Bitcoin is holding around the $90,000 to $91,000 range, steady but volatile, after a turbulent start to the year that has seen institutional flows reverse, political headlines heat up, and long-term forecasts turn increasingly ambitious.

While prices have pulled back modestly from late 2025 highs, the broader crypto market remains firmly in focus. The total digital asset market capitalisation continues to hover above $3 trillion, and despite near-term pressure, many market participants are framing the current phase as consolidation rather than collapse.

The question shaping crypto discussions today is not whether Bitcoin survives, but what role it plays next.

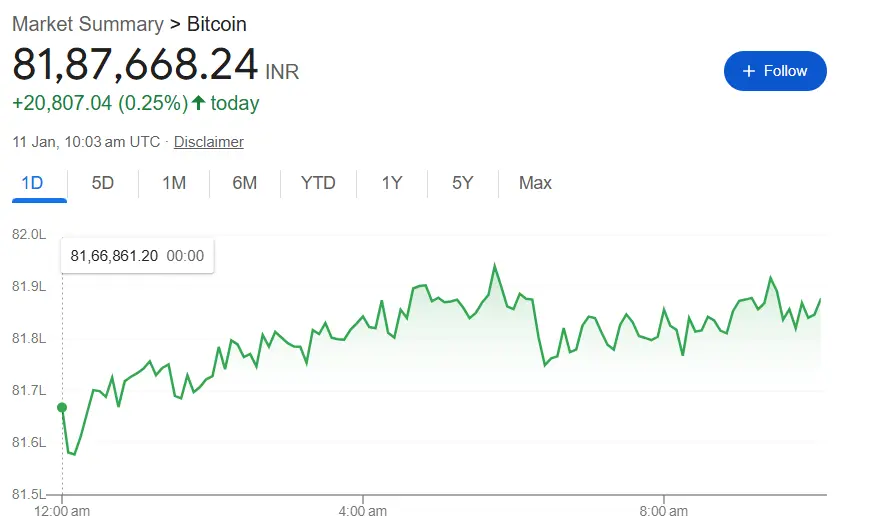

Bitcoin Graph: Google

At the macro level, crypto markets are navigating a crowded landscape of competing signals.

On one hand, expectations of eventual US interest rate cuts later in 2026 continue to underpin risk assets. On the other, sticky inflation data and slowing job growth have kept policymakers cautious, dampening speculative excess.

Wall Street's Tom Lee chimes in with Ether (Ethereum's token) potentially jumping 177% to $9,000 early this year, thanks to friendlier regulations and a broader market rebound. VanEck, an investment firm, goes even longer-term, eyeing Bitcoin at millions by 2050. These forecasts aren't crystal balls, but they stem from trends like Federal Reserve rate cuts that could juice economic activity. On X (formerly Twitter), users are sharing charts and memes, debating if we're in for a bull run or more sideways action.

Layered on top is a growing political dimension.

The return of Donald Trump to the White House has reintroduced uncertainty into digital asset regulation. Over the past week, debate intensified after reports emerged that a crypto firm linked to Trump and co-founded by his sons is seeking a US banking license, raising concerns about conflicts of interest.

Ethics watchdog group CREW flagged the development on social media, warning that regulatory approvals could directly benefit the president’s family. World Liberty Financial, a crypto firm co-founded by Donald Trump's sons and one that profits the family, is applying for a U.S. banking license under the new Trump administration. This has ethics watchdogs like CREW raising red flags about conflicts of interest. The issue has gained traction on X and in financial media, injecting political risk into an already sensitive regulatory backdrop.

It doesn't take an ethics expert to see the conflict of interest here:

— Citizens for Ethics (@CREWcrew) January 10, 2026

The crypto company Trump profits from (and his sons co-founded) is applying for a banking license from Trump's administration. That license could help the company profit more. https://t.co/zr4T5mgBkr

At the same time, the US Senate is preparing for key hearings on crypto market structure legislation later this month. According to CoinDesk, both the Senate Banking and Agriculture Committees are expected to hold markup hearings as lawmakers attempt to resolve outstanding issues around decentralised finance, stablecoins, and executive oversight.

Progress on regulation remains a double-edged sword. Clearer rules could attract institutional capital, but political gridlock risks prolonging uncertainty.

Despite short-term volatility, long-term Bitcoin forecasts remain strikingly bullish.

Hedge fund manager Mark Yusko, founder and chief investment officer of Morgan Creek Capital Management, made headlines this week after stating that Bitcoin’s market capitalisation could eventually rise eightfold from current levels.

Speaking on the Coin Bureau podcast on January 7, Yusko described Bitcoin as “a better form of gold,” citing its fixed supply, portability, and divisibility.

“Bitcoin is equally scarce as gold and is more portable and more divisible,” Yusko said. “It’s just a better form of money, and money is different than currency.”

With Bitcoin’s current market cap estimated at around $1.8 trillion, an eightfold increase would imply a valuation closer to $14 trillion over time. While no timeframe was specified, the comment has reignited debate over Bitcoin’s role as a long-term store of value rather than a speculative trade.

Adding to the optimism, asset manager VanEck has reiterated its ultra-long-term view that Bitcoin could reach multi-million-dollar price levels by 2050 under a scenario of sustained adoption and monetary debasement.

In the short term, however, the market is grappling with outflows.

Bitcoin and Ether exchange-traded funds recorded more than $1 billion in combined outflows in early January, reversing some of the strong inflows seen late last year. According to market data compiled by CoinMarketCap and ETF issuers, the reversal has weighed on sentiment and limited upside momentum.

Crypto sentiment indicators remain subdued. Several analytics platforms continue to flag “fear” or “extreme fear” conditions, reflecting investor caution after the sharp swings seen in November and December.

Yet, volatility is not uniform across the market.

Rotation into selective altcoins and infrastructure tokens has resumed, suggesting that capital is not exiting crypto entirely but repositioning.

While Bitcoin remains range-bound, activity across the broader market tells a more dynamic story.

POL rose between 9% and 15% over the past 24 hours, supported by renewed interest in blockchain infrastructure plays

PIPPIN advanced more than 11%, driven largely by speculative momentum

Golem gained nearly 6% as investors rotated into smaller-cap utility tokens

River fell more than 15%, extending a sharp pullback

Zcash dropped over 14% amid ongoing debate around development direction and governance

Midnight declined around 8%, reflecting broader risk-off sentiment

Trending tokens on social platforms today include POL, GMT, and Zcash, highlighting the growing influence of social sentiment alongside fundamentals.

Source: CoinMarketCap

Behind the scenes, Bitcoin’s mining ecosystem is undergoing another recalibration.

Bitcoin mining difficulty edged slightly lower in the first adjustment of 2026, falling to approximately 146.4 trillion. According to CoinWarz data, the adjustment reflects marginal changes in network conditions after a year marked by intense competition and shrinking margins.

Average block times have since accelerated to around 9.88 minutes, suggesting that the next difficulty adjustment, expected around January 22, could reverse course and move higher.

Despite the brief relief, profitability remains under pressure.

Industry data shows miner hash price dipped below $35 per petahash per second per day late last year, below the roughly $40 level many operators consider sustainable. The April 2024 halving, combined with elevated energy costs and equipment expenses, continues to strain balance sheets.

ASIC manufacturer Bitmain has responded by aggressively cutting hardware prices, with some older-generation machines reportedly selling for as little as $3 to $4 per terahash, according to TheMinerMag.

One area where sentiment is quietly improving is Bitcoin’s energy profile.

Independent researcher Daniel Batten has published fresh analysis challenging long-standing criticisms of Bitcoin mining. Drawing on peer-reviewed studies and grid data from regions such as Texas, Batten argues that Bitcoin mining can stabilise electrical grids through flexible demand and demand-response services.

Former ERCOT interim CEO Brad Jones was quoted in the research as saying miners can “very quickly respond to frequency disruption and allow us to balance our grid more efficiently.”

While the energy debate remains polarised, the growing body of data is gradually reshaping perceptions among policymakers and institutional investors.

If you're dipping your toes into crypto, start small and focus on education. These trends suggest 2026 could be transformative, with adoption growing amid regulatory clarity. But volatility's part of the game – exploits and outflows remind us of risks. For seasoned folks, watch macro cues like Fed moves and micro tweaks in mining for trading edges.

In the end, crypto's evolving from niche tech to global finance player. Stay informed, diversify, and think long-term.

If this wrap added value to your investing journey, consider subscribing to our newsletter. We will be bringing you sharp, data-driven market insights throughout the year ahead.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles