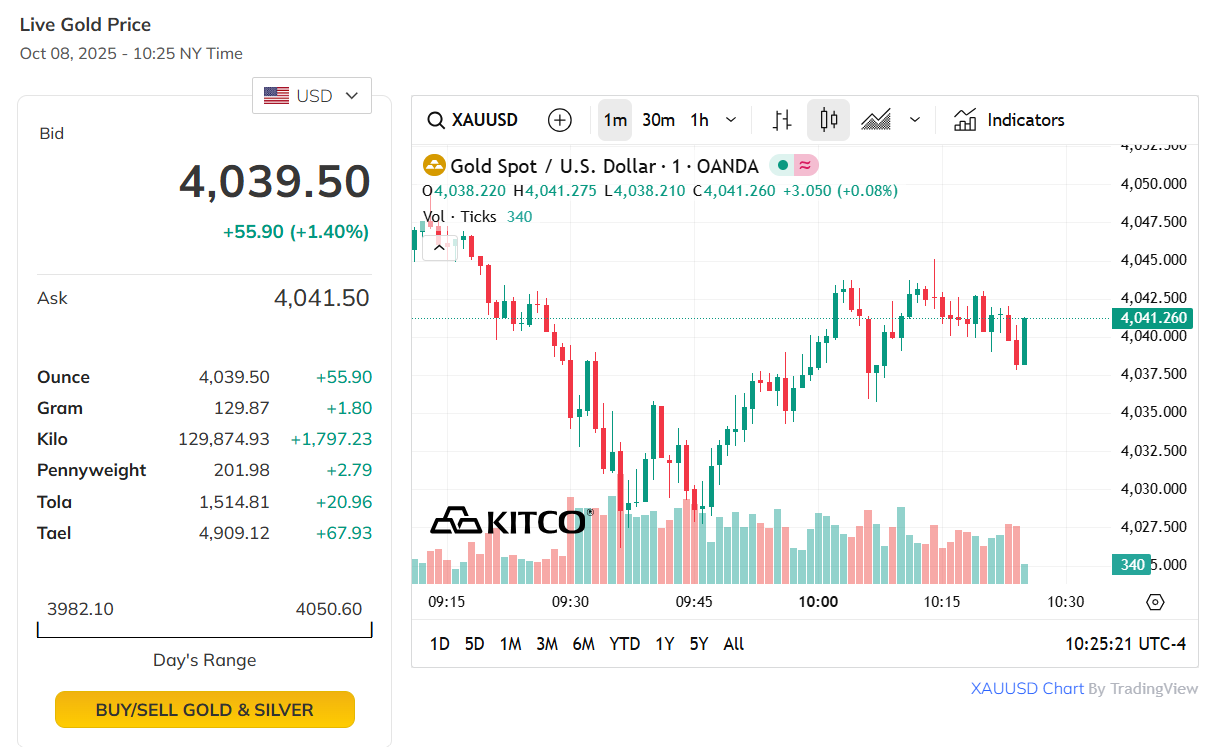

US tech stocks enter the third-quarter results window with constructive—if cautious—risk appetite. Global equities firmed on Oct 8, 2025, helped by expectations that the Federal Reserve will be closer to easing in coming months, even as macro headlines remain noisy. Simultaneously, gold at record levels (~$4,000/oz) signals lingering risk aversion in the backdrop—useful context when parsing any knee-jerk reactions to guidance.

Against that macro mix, the micro story is still AI. Wedbush’s Dan Ives expects Q3 tech to “match/exceed the AI hype,” citing field checks that point to very robust enterprise AI demand at Microsoft, Alphabet and Amazon, with capex likely to accelerate into 2026. His house view: investors underappreciate a multiyear $3 trillion AI spend cycle across enterprise and government.

Nvidia’s demand commentary aligns. In remarks carried Oct 8, Jensen Huang said AI computing demand has surged in recent months—a supportive read-through for the broader cloud/AI stack into earnings (chips, accelerators, networking, and the hyperscalers’ own capex).

SOURCE: CNBC YouTube Channel

Gold Price Chart on 8th October 2025, 10:25 PM NY TIME | Source: KITCO

While companies can update dates, the current line-up suggests a compact late-October slate:

Amazon (AMZN): Thu, Oct 30 (after-market, unconfirmed).

Microsoft (MSFT): Wed, Oct 29 (after-market, unconfirmed).

Alphabet (GOOGL): Tue, Oct 28 (after-market, unconfirmed).

Meta (META): Wed, Oct 29 (after-market, confirmed).

For positioning, that clustering matters: multi-day, cross-read effects can amplify moves as investors rebalance between hyperscalers (Azure/Google Cloud/AWS), semis (GPU suppliers and adjacent silicon), and application layers (from ad-supported platforms to AI-first software).

Ives’ field checks imply AI pilot projects are scaling into production workloads. That should sustain Azure, Google Cloud and AWS momentum if management teams confirm higher utilization and capex run-rates into 2026. Watch for commentary on custom silicon (e.g., AWS Trainium/Inferentia, Google TPU evolution) versus Nvidia allocation, and how each hyperscaler balances gross margin pressure from AI training with long-term unit economics.

For Microsoft, prior quarters showed double-digit Azure growth and early uptake of Copilot—investors will want updated seat counts, ARPU, and attach into M365 E5. Alphabet’s lens is AI-enabled search/ads plus Google Cloud profitability cadence. At Amazon, look for GenAI services adoption (Bedrock, Q) and any shift in AWS customer optimization trends. (Recent coverage frames the bar as reasonable after a choppy summer for megacaps.)

Across the stack, power availability (data-center grid interconnects) and accelerator supply remain constraints. Nvidia’s latest tone—“explosion in demand”—keeps the spotlight on supply allocation and next-gen roadmaps. Any signals from buyers (the hyperscalers) about capacity reservations or H200/B100 transitions will be market-moving for semis and cloud names alike.

Today’s AST SpaceMobile–Verizon announcement is a reminder that connectivity themes can catalyze pockets of tech outside the megacaps. The plan integrates Verizon’s 850 MHz spectrum with ASTS’s LEO network for direct-to-device service from 2026; the stock jumped in early trade. Investors will watch for similar connectivity + AI stories (edge inference, on-device assistants) as Q3 conferences unfold.

Microsoft: After a strong April print underscored AI-driven cloud demand, some strategists say sentiment cooled through summer—potentially lowering the bar for Q3 if Azure stays resilient and Copilot monetization builds.

Alphabet: Focus is on Google Cloud’s margin path and AI in search/ads. Unconfirmed date suggests Oct 28 after market.

Amazon: Street will parse AWS re-acceleration and retail margin mix; provisional date Oct 30.

Meta: Confirmed Oct 29; watch capex (AI infra), ad demand resilience, and commentary on AI assistants and recommendation engines that have powered recent upside.

Even as risk appetite has improved, some investors warn of late-cycle “euphoria” in AI-exposed names—making guidance and capex discipline central to Q3 reactions. The day-to-day tape has reflected that push-pull: Nasdaq leadership has wobbled around headlines (from specific cloud margin concerns to macro noise), but chip and cloud demand signals—Nvidia’s included—keep bulls engaged.

Hyperscaler capex guides rising (again) into 2026 without materially denting segment margins—evidence that AI workloads are monetizing faster than feared.

Google Cloud posting sustained operating profit with accelerating deal wins tied to AI platforms.

AWS re-acceleration plus clearer Bedrock/Q enterprise wins, indicating a second wave of GenAI adoption.

Meta raising capex for AI infrastructure while maintaining expense discipline—signaling confidence in AI-driven engagement and ads ROAS.

Cloud margin pressure from AI training without offsetting monetization.

Slower enterprise ramp of AI copilots/assistants than the sell-side models assume.

Capex fatigue or power-grid bottlenecks that push out data-center timelines.

Macro shocks: the US political backdrop and rate path could still inject volatility around results days.

Dan Ives’ thesis centers on a multi-year AI investment super-cycle—he argues investors still under-appreciate the growth runway as IT budgets pivot to AI platforms and use-cases. He sees Big Tech—Nvidia, Microsoft, Palantir, Meta, Alphabet, Amazon—as the natural platform owners of this “fourth industrial revolution,” and thinks tech could gain another mid-single-digit to high-single-digit into year-end if Q3 prints and guides confirm the demand view.

We believe tech stocks will have a very strong 3Q earnings season led by Big Tech as the cloud stalwarts Microsoft, Alphabet, and Amazon had very robust AI enterprise demand in the quarter based on our field checks. 3Q tech earnings season will match/exceed the AI hype-bullish 🐂

— Dan Ives (@DivesTech) October 8, 2025

Heading into late October, the narrative is straightforward: AI demand remains the engine, and Q3 will test how quickly it converts to revenue, margins, and cash flow across the stack. With the big four reporting within 48 hours of each other, expect cross-currents—but also clarity on where the enterprise AI dollar is landing. For now, sentiment and micro data lean supportive; the onus is on management teams to validate the spending cycle—and, crucially, show the math.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles