Australian Strategic Materials has spent years pitching a simple idea with a hard edge: if rare earths are strategic, then the West needs more than mines. It needs processing, separation, and the capability to produce the alloys and metals that actually feed magnets, motors and defence supply chains.

On Wednesday, ASM said it has agreed to a deal that tries to stitch those steps together faster, through a takeover by U.S. critical minerals group Energy Fuels, best known for uranium but increasingly positioning around rare earths processing.

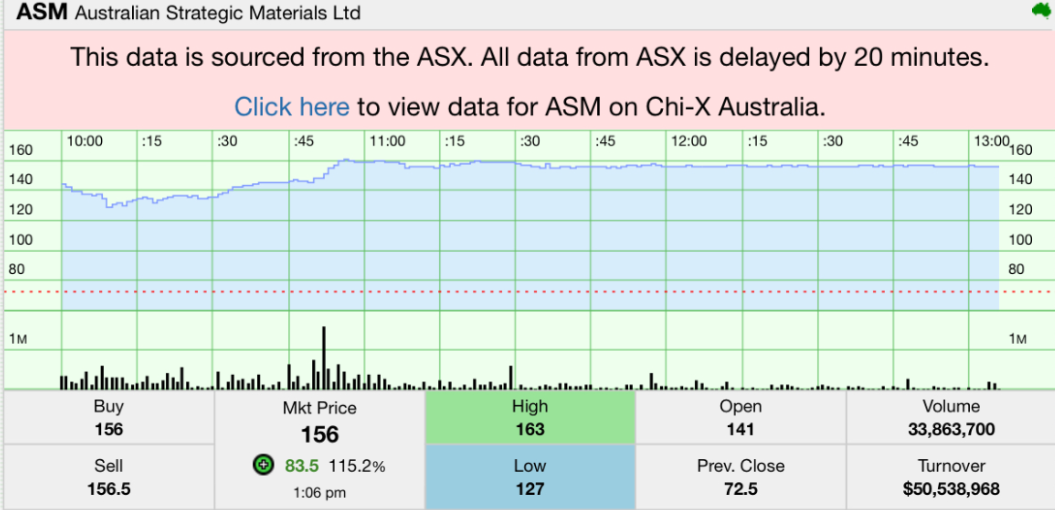

The market reaction was instant. ASM shares surged to A$1.56 (up 115%) with volume above 32 million shares by early afternoon, as traders moved the stock closer to the implied value of the proposed scheme.

ASM stock chart | Source: StocknessMonster

ASM told the ASX it has entered a binding Scheme Implementation Deed with Energy Fuels. If approved, Energy Fuels would acquire 100% of ASM via a scheme of arrangement under the Corporations Act.

For ASM shareholders, the consideration is structured as a mix of equity and cash:

Add those together and the company frames it as A$1.60 per share total implied value.

There is also a parallel arrangement for listed options (ASX: ASMO): option holders would receive A$0.50 per option under a separate option scheme that is concurrent but not a condition of the main scheme (though the option scheme needs the main scheme to become effective).

Energy Fuels also says it will pursue a secondary ASX listing so ASM holders can trade Energy Fuels exposure via CDIs on the ASX, rather than being forced offshore.

When a scheme consideration is laid out with a clear implied value, the share price typically gravitates toward it quickly, but rarely matches it exactly. That gap is the market’s way of pricing “deal risk”, including approvals, timing, and conditions.

ASM itself points to the premium math. It says the A$1.60 implied value represents about:

So the stock’s sharp repricing is not mysterious. It reflects a market that had valued ASM as a longer dated execution story, and then suddenly had a near term reference point anchored by a takeover offer.

ASM’s announcement leans heavily on the phrase “mine to metal & alloy”, and that is the heart of why the deal matters beyond today’s price pop.

Rare earths are not “rare” in a geological sense. What is scarce is capacity to turn ore into separated oxides and then further into metals and alloys at scale, consistently and in a way that meets customer specifications. This processing choke point is why supply chains can be dominated even when mines exist elsewhere.

ASM argues that joining Energy Fuels would build a Western focused chain spanning mining, processing, separation, metallisation and alloying, covering both heavy and light rare earths.

Energy Fuels brings a key piece: its White Mesa Mill in Utah, which ASM describes as having a 45 year operating history and solvent extraction experience. In the rare earths world, solvent extraction is not a buzzword, it is a hard industrial capability and it is one of the main barriers to entry.

ASM’s Managing Director and CEO, Rowena Smith, framed the deal as both a valuation event and an execution accelerator.

“This proposed combination delivers a significant premium for ASM shareholders and ensures our shareholders retain the opportunity to participate in the substantial upside of a larger, better capitalised critical minerals business. We are pleased to recommend this transaction not only for the value it delivers but it accelerates the execution of our mine to metals strategy in a way that unlocks greater scale, de-risks delivery and positions us to capture the full potential of our rare-earths opportunity.”

Two words do a lot of work here: “de risks delivery.” In this sector, timelines and funding are often the story. ASM is effectively acknowledging that the path from a compelling resource to a functioning downstream business is capital intensive and operationally demanding, and that being part of a larger, better funded group is meant to compress those risks.

The scheme is subject to the typical gateposts:

ASM says it expects to send a Scheme Booklet in due course, with the scheme meeting expected in Q2 2026, and implementation targeted before 30 June 2026, if approved.

It also postponed an extraordinary general meeting that had been scheduled for 28 January 2026, pushing it to 23 February 2026, to give shareholders time to assess the scheme related resolutions and context.

For readers following this like a story rather than a term sheet, the next chapters are fairly predictable:

The intraday move tells you the market is taking the scheme seriously, but not treating it as done. The stock is still ultimately pricing two realities at once: the tangible value of the offer, and the practical reality that schemes live on approvals, documents, and time.

For ASM, though, this announcement is also a narrative pivot. After years of being valued as an early stage “build the chain” story, it is now being valued through the lens of an acquisition that promises scale, funding capacity, and an integrated rare earths pathway that extends beyond digging rocks out of the ground.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles