Cannindah Resources Ltd (ASX: CAE) has reported a significant high-grade copper-gold intersection from the first step-out hole at its Mt Cannindah Project in Queensland, reinforcing confidence in the company’s reinterpreted geological model and highlighting the project’s growth potential.

The reverse circulation hole (25CRC001) returned a thick intersection of 52 metres at 1.18% copper equivalent (CuEq) from 4 metres, including a standout 22 metres at 2.63% CuEq from 32 metres. The higher-grade section also included 1.80g/t gold, 18.1g/t silver and 90ppm molybdenum within 0.99% copper.

These results mark the first from a new extensional drilling program designed to expand the Cannindah Breccia resource, which currently stands at 14.5 million tonnes at 1.09% CuEq, or 158,000 tonnes CuEq, according to a July 2024 mineral resource estimate.

The company said the results confirm a reinterpretation of strike extensions and help identify the structure controlling the high-grade breccia mineralisation. Notably, the new intersection extends the mineralised zone eastward, adding fresh growth potential to a system already open to the north and south.

Drill hole 25CRC001 was collared east of the 2023 drill hole 23CAEDD023, which had returned lower-order results due to being drilled on the hanging wall side of the breccia structure. The latest data confirms the mineralised corridor dips eastward, and assays from subsequent holes in the program are still pending.

Cannindah’s Chairman Michael Hansel said the results were “a testament to the high prospectivity of the Cannindah system.”

“These high-grade results clearly demonstrate that the Cannindah Breccia remains open to the north, south, and further east,” Hansel said. “We now have a greater understanding of the controlling structures, which we will target with additional drilling to extend the mineralised system and upgrade the current resource.’’

“The identification of a high-grade zone averaging 2.63% CuEq over 22 metres provides a tremendous platform for future growth opportunities. Mineral systems with grade provide opportunity.”

Interim CEO Cameron Switzer added that the near-surface nature of the mineralisation was particularly encouraging. “From an economic standpoint, intercepts this close to surface strengthen the development case for Mt Cannindah,” he noted.

The drill rig has now completed seven holes at the Cannindah Breccia and is moving toward the Eastern Porphyry and Southern Porphyry targets, which are seen as transformational exploration fronts.

The Eastern Target spans 1.7 kilometres by 400 metres and hosts one of the strongest induced polarisation (IP) chargeability anomalies in the district, suggesting a large mineralised system beneath shallow cover. Three holes are planned here before drilling shifts to the Southern Target, where ten scout holes are expected to test porphyry-style mineralisation across a 1.5km by 700m geochemical anomaly.

The Southern zone has already produced trenching results at the Appletree-Dunno area, indicating high-order copper and molybdenum mineralisation and reinforcing the potential for multiple porphyry centres within the Mt Cannindah system.

Located 90 kilometres southwest of Gladstone, Mt Cannindah sits within a region historically known for copper and gold production, with small-scale mining dating back to the late 19th century. The project includes nine mining leases and two exploration permits, encompassing at least 17 copper-gold-molybdenum occurrences.

The mineralisation at Cannindah occurs in a structurally controlled breccia within a broader porphyry system, featuring copper-gold sulphides hosted in albite-altered volcanic and sedimentary rocks. The breccia body, measuring roughly 600 metres by 100 metres, lies on the periphery of a larger intrusive complex, making it a prime target for continued resource growth.

The company’s systematic approach combines historical data with modern exploration techniques, including downhole EM, IP surveys, and 3D modelling to refine high-priority targets.

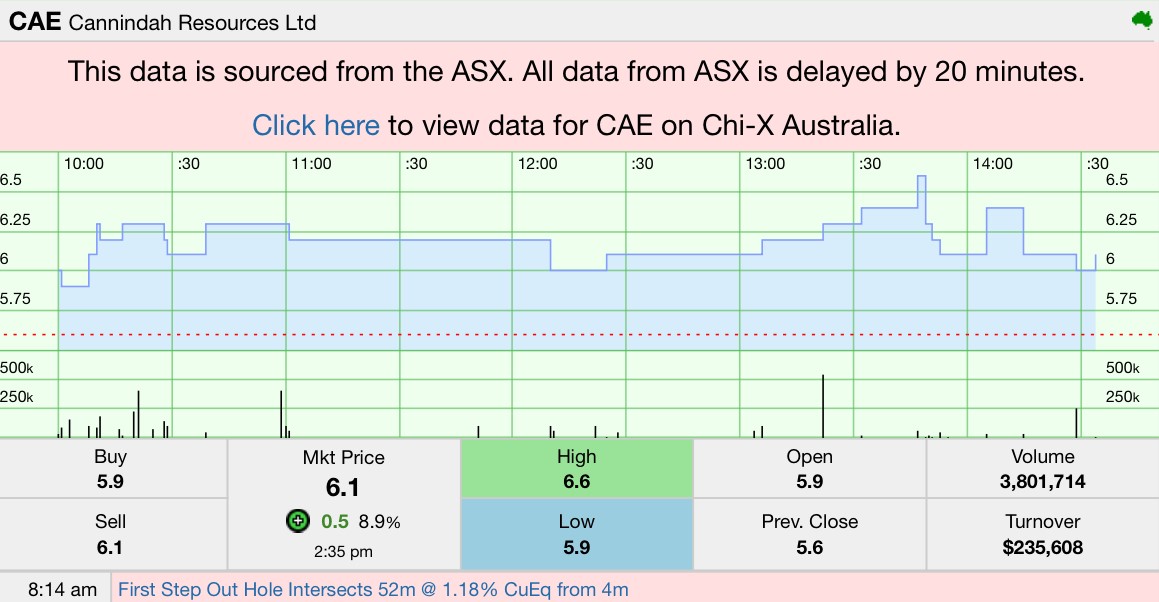

Following the announcement, Cannindah Resources (ASX: CAE) shares were trading at $0.061, up 8.9% on the day, with the stock maintaining a 12-month gain of more than 80%.

Source: StocknessMonster

Analysts following the junior copper-gold space noted that Cannindah’s results come amid renewed investor interest in Australian copper plays, particularly as global supply deficits emerge and long-term demand from clean energy and electrification continues to strengthen.

With assays from six more holes pending and fieldwork expanding to new porphyry zones, the company expects a steady stream of news flow through the December quarter. Cannindah will also present at the Noosa Mining Conference (Nov 12–14), where further geological insights are likely to be discussed.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles