• S&P/ASX 200 surges 1.09% to fresh record at 9,105.2

• Zip Co plunges nearly 38% despite strong earnings growth

• Energy stocks rally on oil spike above US$70 per barrel

• Wall Street tech gains spill into local sentiment

• Unemployment steady at 4.1%, keeping rate debate alive

The Australian share market has marched into record territory, but beneath the headline highs lies a very different story.

By early afternoon, the S&P/ASX 200 had climbed 1.09% to 9,105.2 points, eclipsing its previous all time closing high. The All Ordinaries followed suit, rising 1.01% to 9,331.8. It was, on the surface, a celebratory session.

Yet the day will likely be remembered not just for records, but for the brutal sell off in one of the market’s most closely watched retail names.

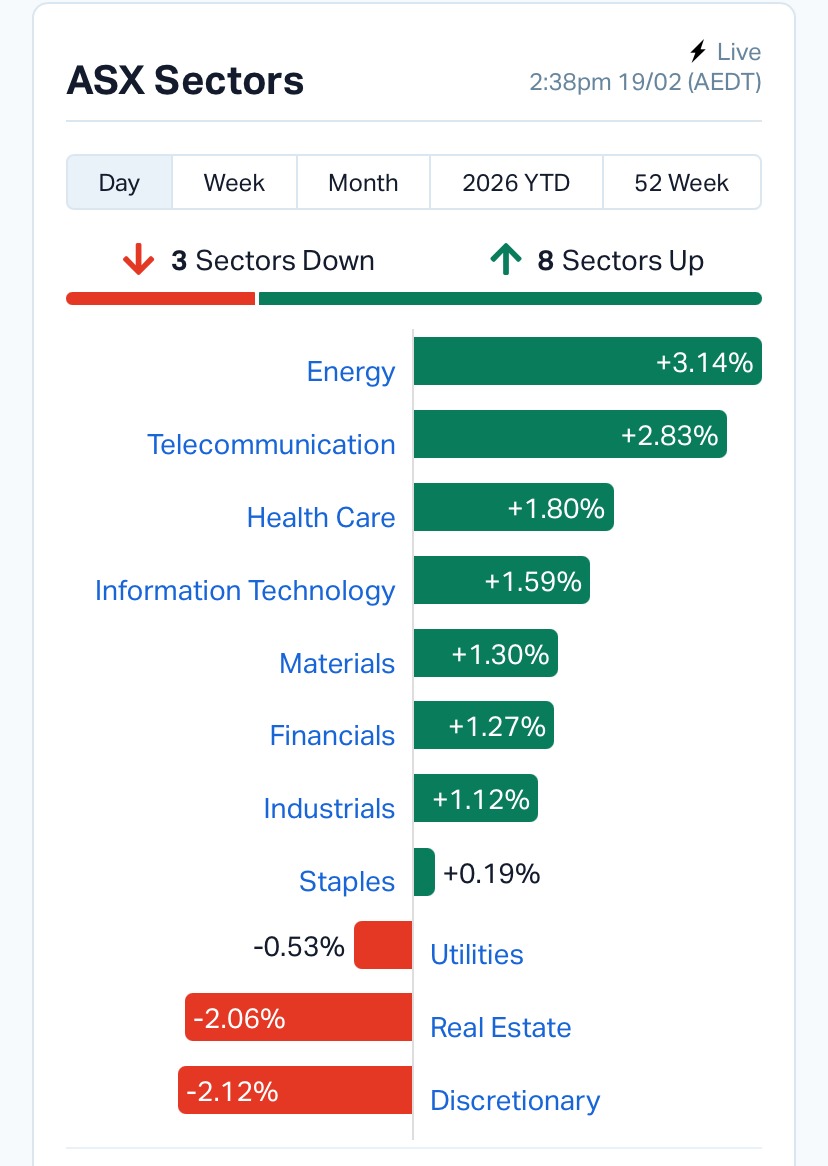

Source: MarketIndex

Nine of eleven sectors traded higher, with Telecommunications and Energy leading gains. Energy stocks rallied as Brent crude surged above US$70 per barrel amid escalating geopolitical tensions in the Middle East. The oil move provided a tailwind to local producers, reflecting how quickly global risk can translate into sector momentum on the ASX.

The rally followed a constructive lead from Wall Street. Overnight, the Nasdaq rose 0.78%, lifted by renewed enthusiasm around artificial intelligence infrastructure after a high profile chip supply deal between Nvidia and Meta. The broader S&P 500 also edged higher, keeping US indices near record territory.

That positive tone filtered into Asia, where markets traded mixed but stable, as investors digested US Federal Reserve commentary and monitored energy markets closely.

The day’s defining drama, however, unfolded in the financial services sector.

Zip Co plunged 37.86% to $1.75, wiping roughly $1 billion from its market capitalisation in a single session. The collapse came despite the company reporting strong growth in cash EBITDA and improved profitability metrics.

So why the panic?

The answer lies in expectations. While earnings growth was robust, investors focused on softer than anticipated US customer momentum and cautious second half guidance. In today’s market, particularly for high volatility fintech names, strong historical performance is not enough if forward growth looks uncertain.

The sell off underscores a broader trend that has defined global markets in 2026. Investors are rewarding dependable cash flow and punishing even minor signs of growth moderation. The tolerance for disappointment is thin.

Other growth stocks also struggled. Calix fell 19.34%, Appen dropped 14.85%, and Lovisa slid 10.06%. It was a sharp reminder that record index levels do not mean universal prosperity.

In contrast, investors gravitated toward more traditional and earnings reliable names.

IPH Ltd jumped 13.91% to $3.85, while Sonic Healthcare rose 13.89% to $24.19 after strong earnings updates. NRW Holdings and Hub24 also posted double digit gains, reflecting appetite for companies delivering consistent operational results.

The divergence mirrors patterns seen in previous late cycle rallies. In 2021, during the post pandemic surge, indices hit records while pockets of speculative growth stocks corrected sharply. The current environment carries similar characteristics, albeit with higher interest rate sensitivity and more disciplined capital allocation.

Fresh data from the Australian Bureau of Statistics showed unemployment holding at 4.1%. The labour market remains tight by historical standards, reinforcing the narrative of economic resilience.

However, steady employment also keeps interest rate expectations in play. With inflation still a central focus for policymakers, the Reserve Bank’s next moves remain closely watched. The Australian dollar traded around 70.61 US cents, supported by relatively firm rate expectations and solid commodity pricing.

Internationally, markets are balancing optimism around AI driven productivity gains with caution over geopolitical risk.

Gold hovered near record highs at US$4,972 per ounce, reflecting its traditional role as a hedge during periods of uncertainty. Oil’s spike added another layer of complexity, particularly for inflation outlooks.

Meanwhile, the VIX, often referred to as Wall Street’s fear gauge, remained subdued around 11.7, signalling that broader market volatility expectations are still low despite sharp individual stock moves.

The key takeaway from today’s session is contrast.

On one hand, the ASX 200 is breaking records, buoyed by energy strength, defensive earnings, and global tech optimism. On the other, retail favourites like Zip are experiencing severe repricing.

For newer market participants, it is an important lesson. Indices can climb even as individual portfolios feel pain. Markets are not monolithic; they are collections of very different stories unfolding at the same time.

As reporting season continues, that divergence may widen further. In 2026, the market is sending a clear message. Reliable earnings are prized. Hype without forward clarity is costly.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles