DroneShield Ltd (ASX: DRO), one of the ASX’s fastest-rising defence technology names, has entered a turbulent chapter as its share price slumped on Wednesday following a combination of leadership upheaval, heavy insider selling, and public scepticism highlighted in recent financial press.

The stock fell more than 14 per cent to trade near $2.10 by early afternoon, extending a fortnight of volatility that has wiped billions off its market capitalisation. The latest catalyst: the resignation of the company’s US Chief Executive Officer, Matt McCrann, a senior figure widely credited with advancing DroneShield’s North American footprint.

The departure comes at a moment when investors were already uneasy after a wave of director-level share disposals totalling roughly $67 million, with filings showing some of the largest insider sales in DroneShield’s history.

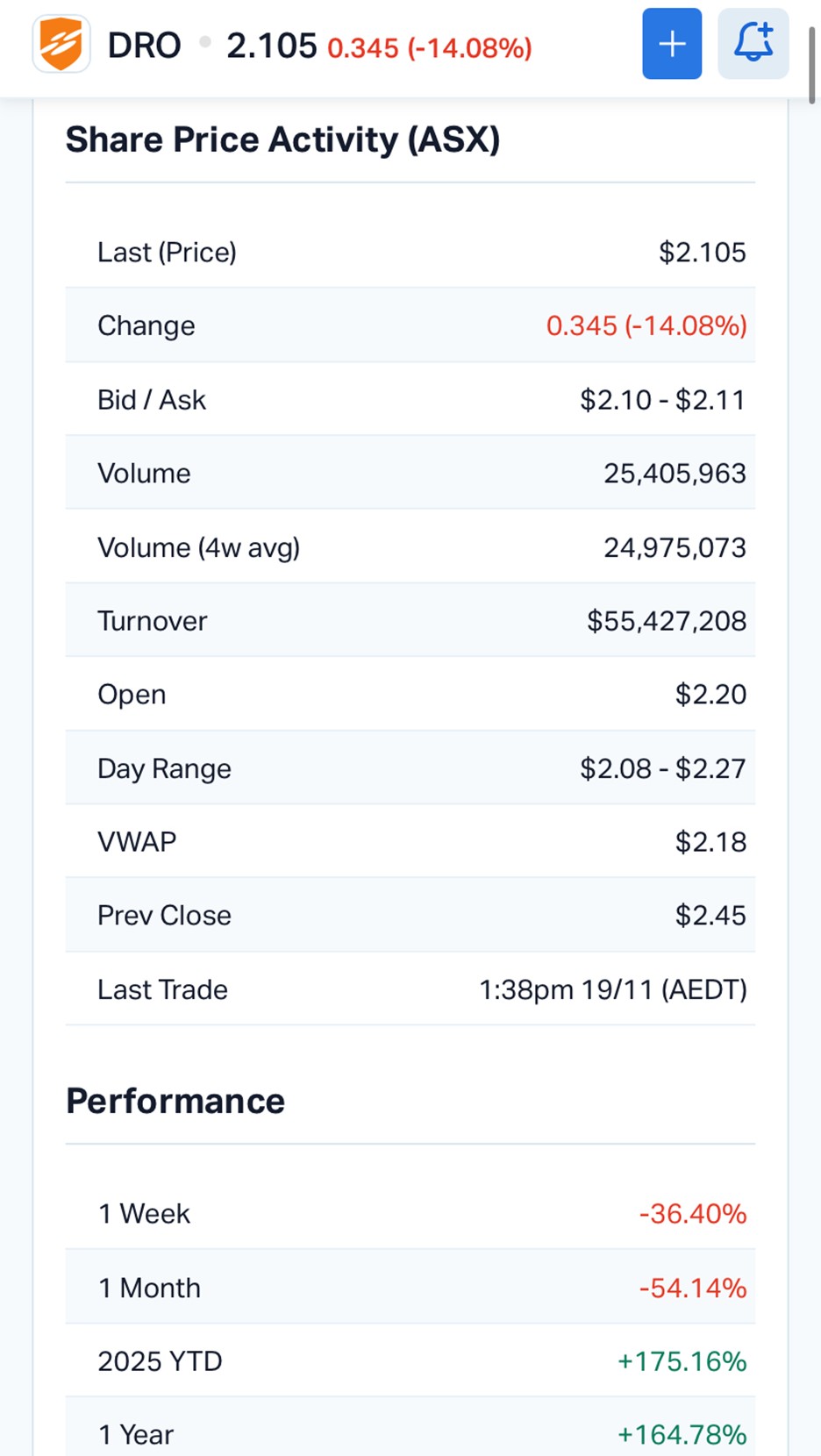

DRO Share Price data | Source: MarketIndex

DroneShield’s ASX filing announcing the resignation of its US CEO gave no dramatic explanation, but the timing has become the core of market discussion. McCrann, who previously served in both strategic and operational roles across US defence and security, had been instrumental in pitching DroneShield’s counter-drone technologies to US agencies, defence integrators, and NATO-aligned partners.

Investors had viewed his presence as an anchor for credibility in the company’s most strategically important growth market. His exit, paired with the recent director transactions, has amplified perceptions that internal momentum may be shifting.

Industry investors familiar with defence-tech commercialisation noted that US market leadership roles are often critical to contract visibility. While no operational concerns were raised by DroneShield in the announcement, the market’s reaction shows how tightly investors are now pricing sentiment risk.

A deeper look into ASX filings reveals striking numbers.

Director trades lodged on 12 November show:

Together with earlier disposals and option exercises, the three key insiders have collectively sold roughly A$67 million in stock across the November period.

The AFR reported that Vornik’s sale was partly attributed to funding a major property purchase in North Sydney, citing sources familiar with the matter. While property-related reasons are not uncommon for executives to reduce holdings, the scale of the sale at a time when DroneShield was priced near historic highs immediately drew scrutiny.

In a separate AFR report, DroneShield’s own house broker, Bell Potter, was quoted saying the insider selling had made the stock “dead money” in the eyes of institutions. The broker, which helped the company raise $220 million last year, noted that many large investors would likely “stay away for a long time” given the optics.

For a high-growth technology company built on institutional conviction and government confidence, this shift in perception is meaningful.

DroneShield has long been one of the ASX’s standout defence technology names, benefiting from geopolitical tensions, rapidly growing counter-drone demand, and rising global military spending. Its products, especially DroneGun and DroneSentry, have been widely discussed in defence circles for their role in neutralising modern battlefield threats.

However, sentiment cycles in emerging defence sectors can turn quickly, and the combination of leadership change and insider cashouts has created an unusually sharp break in momentum.

DroneShield’s share price had rallied more than 600 per cent over the past year before the recent decline, placing it among the best performers on the exchange. Such elevated valuations made the stock particularly sensitive to perception-driven risks.

As one investment manager who follows defence equities put it:

“High-growth defence tech relies heavily on trust. When key insiders sell tens of millions at once, the market is forced to reassess risk-reward, regardless of operational performance.”

Just as investors were digesting the leadership shift and insider sales, another AFR report this week added fresh challenges. According to defence correspondents Andrew Tillett and Tess Bennett, military insiders have raised concerns that DroneShield’s flagship products are being “superseded on the battlefield” as Ukrainian and Russian forces adapt their tactics.

The report cites examples of soldiers returning to improvised or old-school methods, including shotguns, to down certain drones. Observers say both Russia and Ukraine have learned to rapidly modify drone behaviour to avoid electronic countermeasures, creating an arms race that places pressure on all counter-drone suppliers.

For DroneShield, the report does not suggest immediate operational failure, but it highlights the pace at which modern conflict zones evolve. Defence procurement teams, according to the AFR article, are increasingly seeking systems that integrate multiple layers of detection and interception, including kinetic options.

DroneShield has long promoted upgrades, software-driven improvements, and modular capabilities, but investors appear concerned that the company must now prove continued competitiveness.

Three intertwined forces are now shaping the stock’s trajectory:

Large insider disposals, particularly by the CEO and chairman, are among the strongest sentiment signals in public markets. Even if the reasons are legitimate, the scale raises unavoidable questions.

The US market accounts for some of the world’s largest defence-tech budgets and is central to DroneShield’s long-term expansion. A leadership vacancy in that region is non-trivial.

Counter-drone warfare is evolving rapidly. Companies must innovate continuously to remain viable. Reports suggesting Ukrainian and Russian soldiers are using shotguns to counter some drones highlight the fluidity of modern conflict zones.

While sentiment has clearly turned negative in the short term, several analysts remain supportive of the long-term structural demand driving the counter-drone market. Military procurement cycles remain multi-year in nature, and defence budgets globally continue to grow.

One defence-sector analyst noted privately:

“DroneShield still operates in a sector with enormous tailwinds, but the company must now rebuild trust. Investors will look closely at how transparent management can be over the next few months.”

Another fund manager argued the recent selloff could create an entry point for longer-term investors, provided DroneShield demonstrates clearer communication around leadership succession and product development.

The company now faces a period where narrative management is almost as important as operational performance. A swift appointment to replace the outgoing US CEO, clearer explanation around insider sales, and a strong demonstration of product resilience could help stabilise sentiment.

In typical DroneShield fashion, investor sentiment may recover as quickly as it fell. But until then, the stock remains in a valuation reset driven not by contracts or cashflows, but by confidence.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles