Evolution Mining Limited (ASX: EVN) has delivered one of its strongest financial performances to date, benefiting from the sustained rally in global gold prices while advancing key long-term growth projects across its portfolio.

The Australian gold producer reported first-half FY26 profit after tax of $767 million, more than doubling the $365 million recorded a year earlier. Revenue climbed 37% to $2.8 billion, reflecting both higher realised gold prices and steady operational performance across its six producing assets.

Chief Executive Officer Lawrie Conway said the results highlight the company’s disciplined operating strategy and its ability to capitalise on favourable commodity conditions.

“Our half-year result reflects the strength of our operating discipline and our ability to capture the upside in a favourable metal market,” Conway said.

Shareholders were rewarded with a record interim dividend of 20 cents per share, nearly triple the 7-cent payout in the previous corresponding period, signalling management’s confidence in cash flow generation and balance sheet strength.

Alongside its earnings update, Evolution announced a revised funding arrangement tied to its Northparkes operation in New South Wales, a move that strengthens development flexibility while unlocking potential new gold production zones.

Under the amended agreement with Triple Flag Precious Metals, Evolution will receive A$120 million in upfront capital aligned with the development timeline of the E22 block cave. The revised structure also reduces streaming rates over the gold-rich E44 deposit, enhancing the economics of future mining activity.

The new terms create a pathway for Evolution to advance the E44 deposit and potentially develop additional gold-dominant resources across the broader Northparkes tenement package.

Commenting on the transaction, Conway said:

“Today marks a major milestone for our Northparkes operation, where we have now established a pathway to unlock even more value. Triple Flag has demonstrated a commitment to jointly work on unlocking this potential.”

The agreement also includes a study update to reassess the E44 feasibility work, positioning the project for potential investment decision milestones later this decade.

Source: Company Announcement

Evolution maintained its FY26 production guidance of 710,000 to 780,000 ounces of gold, while noting that copper output is expected to be toward the lower end of the 70,000 to 80,000 tonne guidance range due to weather-related disruptions at the Ernest Henry mine.

Importantly, the company reported a 6% reduction in all-in sustaining costs to $1,640 per ounce, highlighting improved cost discipline and operational efficiencies, particularly at upgraded processing facilities such as the Mungari operation in Western Australia.

The miner recently invested more than $212 million upgrading processing capacity at Mungari, allowing higher recovery rates and supporting long-term production stability as gold prices remain elevated.

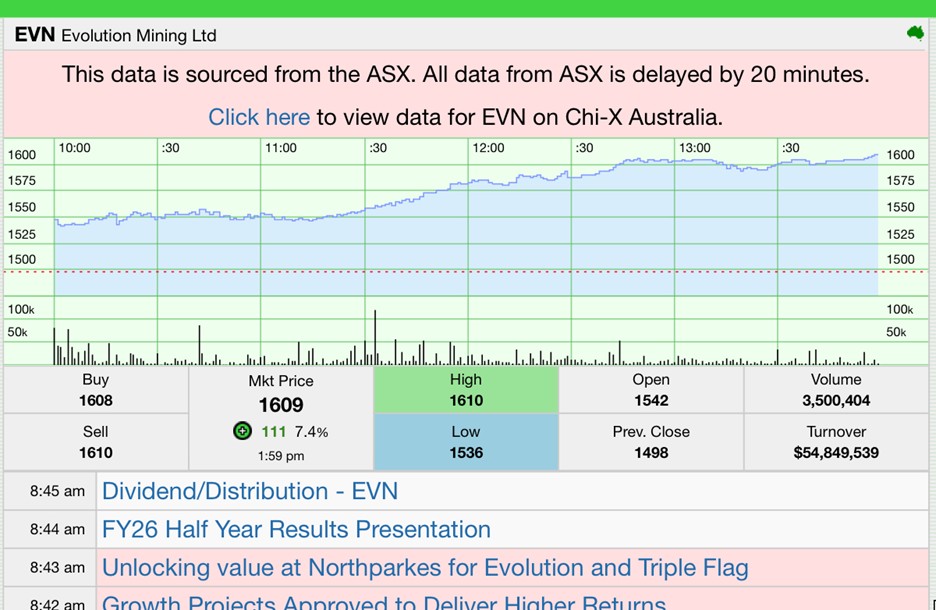

Evolution shares continued their upward trajectory following the results announcement, trading near record highs after rising roughly 150% over the past 12 months. The stock gained strongly in early trade as investors reacted positively to the dividend increase, improved earnings visibility, and long-term growth pipeline.

Mining analysts described the results as “robust,” noting that the combination of record dividends and continued investment in mine-life extensions demonstrates management confidence in the company’s asset base and future production profile.

Source: StocknessMonster

At the time of writing this article, EVN shares were up by 7.4%, trading at A $16.11

Evolution’s performance reflects the broader macroeconomic environment, where gold has surged amid ongoing geopolitical tensions, policy uncertainty, and continued central bank demand for bullion. Prices recently approached US$5,600 per ounce before stabilising near the US$5,000 range, significantly above levels seen just two years ago.

This sustained strength in gold prices has encouraged producers across Australia to prioritise expansion projects, resource extensions, and operational optimisation, particularly where deposits offer strong margins even under conservative price assumptions.

For Evolution, the combination of improved funding structures, operational efficiency gains, and steady production guidance positions the company as one of the sector’s key beneficiaries of the current commodity cycle.

Looking ahead, Evolution’s strategy remains focused on three core priorities:

The company’s integrated approach of operational discipline, targeted growth investment, and opportunistic capital returns has allowed it to capture the upside of the gold cycle while preserving financial flexibility.

With global economic uncertainty continuing to underpin demand for safe-haven assets, Evolution Mining enters the second half of FY26 with strong momentum, robust earnings visibility, and a clearly defined development pipeline that could drive production growth well beyond the current guidance horizon.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles