Australian equities rallied strongly on Wednesday, with financial stocks leading the charge and pushing the S&P/ASX 200 close to the psychological 9,000 mark. By early afternoon, the benchmark index had climbed 1.44% to 8,995, while the All Ordinaries rose 1.28%, reflecting broad-based gains across most sectors.

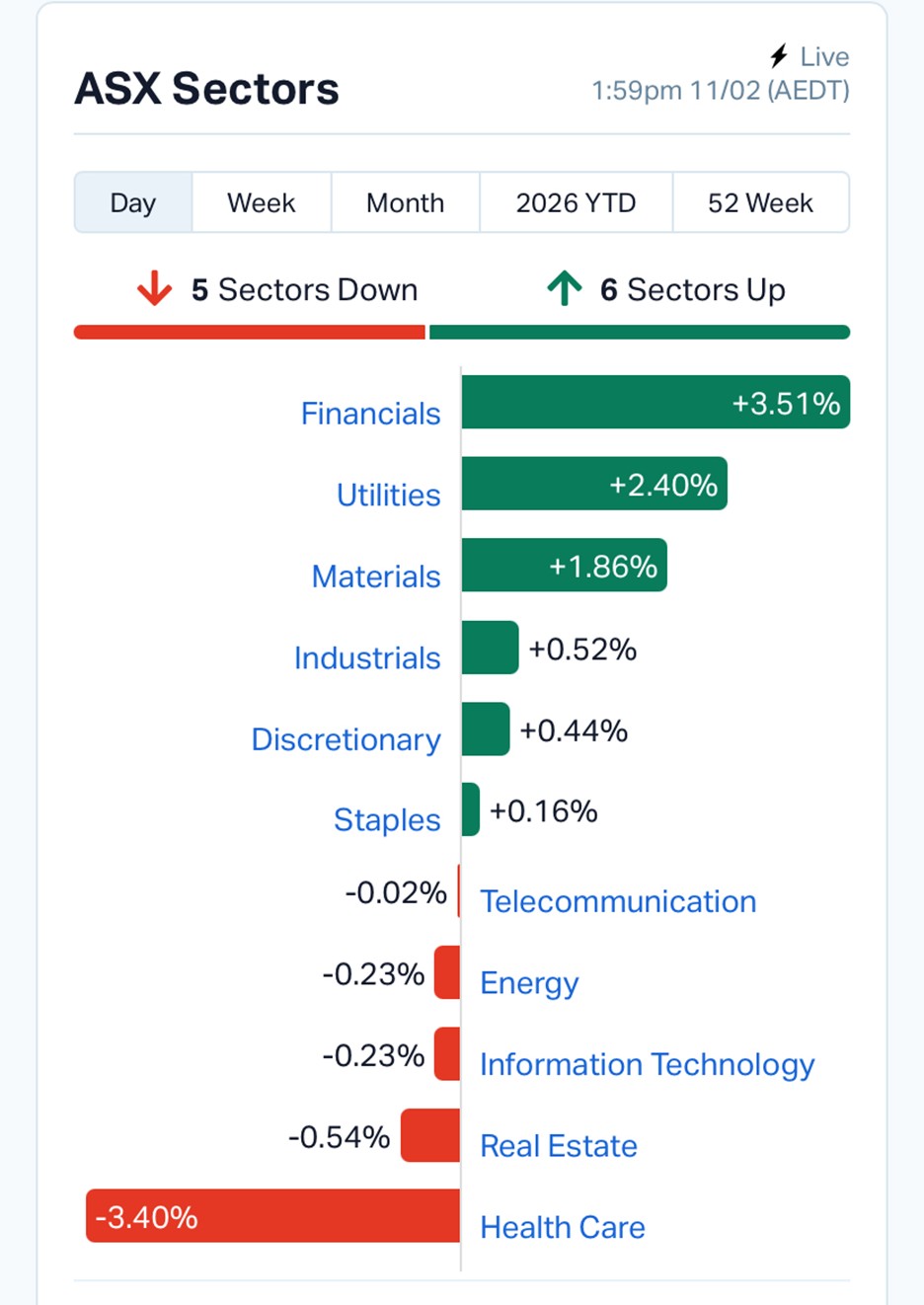

The rally was largely driven by a powerful rebound in banking stocks, with the ASX 200 Banks Index surging 4.56%, its strongest daily move in weeks. Gains in utilities and materials stocks further supported the market, while weakness in real estate, healthcare and technology shares limited the upside slightly.

Source: MarketIndex

Financials emerged as the dominant driver of market momentum. Shares of Commonwealth Bank of Australia jumped nearly 8%, helping lift the broader banking sector and reinforcing the view that institutional investors continue to rotate back into high-quality financial names amid expectations of stable interest rate settings.

Industrial and infrastructure-related companies also contributed to the positive tone. James Hardie Industries rose sharply after reporting quarterly results that, despite showing a drop in statutory profit, exceeded analyst expectations on an adjusted basis.

The company said its adjusted net income reached US$142.2 million, ahead of forecasts, while CFO Ryan Lada noted that “market conditions remain challenged, consistent with our prior expectations,” adding that inventories are expected to remain at seasonal levels for the remainder of fiscal 2026. Investors appeared encouraged by the company’s upgraded full-year earnings outlook.

Telecommunications provider Aussie Broadband also recorded strong gains after announcing an agreement worth up to $125 million to acquire the telecommunications business of AGL Energy. The acquisition is expected to significantly expand the company’s customer base, which currently includes hundreds of thousands of broadband and mobile connections.

Among the day’s best performers, Energy Resources of Australia surged 16.7%, while Aussie Broadband gained more than 14%, and James Hardie Industries advanced nearly 13%. Gold producers such as Evolution Mining also climbed, benefiting from modest increases in precious metal prices.

On the downside, healthcare heavyweight CSL Ltd fell over 6%, weighing on the healthcare sector, while Meteoric Resources, Canyon Resources, and Peninsula Energy also declined. The Real Estate sector, down 3.4%, was the weakest segment of the market, reflecting ongoing pressure from elevated borrowing costs.

Corporate developments provided additional market catalysts. Domino’s Pizza shares rose after the company announced the appointment of Andrew Gregory as incoming group chief executive officer and managing director. Executive chairman Jack Cowin said Gregory is “a highly regarded operator and leader,” adding that the board is confident he can lead the company through its next phase of growth.

Meanwhile, labour negotiations at Crown Resorts remained in focus after the company reiterated that employees earn “around 40 per cent above industry standards,” while negotiations over a new enterprise agreement continue.

Overseas markets presented a mixed picture. On Wall Street, the Dow Jones edged higher to another record close, while the S&P 500 and Nasdaq slipped as investors assessed economic data and corporate earnings. Technology stocks were under pressure after Alphabet announced a large bond sale, raising concerns about the sustainability of heavy capital expenditure across the artificial intelligence sector.

Joe Hegener, chief investment officer at Asterozoa Capital Management, said the scale of AI-related spending raises important long-term questions. “I don’t think that the CapEx spend is very sustainable,” he said, noting that the broader economic implications of continued large-scale investment in data centres and AI infrastructure remain uncertain.

Asian markets provided a stronger lead, with Japan’s Nikkei 225 rising more than 2%, while Hong Kong and mainland Chinese indices also posted moderate gains. European markets, however, traded slightly lower, reflecting caution ahead of upcoming economic data releases.

Commodity prices were relatively stable during the session. Gold rose slightly to around US$5,036 per ounce, while Brent crude oil edged higher to approximately US$69 per barrel as markets monitored ongoing geopolitical developments and US–Iran negotiations. Iron ore remained steady near US$100 per tonne, supporting resource-sector sentiment.

The Australian dollar strengthened modestly, trading around US70.98 cents, reflecting a slightly improved risk appetite in global currency markets.

Economic commentary also entered the market discussion after Reserve Bank Deputy Governor Andrew Hauser highlighted the need for stronger productivity growth. Hauser noted that addressing capacity constraints requires cooperation between government and industry, stating that “it’s the job of government, but it’s also the job of industry,” adding that weak investment growth has contributed to the current productivity challenges.

His comments reinforced a broader policy theme that productivity improvement, rather than purely monetary policy adjustments, may become a central focus of Australia’s economic strategy in the coming years.

Wednesday’s rally suggests that confidence in the Australian equity market remains intact, particularly as banking stocks regain leadership and global markets continue to show resilience despite mixed economic signals. With reporting season gathering pace and several corporate announcements driving sector-specific movements, analysts expect markets to remain selective, rewarding companies that deliver earnings stability and clear strategic direction.

While short-term volatility in global technology stocks may persist, the combination of strong financial sector performance, steady commodity prices and improving corporate activity continues to provide a supportive foundation for the ASX as it approaches record territory.

Source: ASX market data, company announcements, global exchange data and central bank commentary (11 February 2026).

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles