Australian shares rallied strongly on Monday as improving global risk sentiment, a rebound in Wall Street technology stocks and supportive international developments drove a broad-based market recovery. The advance marked a sharp reversal from last week’s weakness, with nearly all sectors posting gains and only a handful of companies trading lower.

By mid-afternoon trade, the S&P/ASX 200 climbed 1.94% to 8,877.9, while the All Ordinaries rose 2.05%. The All Technology Index surged 3.6%, reflecting renewed investor appetite for growth and technology companies after the Nasdaq posted a strong rebound late last week.

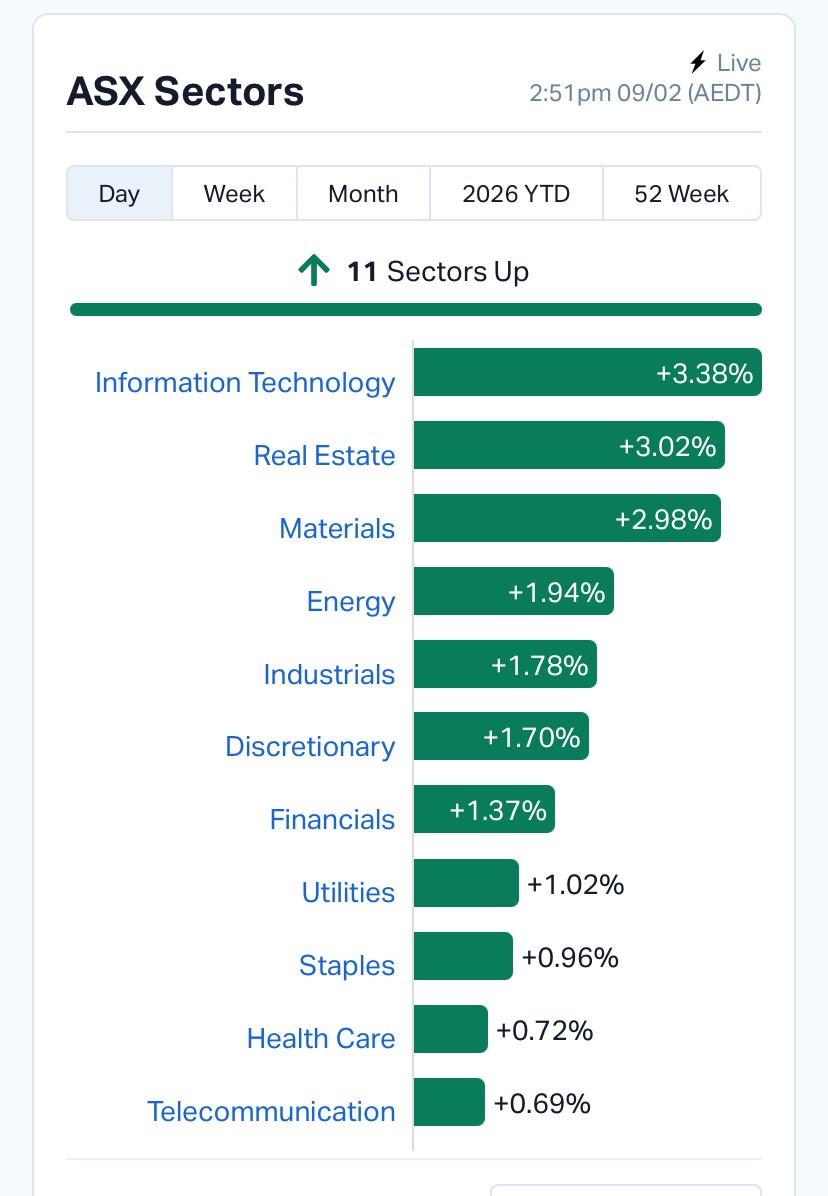

Market breadth was notably strong, with all eleven major sectors finishing in positive territory. Information technology, real estate and materials stocks led the advance, reinforcing the view that global equity markets are stabilising following recent volatility.

Source: MarketIndex

Technology shares were among the strongest performers as investors rotated back into growth names. Wealth management software provider Bravura Solutions surged 27.8% after upgraded earnings guidance, while semiconductor developer Weebit Nano climbed over 14%. Artificial intelligence and digital infrastructure plays also saw renewed buying interest, reflecting improved sentiment toward the global tech cycle.

Mining stocks also contributed meaningfully to the rally. Gains across gold, lithium and copper companies followed a modest recovery in precious metal prices and the reopening of Western Australia’s Port Hedland, a key export hub for iron ore shipments. Large miners continued to trade steadily, with gold producers benefiting from bullion prices pushing back above the US$5,000 per ounce mark.

Market momentum was clearly visible in the day’s leaderboard. Among the best performers were:

Pepper Money rallied sharply after corporate developments linked to potential strategic transactions, while WEB Travel rebounded following last week’s heavy sell-off, suggesting investors reassessed the earlier decline as excessive.

On the downside, losses were relatively limited compared with recent sessions. The key laggards included:

Overall, the small number of decliners highlighted the strength of the market rebound.

International markets played a central role in shaping the positive tone. US equities ended the previous session firmly higher, with the Dow Jones rising 2.47%, the S&P 500 gaining 1.97% and the Nasdaq advancing 2.18%, supported by renewed confidence in the technology sector and resilient economic indicators.

The recovery in global markets continued into Asia. Japan’s Nikkei 225 extended gains, supported by political clarity following the ruling party’s decisive election victory. Analysts noted that the landslide win removed policy uncertainty and strengthened expectations for continued fiscal support, which helped drive regional equity optimism.

Mizuho strategist Shoki Omori commented that the election outcome “removes political uncertainty and strengthens policy execution,” though investors will now watch closely how fiscal expansion policies are implemented and communicated.

Japanese Shares Rally on Election Results

— TRADING ECONOMICS (@tEconomics) February 9, 2026

The Nikkei 225 Index surged 5% toward 57,000 while the broader Topix Index gained 2.2% to 3,780 on Monday, with Japanese shares hitting fresh record highs after the ruling Libe...

More here: https://t.co/FyutRFryAk pic.twitter.com/B1vaxkCzHT

Commodity markets presented a mixed picture during the session. Gold rose above US$5,020 per ounce, supporting mining sentiment, while silver gained more than 4%, reflecting improved risk appetite. Oil prices edged slightly lower, with Brent crude trading near US$67 per barrel, suggesting stable but not accelerating global demand conditions.

Currency markets were relatively steady, with the Australian dollar trading near US$0.70, supported by stronger commodity-linked sentiment and improved global equity flows.

Economic data released during the day showed Australian household spending dipped modestly in December, though quarterly volumes still indicated gradual consumption growth. Economists noted that shifts in tobacco consumption patterns affected the headline reading, highlighting the importance of adjusting for structural consumption changes when interpreting the data.

Meanwhile, the reopening of Port Hedland, the world’s largest iron ore export terminal, after cyclone disruptions provided reassurance for the mining sector. Continued operations at the port are expected to stabilise export volumes and support supply chain continuity across Western Australia’s resource industry.

Monday’s rally highlights several emerging themes in the current market environment:

With the ASX now approaching recent highs again, attention is likely to shift toward upcoming corporate earnings, interest rate expectations and commodity price movements. If global markets maintain their current recovery trajectory, Australian equities could continue to benefit from renewed international capital flows and stabilising economic expectations.

However, analysts caution that volatility may persist, particularly in technology and small-cap resource names, as markets continue to recalibrate expectations around global growth, monetary policy and structural technological change.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles