Australian shares retreated on Friday as global risk sentiment weakened, with technology, resources and energy stocks leading a broad market sell-off. The decline followed overnight losses on Wall Street and continued uncertainty around global commodity demand, geopolitical developments and company-specific news across the mining sector.

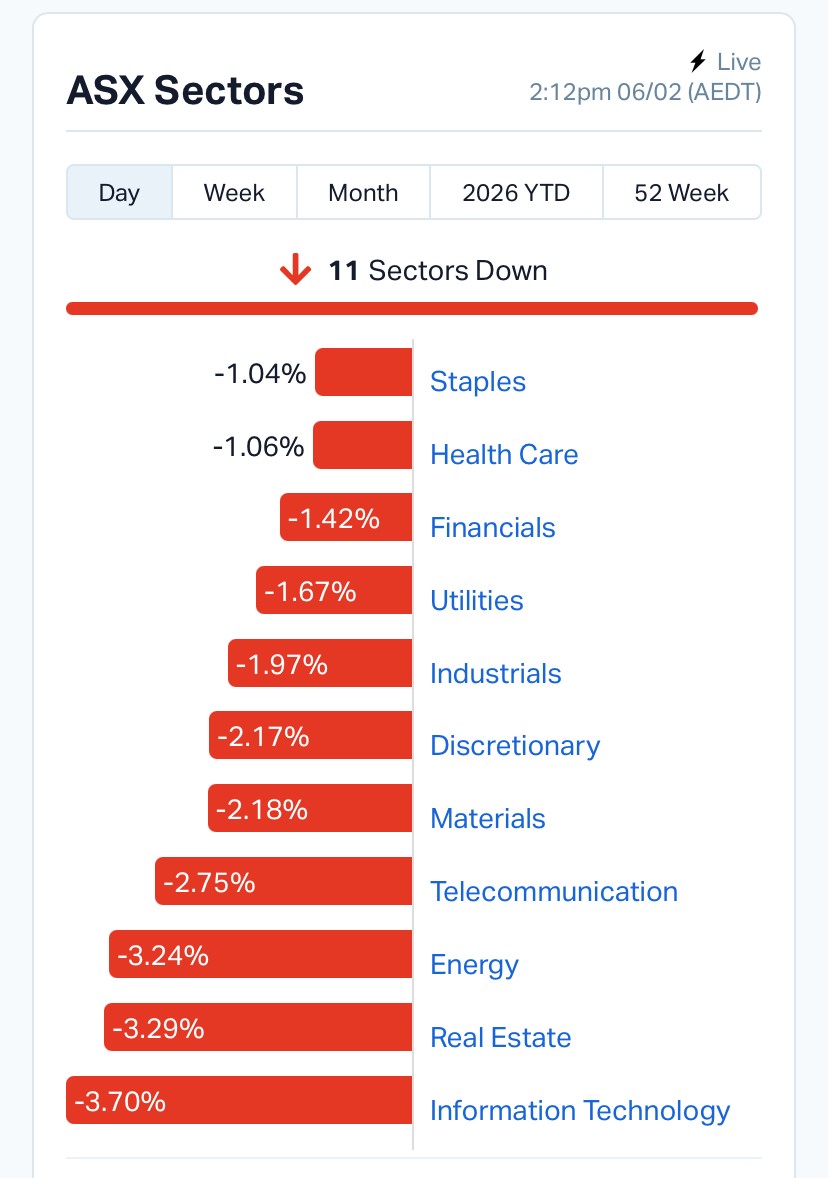

At midday trade, the S&P/ASX 200 slipped about 1.7% to 8,738.9, while the All Ordinaries fell 1.9%. The All Technology Index dropped nearly 4.9%, highlighting the persistent pressure on growth and software names. Eleven of the eleven major sectors traded lower, underscoring the defensive tone across the market.

Materials stocks also weakened after the collapse of merger discussions between Rio Tinto and Glencore, a deal that would have created the world’s largest mining company. Analysts suggested that valuation and governance disagreements prevented the two companies from reaching acceptable terms, reinforcing the difficulty of executing mega-mining mergers in today’s regulatory environment.

Source: MaketIndex

Despite the broad market sell-off, several mid-cap names managed to post gains. Orion Minerals rose about 5.4%, followed by Liberty Financial Group (+4.6%) and Pepper Money (+4.3%), reflecting stock-specific momentum rather than sector-wide strength. Defensive and infrastructure-related names such as Brambles and ResMed also traded modestly higher.

On the downside, travel, uranium and emerging metals stocks led the declines. WEB Travel Group plunged more than 28%, after news that its Spanish subsidiary is under tax audit, while Lotus Resources dropped about 26% and Electro Optic Systems fell over 16%. Several lithium, uranium and exploration companies also posted double-digit losses, illustrating the volatility that continues to characterize the small-cap resources segment.

Mining stocks remained firmly in the spotlight following confirmation that Rio Tinto and Glencore have abandoned plans for a mega-merger after failing to agree on ownership structure and governance arrangements. Analysts noted that while the strategic rationale for combining copper, coal and iron ore portfolios was compelling, the execution risk of such large transactions remains extremely high.

Separately, Berkeley Energia escalated its legal dispute with Spain by filing a US$1.25 billion compensation claim related to the stalled Salamanca uranium project. The arbitration process, expected to unfold over several years, highlights the regulatory and geopolitical challenges facing mining projects across Europe. Berkeley’s shares declined during the session, reflecting the uncertainty surrounding the lengthy legal timeline.

Together, these developments contributed to cautious sentiment across mining equities, particularly among companies linked to uranium and critical minerals.

The negative local session mirrored overnight weakness in the United States, where the Dow Jones fell 1.2%, the S&P 500 dropped 1.23% and the Nasdaq declined 1.59%. Technology stocks remained under pressure amid ongoing concerns that rapid advances in artificial intelligence could reshape software business models and compress margins across the sector.

Market strategists have increasingly pointed out that the next phase of the AI cycle may shift competitive advantages toward companies controlling computing infrastructure and data, potentially disrupting traditional enterprise software providers. This shift has contributed to volatility across global technology markets and spilled into Australian-listed tech names.

International markets presented a mixed but generally cautious picture. Asian indices were subdued, with Japan’s Nikkei falling 0.9% and Shanghai down about 0.6%, while Hong Kong’s Hang Seng posted a modest gain. European markets also traded lower, reflecting similar macroeconomic concerns around growth and interest rates.

Commodity markets were relatively stable compared with equity volatility. Gold held near US$4,787 per ounce, supported by safe-haven demand, while Brent crude traded around US$67 per barrel. Copper prices eased slightly, reinforcing concerns about industrial demand softness. Iron ore also edged lower, adding pressure to large mining stocks.

Currency markets showed limited movement, with the Australian dollar trading around US$0.69, reflecting stable but cautious global risk sentiment.

Friday’s session highlighted several key themes shaping the early 2026 market environment:

With the ASX now trading below recent highs, the focus in the coming sessions is likely to shift toward central bank commentary, commodity price movements and corporate earnings updates. Market participants will also continue to monitor developments in the global technology sector, where shifts in competitive dynamics are increasingly influencing broader equity trends.

Meanwhile, the mining sector remains central to the Australian market narrative. From consolidation attempts among global majors to arbitration disputes affecting uranium supply chains, structural changes across the resources industry are likely to remain key drivers of investor sentiment through 2026.

Source: ASX market data, global indices data, company announcements, Reuters reporting.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles