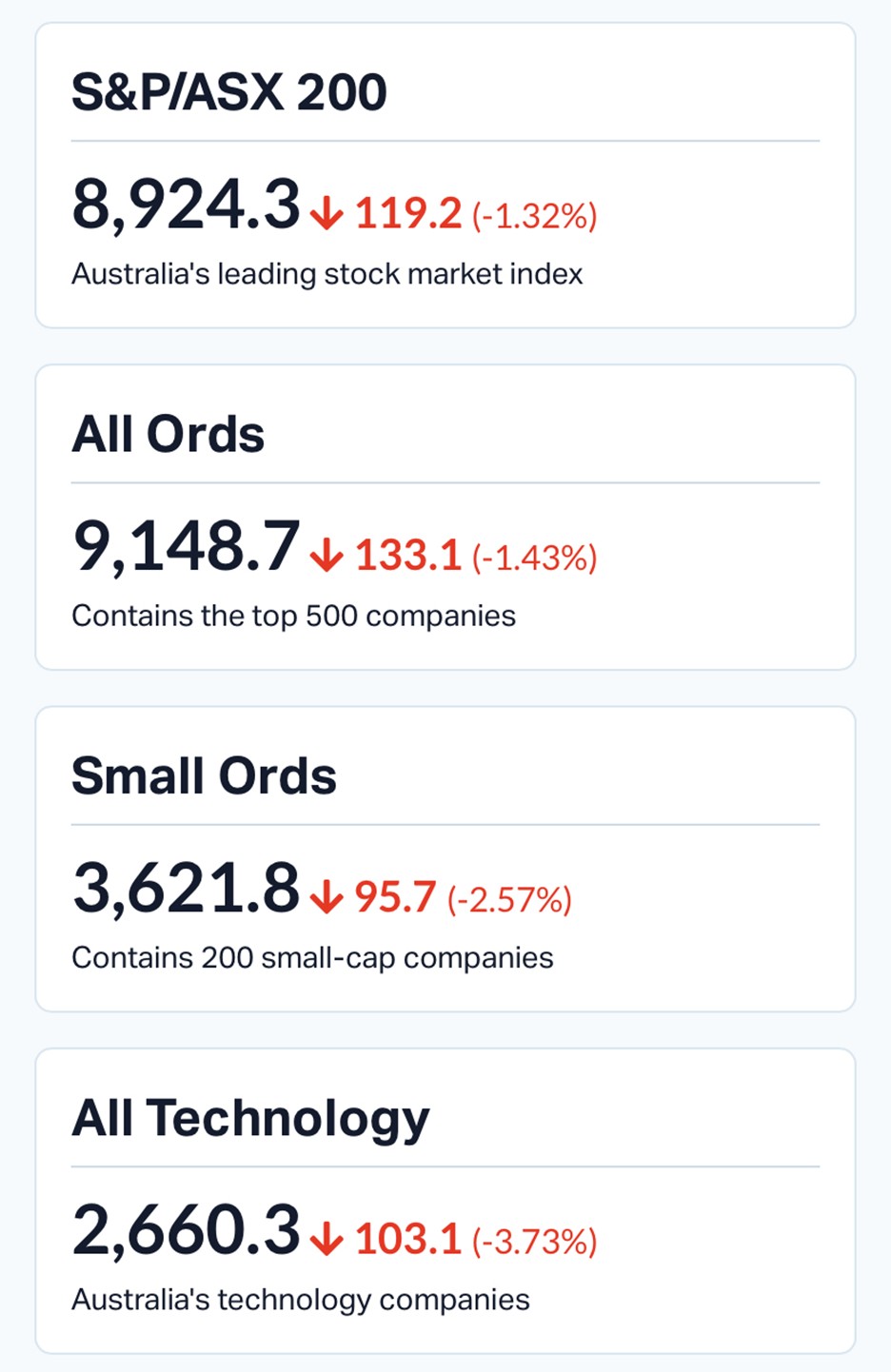

Australian equities moved sharply lower on Friday, mirroring a broader global risk-off shift that began overnight on Wall Street and extended across Asian markets. The S&P/ASX 200 dropped 1.3% to around 8,926 points in afternoon trade, while the broader All Ordinaries fell 1.4%. Technology stocks bore the brunt of the selloff, with the All Technology Index sliding more than 3.6%, reflecting renewed pressure on growth-oriented sectors globally.

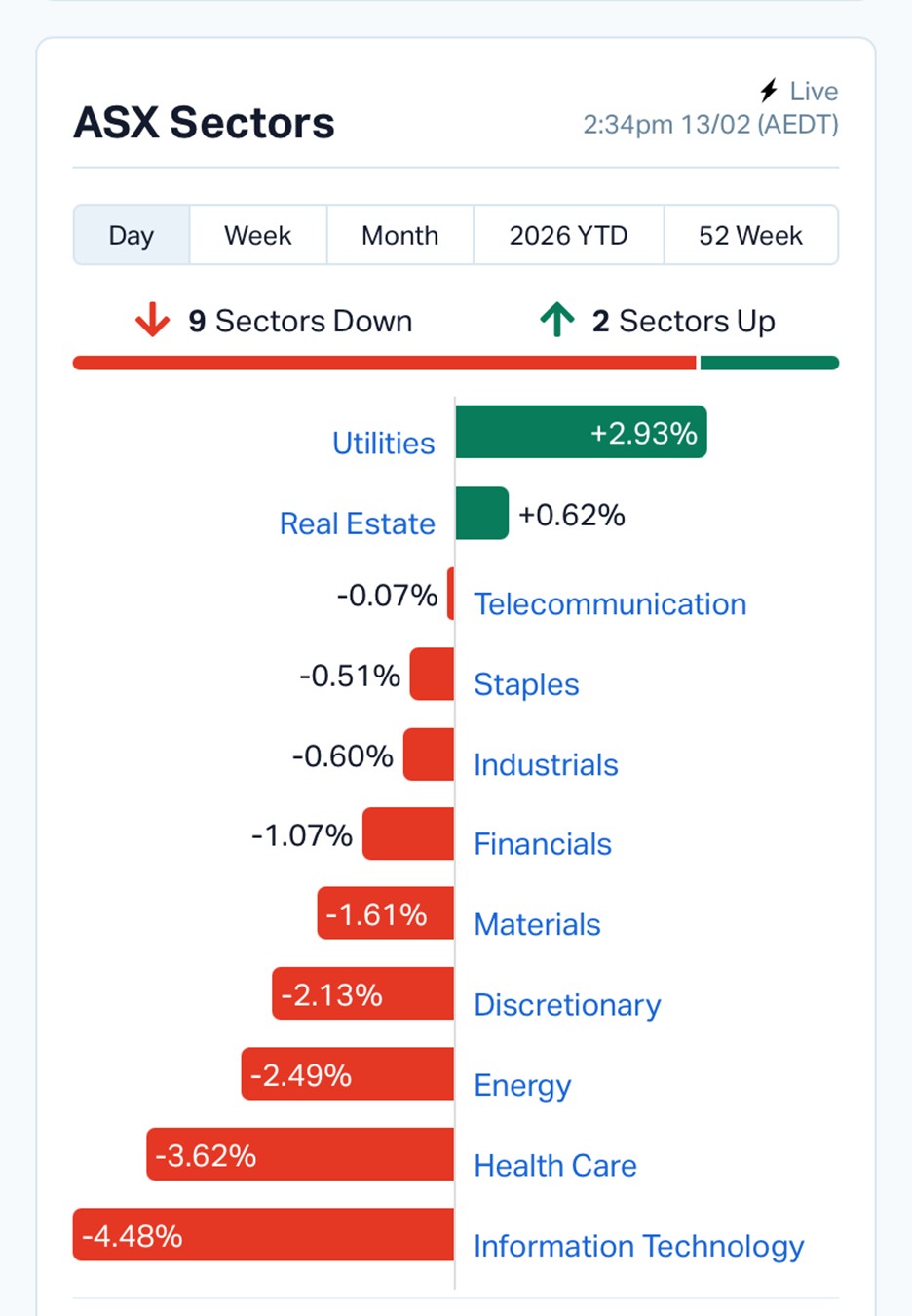

The session unfolded in a familiar pattern seen during periods of macro uncertainty. Defensive sectors such as utilities and real estate held firm, while cyclical and growth-heavy segments including materials, financials, and discretionary stocks weakened. Utilities climbed roughly 2.5%, highlighting a classic rotation into stability when markets turn cautious.

Source: MarketIndex

Market sentiment was influenced by global developments as well as domestic macro signals. The Reserve Bank of Australia reiterated a data-driven approach to policy, with Governor Michele Bullock warning that inflation “with a three in front of it” remains unacceptable and further tightening may be required if price pressures persist. The prospect of additional rate hikes continues to shape valuation expectations across rate-sensitive sectors such as technology, real estate, and consumer discretionary.

Source: MarketIndex

Overnight, U.S. equities closed sharply lower, with the Dow Jones down 1.34%, the S&P 500 falling 1.57%, and the Nasdaq losing more than 2% following technology-driven selling and concerns around economic momentum. Weak global sentiment spilled into Asia, where regional indices in Hong Kong and Singapore also traded lower, while Japan remained broadly flat.

Strategists continue to highlight that global markets are transitioning from liquidity-driven rallies to earnings- and macro-driven performance. Concerns about sustained capital spending in technology sectors, especially AI infrastructure, have prompted some investors to reassess valuations, contributing to the broader risk-off tone.

Commodity markets played a mixed but influential role in Friday’s trading. Gold and silver prices rebounded modestly during the session after earlier weakness, yet precious-metal equities remained under selling pressure as traders reacted to the sharp overnight drop in bullion and profit-taking following months of strong gains. The ASX Gold Index declined more than 3%, reflecting widespread weakness across gold producers.

Silver-focused companies were particularly affected after spot silver dropped sharply overnight, triggering declines of between 6% and 10% across several exploration and mid-tier mining stocks. Lithium producers also traded lower despite a slight rise in Chinese lithium carbonate futures, suggesting the sector is currently more sensitive to global risk appetite than short-term commodity movements.

Energy and broader resources stocks also slipped as commodity prices showed limited directional momentum, with oil trading near recent ranges and copper posting only modest gains.

Despite the broad selloff, pockets of strength remained. Asset manager GQG Partners rose more than 8%, while AMP advanced over 7% following renewed buying interest in financial services names. NEXTDC gained more than 5% as data infrastructure companies showed resilience relative to the broader technology selloff. Energy majors such as Origin Energy and AGL Energy also posted moderate gains, supported by stable oil prices and defensive demand for utilities-linked assets.

On the downside, travel platform Webjet plunged more than 24% after deal developments disappointed the market, while defence shipbuilder Austal dropped over 23%. Cochlear fell sharply following earnings concerns, and technology leaders including WiseTech Global and Appen declined double digits as investors reduced exposure to high-growth stocks amid rising rate expectations.

Corporate results continued to drive sharp stock-specific movements. Furniture retailer Nick Scali, for instance, reported strong earnings growth but still saw its shares fall significantly, illustrating how elevated expectations during earnings season can amplify downside reactions even when financial performance improves. Similar volatility has been observed across global markets, where earnings beats are increasingly required to justify premium valuations.

Meanwhile, Westpac reported quarterly profit growth of 5% to $1.9 billion, highlighting continued resilience in Australia’s banking sector despite margin pressures from intense competition. The bank noted that both household and business balance sheets remain relatively stable, though the sector faced selling pressure alongside broader market declines.

Friday’s decline fits into a broader pattern emerging in 2026. After a strong rally through 2025 driven by liquidity, commodities, and artificial intelligence optimism, markets are now entering a phase defined more by macroeconomic policy, productivity trends, and earnings sustainability. Portfolio manager Henry Jennings described the session as a “traditional Friday 13 meltdown,” pointing to underwhelming earnings results and global risk aversion ahead of the Lunar New Year period.

Looking historically, similar transitions between liquidity-driven rallies and fundamentals-driven markets often bring heightened volatility as investors reassess growth expectations and sector leadership. The recent rotation into defensives and infrastructure-style assets suggests capital is gradually repositioning toward stability while awaiting clearer signals on inflation, interest rates, and global growth.

With the ASX volatility index remaining in the low range, markets are not signalling panic but rather a controlled adjustment phase. Upcoming economic releases, the next RBA meeting, and further earnings announcements are likely to determine whether the current weakness evolves into a broader correction or stabilises as a short-term consolidation.

For now, Friday’s session underscores a key message for market participants: global cues, central bank policy expectations, and commodity sentiment are once again taking centre stage, and sectors that led the rally over the past year may experience sharper swings as markets recalibrate.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles