Black Bear Minerals Ltd (ASX: BKB) moved a step closer to potential production after confirming that all major operating and environmental permits remain valid for its flagship Shafter Silver Project in Texas, a milestone that significantly reduces development risk and strengthens its near-term restart strategy.

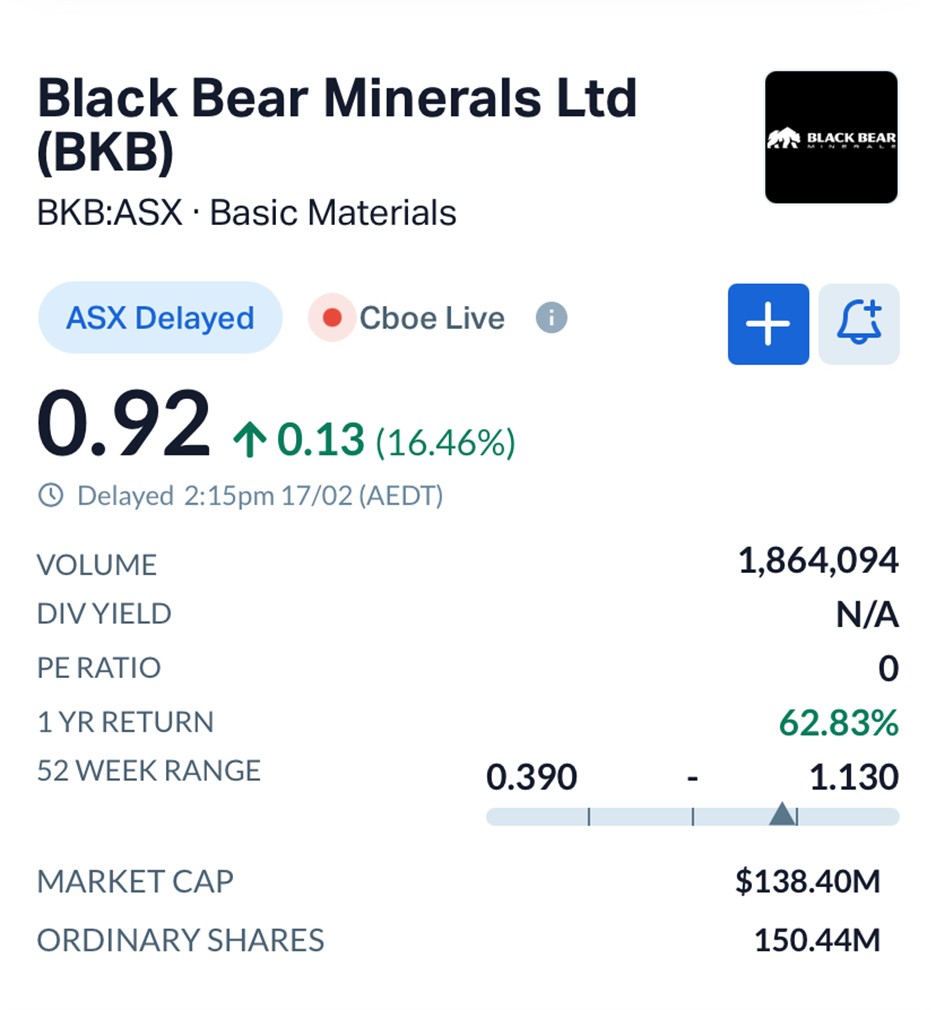

Markets reacted quickly. Shares surged about 16.46% to $0.91 on February 17, reflecting renewed optimism that the project could transition from exploration toward development faster than many early-stage mining projects.

Source: MarketIndex

In the mining sector, securing permits is often the longest and most expensive phase of project development. Many projects stall for years waiting for regulatory approvals, consuming capital without generating returns. By confirming that Shafter’s permits remain active and transferable, Black Bear has effectively shortened that timeline and improved the project’s financing attractiveness.

Chief Executive Officer Dennis Lindgren described the permitting outcome as a crucial turning point, stating:

“Confirming that all major permits are in place is a critical milestone for Shafter. Since acquiring the project, our focus, in addition to exploration, has been on ensuring administrative continuity, regulatory compliance, and permitting so that the project is development ready. This outcome materially strengthens our ability to advance technical studies, engage financing partners, and progress toward a near-term restart strategy.”

One of Shafter’s strongest differentiators is its existing infrastructure. The site already hosts a mill, refinery, warehouse facilities and supporting operational assets built during earlier production phases, representing an estimated A$150 million in installed infrastructure.

Because permits remain active, these facilities can be refurbished rather than rebuilt, potentially reducing both capital expenditure and development timelines. The company is currently conducting engineering and refurbishment studies, including equipment condition assessments and restart capital cost estimates, as part of a staged development plan.

This “rapid restart” model is increasingly common across the mining industry, particularly in markets experiencing strong commodity price cycles. Restarting previously operating mines often provides faster production timelines compared with greenfield projects that require entirely new infrastructure.

The timing of the Shafter advancement coincides with a structurally tighter global silver market. Silver prices have climbed significantly from the lows that forced the mine into care and maintenance in 2013, when prices fell below US$18 per ounce. Today, prices are trading near record levels around US$75 per ounce, supported by rising industrial demand tied to electronics, defence systems, semiconductors and renewable energy technologies.

Industry analysts widely point to a persistent structural deficit in silver markets, where global demand continues to exceed mine supply. That dynamic has provided a stronger long-term pricing foundation compared with the volatility that characterised earlier cycles.

Black Bear’s Shafter project currently hosts a foreign resource estimate of approximately 17.6 million ounces of silver, which the company is working to convert into JORC-compliant reporting through ongoing drilling and metallurgical work.

Resource conversion is a key step because JORC classification is required before formal feasibility studies and investment decisions can be completed under Australian reporting standards.

Beyond price dynamics, Shafter’s location in Texas adds another strategic dimension. Silver was added to the United States critical minerals list in 2025, reflecting its growing importance across defence, semiconductor and renewable energy supply chains. Projects capable of supplying domestic feedstock are therefore gaining increased strategic attention as governments seek to reduce reliance on imports.

A recent US$7.4 billion smelter investment partnership between Korea Zinc and the U.S. government further highlights the push to strengthen domestic metal processing capacity. Black Bear believes its Shafter project could ultimately support these emerging supply chains by providing locally sourced silver feedstock once production resumes.

The company is also advancing exploration work aimed at expanding mineralisation beyond the current resource footprint, including drilling programs targeting new strike extensions and potential shallow mineralisation zones.

While Shafter remains the primary development focus, Black Bear continues to build a broader North American metals portfolio. The company also holds the Independence Gold Project in Nevada, which contains a defined gold resource and sits adjacent to a major producing mining complex, as well as lithium exploration assets in Canada’s James Bay region.

This diversified project base provides optionality across both precious metals and battery-related commodities, allowing the company to respond to shifting market cycles while advancing near-term production opportunities.

Investors often reward mining companies when projects move from conceptual exploration toward tangible development milestones, and the confirmation of Shafter’s permitting status represents exactly that type of transition. With regulatory certainty improving, existing infrastructure in place and commodity prices supportive, the project’s perceived development risk has declined materially.

While additional technical studies, resource upgrades and financing steps remain ahead, the permitting milestone positions Black Bear Minerals closer to what industry observers describe as a “development-ready” silver asset, narrowing the gap between project ownership and potential production.

Source: Black Bear Minerals ASX announcement, and Market data - February 17, 2026.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles