Auravelle Metals (ASX: AUV) has begun 2026 with a clear statement of intent. Fresh drilling results from the Sheoak Prospect at its Nuckulla Hill Gold Project in South Australia have delivered broad, high-grade gold intercepts, reinforcing the scale potential of the system and setting the stage for an active year of exploration.

The latest results, released to the market on Friday, show that Sheoak continues to deliver consistent gold mineralisation across meaningful widths, a combination that exploration geologists pay close attention to. In a market where gold remains structurally strong, the timing of these results adds further weight to the story unfolding at Nuckulla Hill.

The November 2025 reverse circulation drilling program comprised 11 holes for a total of 1,638 metres, designed to follow up earlier gold hits and refine the geological understanding of the Sheoak system.

The standout intercept came from hole NHRC040, which returned 28 metres at 3.4 grams per tonne gold from 48 metres, including 4 metres at 12.7g/t gold and 4 metres at 5.6g/t gold. Importantly, this mineralisation remains open at depth, suggesting the system continues beyond the current drilling envelope.

Additional strong results across the program included:

These intercepts confirm that gold is not confined to isolated narrow zones but occurs across broader intervals, a feature often associated with larger mineralised systems.

In early-stage gold exploration, grade alone rarely tells the full story. Width and continuity are equally important, particularly when assessing whether a discovery has the potential to evolve into a standalone deposit.

At Sheoak, the 28-metre intercept sits within a much broader anomalous zone of 60 metres at 1.7g/t gold, based on no lower grade cut-off. This suggests the mineralised system is not just high grade in places but consistently mineralised across a substantial footprint.

Gold mineralisation has now been intersected over more than 200 metres of strike, within a broader 600-metre zone of gold anomalism that remains open to the north, south and at depth.

Sheoak sits within the Yarlbrinda Shear Zone, a regionally significant structure on the western margin of the Gawler Craton. This same structural corridor hosts Barton Gold Holdings’ neighbouring 1.6 million ounce Tunkillia Gold Project, underlining the prospectivity of the area.

The gold mineralisation at Sheoak is interpreted as hydrothermal lode-style gold, hosted within sheared and brecciated granitoids and gneisses. Alteration associated with the gold includes sericite, chlorite and epidote, with minor disseminated sulphides. These geological characteristics are consistent with other large shear-hosted gold systems in South Australia.

The company believes the gold was sourced from the Hiltaba Suite granites, a metal-rich intrusive suite also associated with major deposits such as Olympic Dam. While Sheoak is still early in its exploration life, the geological ingredients align with known large-scale mineral systems in the region.

A series of exploration activities is already planned or underway, ensuring a steady flow of data through the first half of 2026.

Near-term work includes:

This multi-project approach gives Auravelle several opportunities to add value across its portfolio rather than relying on a single prospect.

Auravelle Managing Director Andrew Muir said the Sheoak results provide a strong platform to build from early in the year.

He noted that the latest drilling continues to deliver meaningful grades and widths, reinforcing confidence in the system and its broader potential within the Yarlbrinda Shear Zone. Importantly, mineralisation remains open in multiple directions, which is a key driver behind the company’s decision to commit further drilling in 2026.

Muir also highlighted that Sheoak is only one of several gold prospects within Auravelle’s South Australian landholding, pointing to additional discovery potential beyond the current focus area.

Source: StocknessMonster

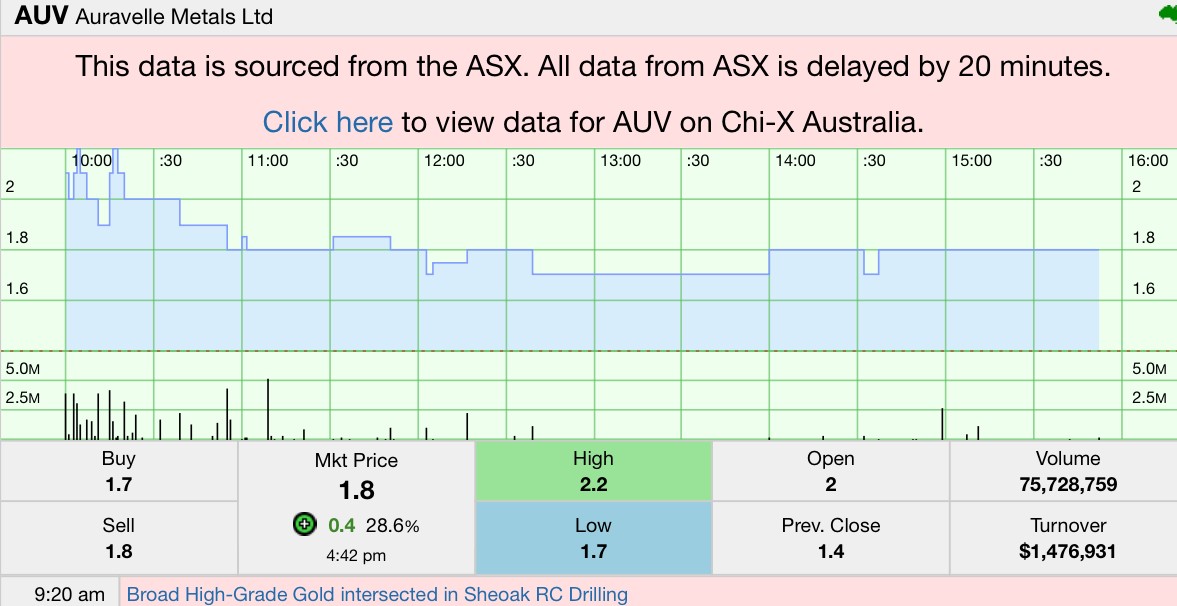

Auravelle Metals shares moved sharply higher on Friday following the release of its Sheoak RC drilling results, as the market responded to the scale and grade of the latest gold intercepts.

The stock closed at $0.018, up $0.004 or 28.6%, on heavy turnover of more than 75.7 million shares, making Auravelle one of the most actively traded small-cap mining stocks on the session. The move pushed the company’s market capitalisation to approximately $11.95 million.

The rally extended Auravelle’s recent momentum, with the shares now trading near the upper end of their 52-week range of $0.010 to $0.030. The sharp increase in volume suggests renewed interest following confirmation of broad, high-grade gold mineralisation at Sheoak, particularly given the company’s modest valuation and extensive exploration upside.

Price action on the day reflected a decisive shift in sentiment, as the drilling results added geological weight to Auravelle’s broader gold exploration strategy and highlighted the potential for further discovery-driven news flow.

Source: ASX market data, MarketIndex

The drilling success at Sheoak comes against a backdrop of sustained strength in the gold market. While short-term price movements can be volatile, broader structural drivers such as central bank buying, geopolitical uncertainty and long-term inflation hedging continue to support gold at elevated levels.

For exploration companies, this environment tends to sharpen market focus on genuine discovery stories, particularly those demonstrating scale and continuity rather than isolated high-grade hits.

At this stage, Auravelle remains firmly in the exploration phase, with no mineral resource defined. However, the combination of broad gold intercepts, structural continuity and a large, underexplored land package positions Sheoak as a project that warrants close attention as drilling ramps up.

The next rounds of drilling will be critical in determining whether the system can be extended both laterally and at depth, and whether multiple mineralised zones connect into a coherent deposit model.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles