Germany is rebooting electric vehicle incentives with a €3 billion program designed to get buyers back into showrooms, and it is doing it without the eligibility filter many expected. The subsidies will be open to all manufacturers, including Chinese brands, as Berlin tries to revive demand in Europe’s largest car market after the previous scheme ended in late 2023.

The government’s stance was summed up by Environment Minister Carsten Schneider, who said he does not see evidence of a surge of Chinese vehicles in Germany. “I cannot see any evidence of this postulated major influx of Chinese car manufacturers in Germany, either in the figures or on the roads,” he said at a press conference on Monday. Schneider argued Germany should meet the competition rather than restrict it, adding he is confident in the quality of European and German brands.

That is the bet behind the policy reset: stimulate EV adoption first, and let the market fight play out on price, product and service.

Germany’s plan is built around a clear set of numbers and a targeted audience, leaning toward low to middle income households.

Alongside the purchase incentives, Germany’s coalition has also extended an EV tax exemption through 2035, with an estimated fiscal cost of €600 million in lost revenue through 2029.

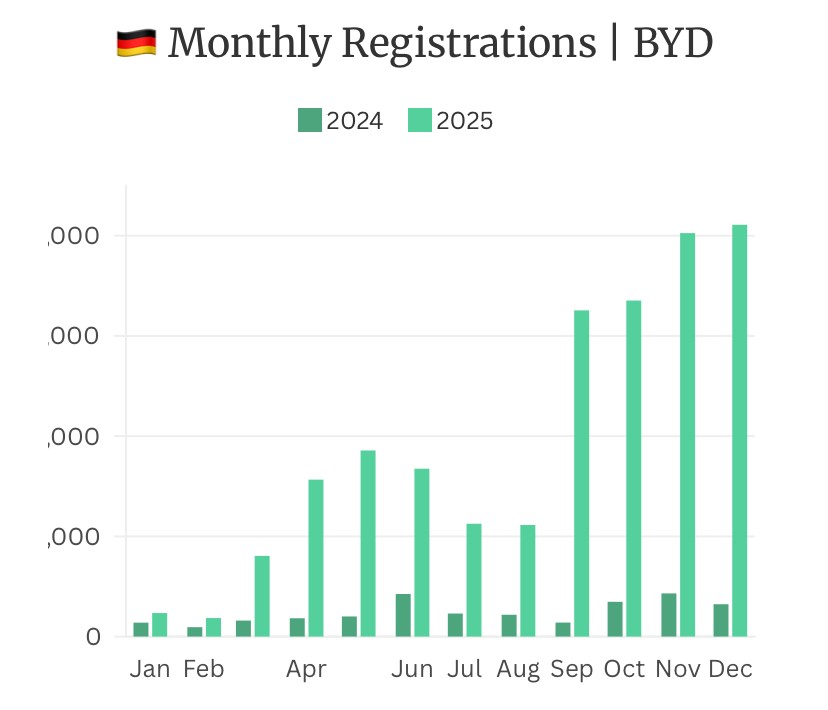

Germany’s decision to include Chinese brands inevitably sharpens attention on market share, and the current numbers explain why Schneider feels comfortable with his “no flood” argument.

Chinese automakers remain a modest slice of Germany’s EV story, even after a year of growth.

Source: KBA

For context, the local leaders are still operating at a different scale in pure battery electrics:

The takeaway is not that Chinese brands are dominant. It is that they are building a foothold, and the subsidy framework will now sit directly on top of that trendline.

BYD’s Showroom in Stuttgart, Germany

Opening subsidies to all brands increases the pressure on incumbents in the most practical way possible: it narrows the “policy gap” that can otherwise cushion higher-priced models.

If a buyer can apply the same incentive to a sharply priced import as they can to a domestic badge, the contest shifts quickly to:

Germany’s government is effectively signalling that EV uptake is the priority, even if that means sharper competition at the bottom and middle of the market.

Germany’s decision also stands out because other markets have taken more indirect approaches that, in practice, screen out some Chinese-made vehicles through eligibility standards tied to production and supply chain requirements. Berlin has chosen not to go down that route, at least for this program.

That does not mean Chinese brands enter tariff-free. Chinese manufacturers still face European Union tariffs on imported EVs, which remain a cost headwind even with subsidies available.

The policy is big enough that its effect should show up quickly in the data.

Germany has set the rules for a more open contest. The next chapter will be written in monthly registrations, pricing moves, and whether buyers treat the new incentives as a nudge or a turning point.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles