The Purchasing Managers’ Index rose to 52.3 in January from 51.6 in December, moving further above the key 50 level that separates growth from contraction. In simple terms, factories are busier, not quieter.

S&P noted that new orders increased solidly, with overseas demand improving and helping lift output at a faster pace. Production, hiring and purchasing activity all strengthened, suggesting businesses are preparing for more work ahead rather than bracing for a slowdown.

Economist Jingyi Pan said, “The Australia Manufacturing PMI indicated that business conditions in the goods-producing sector improved at a faster pace in the opening month of 2026. Manufacturing output growth accelerated to a level matching the long-run trend, while employment and purchasing activity also increased at historically marked rates. PMI sub-data, including the new orders and future output indices, all pointed to the likelihood of continued output growth in the coming months.”

This means more production, more jobs and steadier demand, which provides a supportive backdrop for industrials, logistics and consumer-facing sectors even as miners and commodity stocks struggle.

Among individual names, the stand-out was Nine Entertainment Co. Holdings Ltd, which climbed 6.11% to $1.215. The market continues to respond positively to the company’s strategic pivot away from traditional radio assets and toward higher-growth outdoor and digital advertising. The move is being viewed as a cleaner, more focused portfolio play.

Elsewhere:

These gains were selective rather than broad. They felt more like stock-specific stories than a sector revival.

On the other side of the ledger, the losses were steep and revealing.

The pattern was clear. Commodity-exposed and smaller-cap resource plays bore the brunt.

Offshore markets were hardly supportive.

On Friday, Wall Street closed weaker, with the S&P 500 down 0.43%, the Dow off 0.37% and the Nasdaq down 0.94%. Tech stocks in particular struggled.

Across Asia, trading was mixed. The Hang Seng fell more than 2%, while Shanghai was down close to 1%. Only Japan’s Nikkei showed modest strength.

When global equities are hesitant and commodities are falling together, local traders tend to keep their powder dry. That caution spilled into Monday’s session.

Step back and the day’s move feels less dramatic than it looks.

Yes, a 1% slide stings. But context matters.

Gold had surged more than 100% over the past year. Energy prices were elevated. Resource stocks had outperformed. Some cooling was always likely, and markets rarely move in straight lines.

Meanwhile, domestic data still hints at resilience. Job advertisements rebounded in January, and volatility remains low. That suggests the market is repricing sectors rather than panicking about the economy.

In practical terms, this looks like rotation, not capitulation.

Money is shifting away from high-beta miners and toward steadier cash generators like banks, utilities and selected media names.

Commodity prices

If gold and oil stabilise, resource stocks may find a floor.

Interest rate expectations

Any clarity from central banks will influence both financials and defensives.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles