Australia’s market had the look of a session that wanted to rally, but could not quite commit. The S&P/ASX 200 ended up 0.04% at 8,812.2, while the All Ordinaries rose 0.05% and the Small Ordinaries gained 0.28%.

Under the hood, though, the day was anything but bland. The tape was shaped by two competing forces.

First, there was a familiar risk-off flavour from offshore, after Wall Street stepped back from record highs. The Dow fell 0.8% to 49,191.99, the S&P 500 slipped 0.19% to 6,963.74, and the Nasdaq edged down 0.10% to 23,709.87.

Second, commodities kept pulling attention back to Australia, particularly energy and metals. Brent crude eased to $US65.29 a barrel, but local energy names still pushed the sector up 2.31%, suggesting the market is treating the current oil range as “good enough” for cash flow and near-term earnings resilience.

Meanwhile, gold was back in the driver’s seat. Spot gold rose 0.86% to $US4,625.97/oz, and the ASX All Ordinaries Gold index gained 0.76%.

Source: MarketIndex

Silver broke through $US90 per ounce.

This was the day’s cleanest global headline. Spot silver jumped above $US90/oz for the first time, with Reuters pointing to a combination of softer US inflation, rate-cut expectations, geopolitical tensions, robust industrial and investment demand, and tightening inventories. Silver was up more than 3% at the time of the update.

The simplest way to think about it is this: silver has a split personality. It is both a precious metal and an industrial input. When demand is strong and supply feels tight, it can move faster than gold.

Central bank independence became a market story again.

The ongoing tussle between Trump and Jerome Paul made headlines again, highlighting political pressure on US Federal Reserve Chair Jerome Powell, with commentary from Westpac’s chief economist Luci Ellis describing the Department of Justice investigation as “a whole new level of attempted government coercion of the Fed on monetary policy.”

Even when markets are not collapsing, this kind of storyline matters because it goes to the credibility of monetary policy. If participants start to doubt that interest rate decisions are made independently, risk pricing can change quickly.

Rate expectations at home stayed anchored.

ANZ’s research team said it continues to expect the RBA to hold the cash rate at 3.60% for an extended period, while noting risks of a hike in early 2026 have risen. It pointed to November inflation outcomes and what that implies for the December quarter trimmed mean trajectory.

For the ASX, a steady rates outlook can be supportive for valuations, but today’s sector performance showed that it does not automatically translate into broad-based buying.

Source: ABC News, Reuters

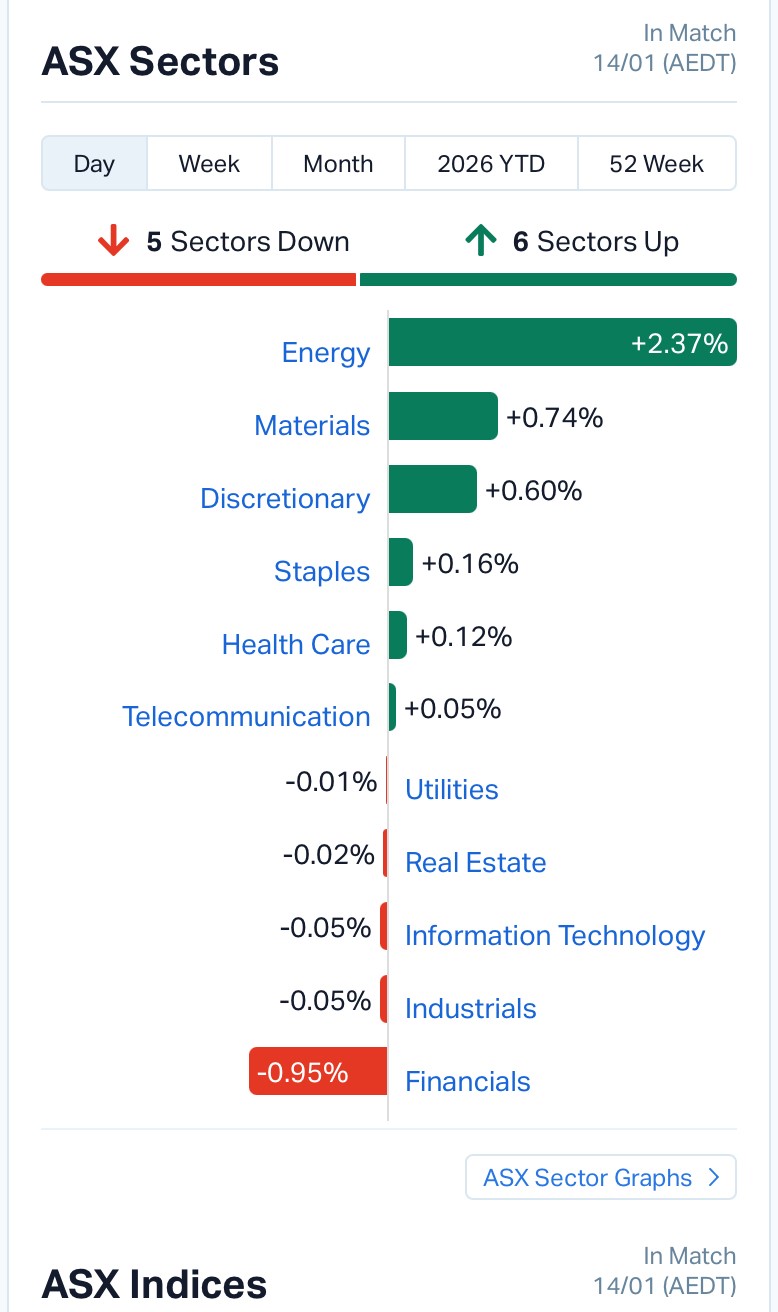

The sector scoreboard told the story.

Today looked like a session where money rotated toward “real economy” exposures like energy and resources, while reducing exposure to rate-sensitive or valuation-sensitive areas like banks and tech.

Global risk mood: Powell pressure and geopolitical oil risk collide

Offshore, the market tone remained cautious as Wall Street stepped back from record highs, with the Dow down 0.8%, the S&P 500 off 0.2% and the Nasdaq slipping 0.1%. The underlying theme was not earnings or a single data print, but uncertainty about the institutional guardrails that typically anchor policy and risk pricing.

US President Donald Trump continued to publicly criticise Federal Reserve chair Jerome Powell, with reporting also flagging that Powell is set to face a criminal investigation. The unusual combination of political pressure and legal scrutiny is being read by markets as a potential challenge to central bank independence. Central bank leaders globally, including RBA governor Michele Bullock, issued a joint statement backing Powell, reinforcing the message that monetary policy credibility matters, especially when inflation and growth are still in focus.

At the same time, geopolitical tension in the Middle East kept energy traders on alert, with commentary suggesting Iran-related developments had oil markets betting on the risk of broader disruption. While Brent crude was only modestly lower in the afternoon snapshot at around US$65 a barrel, the broader narrative helped keep energy pricing sensitive to headlines, and it may also have supported risk appetite in energy equities even as other sectors cooled.

The day’s biggest winners were clustered around resources and energy, with a few notable outliers.

Top gainers (selected):

A few things stand out here.

One, the market’s appetite was clearly tilted toward miners and energy names, which fits the day’s sector leadership.

Two, even in a resources-heavy list, the presence of Synlait Milk and Neuren Pharmaceuticals is a reminder that stock-specific stories can still cut through a macro-driven session.

On the downside, the biggest fallers list leaned toward lithium and a handful of high-profile industrial names.

Biggest fallers (selected):

If silver and gold were the bright spots in commodities today, the weakness in European Lithium suggests the lithium complex is still trading with a different rhythm. It is less about “metals up” and more about project economics, capital discipline, and sentiment.

Overnight leads were mixed and, importantly, not aligned.

That Nikkei surge is the kind of move that tends to attract attention in Australia, even if it does not always translate directly into ASX leadership.

Markets rarely trade in isolation, and today’s cross-asset moves delivered a clear theme: precious metals strength and a softer oil tape.

The Australian dollar was roughly steady around US66.8 cents, while the FX table showed 1 AUD buying US$0.6697 (+0.25%). Source: market snapshot and FX table provided.

Two near-term signposts are emerging from today’s tape.

Interest rate narratives are splitting by region.

ANZ sees the RBA likely holding at 3.60% for an extended period, while US rate expectations are being tugged by inflation data and political noise around the Fed.

Metals are moving, and silver is now the headline asset.

A silver breakout above $US90 is not a daily event. Whether it holds matters for sentiment across miners, broader commodities, and risk appetite more generally.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles