Gold and silver miners are taking centre stage on the ASX today, powering ahead even as global equity markets continue to wobble. While the broader market is trading modestly higher, the real momentum is clearly in precious metals, with the ASX All Ordinaries Gold Index up a strong 2.65 per cent by midday. Silver names are also on the move, supported by firmer prices and rising safe-haven flows.

This outperformance comes at a time when technology shares remain under pressure, both locally and globally. Investors continue to pivot toward defensive sectors, marking a notable rotation following last week’s steep losses on Wall Street and escalating concerns about overstretched valuations in AI-exposed stocks.

The standout theme across the ASX is the renewed strength in precious metals. Materials is the best-performing sector of the session, up 1.20 per cent, driven by buying in gold and silver miners as global risk appetite deteriorates.

The ASX All Ordinaries Gold Index is up more than 430 points, while silver-focused names such as Silver Mines Ltd (SVL), Andean Silver Ltd (ASL) and Rox Resources (RXL) all feature prominently in the top gainers list. SVL jumped 9.68 per cent, with RXL up 10 per cent.

Analysts say the uptick in gold and silver stocks reflects broader macro caution.

One commodities strategist noted that the shift is “a classic risk-off rotation into real assets,” adding that investors are now “questioning how long tech multiples can remain elevated when interest-rate expectations are moving again.”

Spot gold is holding near USD 4,064 per ounce, while silver is trading slightly lower at USD 50.65 per ounce but well above last week’s levels. These prices continue to support Australian producers, particularly those operating on lower cost bases and benefiting from a relatively firm Australian dollar.

Despite ongoing global volatility, the ASX 200 is trading at 8,480.4 points, up 0.13 per cent. The broader All Ordinaries shows a similar gain at 0.17 per cent.

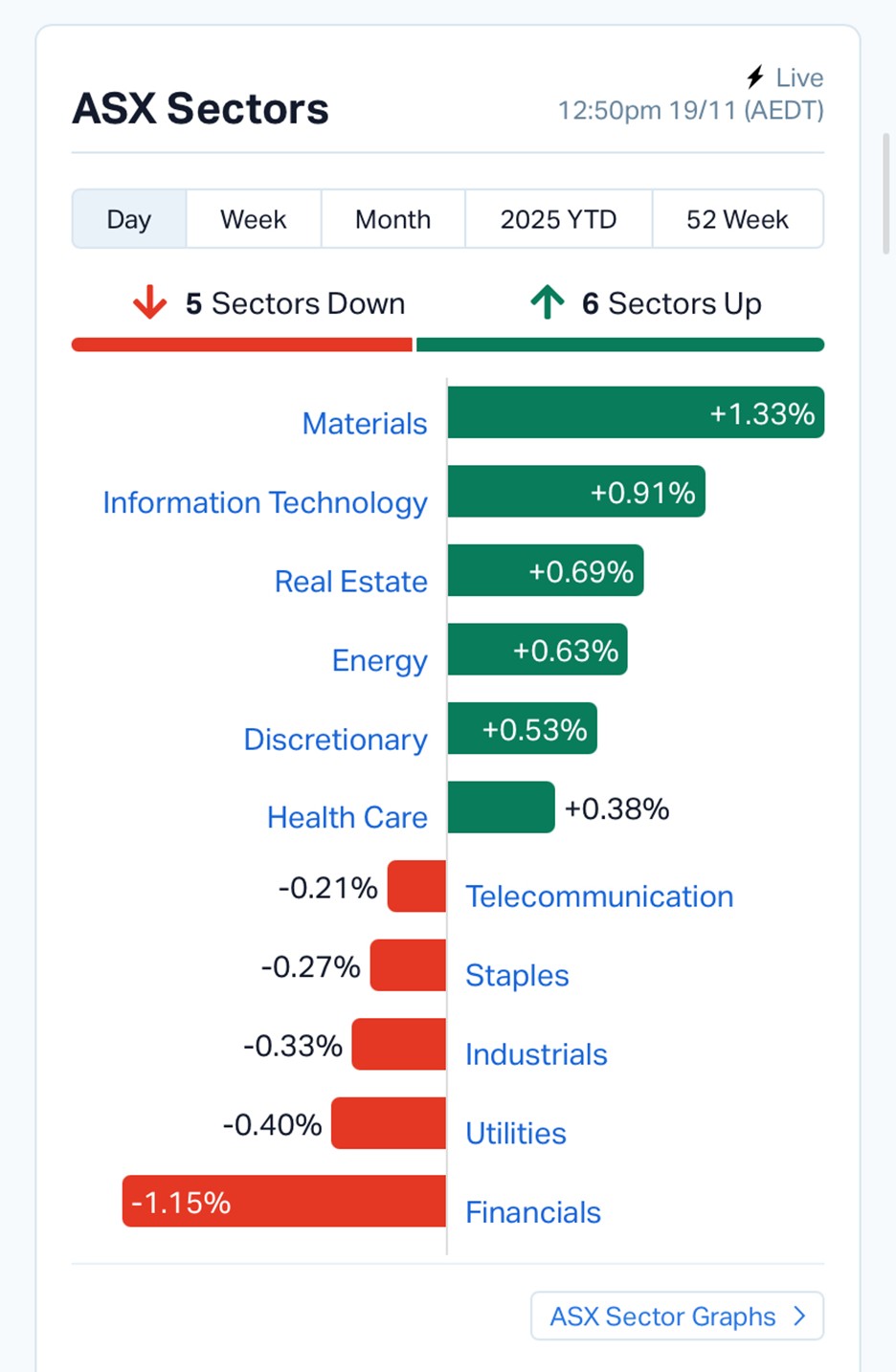

ASX Sector Breakdown: Source- MarketIndex

Top-performing indices include:

Sector breadth, however, remains mixed, with five sectors down and six sectors up. Financials remain a drag, down 0.80 per cent, while Utilities and Staples also lag.

Resource-heavy small caps are relatively firm, with the Small Ordinaries up 0.10 per cent.

One of the biggest stories of the day comes from the travel sector, where Webjet Group Ltd (WJL) has jumped as much as 17.88 per cent after receiving a $353 million takeover proposal from Helloworld Travel.

Helloworld CEO Andrew Burnes said the offer “represents compelling value for Webjet shareholders,” pointing to potential synergies in a still-fragmented travel technology market.

The Webjet board has agreed to open its books for due diligence, though corporate activist Gary Weiss and BGH Capital — who jointly hold 17 per cent — are pushing for board representation ahead of Friday’s shareholder meeting.

The timing of the takeover coincides with Webjet’s half-year results, which revealed a 51 per cent lift in statutory net profit to $6.2 million.

The common theme: gold, silver, rare earths, and travel stocks.

Tech and emerging growth names remain under pressure, as investors retreat from higher-beta plays.

Overnight, Wall Street extended its losing streak for a fourth consecutive session.

The S&P 500 slid 0.8 per cent, the Dow fell 1.1 per cent, and the Nasdaq dropped 1.2 per cent amid renewed fears of overheating in the AI sector. The PHLX Semiconductor Index moved into correction territory after steep falls in Nvidia, AMD, and Marvell.

A new global fund manager survey revealed 45 per cent of participants now view an AI bubble as the market’s biggest tail risk.

Adding to the caution, several Federal Reserve officials signalled a need to remain “somewhat restrictive,” warning against premature expectations of aggressive rate cuts. Market-implied odds of a December cut slipped below 50 per cent.

Retail earnings also weighed heavily. Home Depot cut its annual guidance, saying the slowdown in home improvement spending is persisting, pushing its shares down nearly 6 per cent — the steepest single-day fall since February 2023.

Bitcoin briefly dipped below USD 90,000 as risk sentiment deteriorated.

Markets across Asia also reflected the risk-off tone, with the Nikkei 225 down a sharp 3.22 per cent and the Hang Seng falling 1.72 per cent.

Market strategists say the current environment reflects both profit-taking and recalibration.

One equity analyst commented that “after the runaway rally in megacap tech since April, any hint of softening data or slower growth quickly becomes a catalyst to reassess valuations.”

Another strategist added that the internal rotation from tech to precious metals, energy, and defensives “may indicate fading risk appetite, although not necessarily a collapse.”

For now, traders are keeping a close watch on Thursday’s delayed US jobs report, which could shift expectations around rate policy.

Fresh ABS data showed Australian workers received average base pay increases of 3.4 per cent in the year to September, matching expectations.

While this supports consumer confidence, it also reinforces the Reserve Bank’s cautious stance, especially with US policymakers signalling resistance to near-term rate cuts.

Gold tends to benefit when uncertainty rises, and analysts expect further inflows into precious metals if volatility remains elevated.

The ASX is showing resilience, but under the surface a clear rotation is underway.

With safe-haven demand rising and local gold names delivering strong momentum, the spotlight on precious metals is unlikely to dim anytime soon.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles