Gold and silver prices surged sharply on Monday as geopolitical tensions flared following the United States’ military action in Venezuela, triggering a renewed global flight to safety and reinforcing the precious metals’ role as defensive assets.

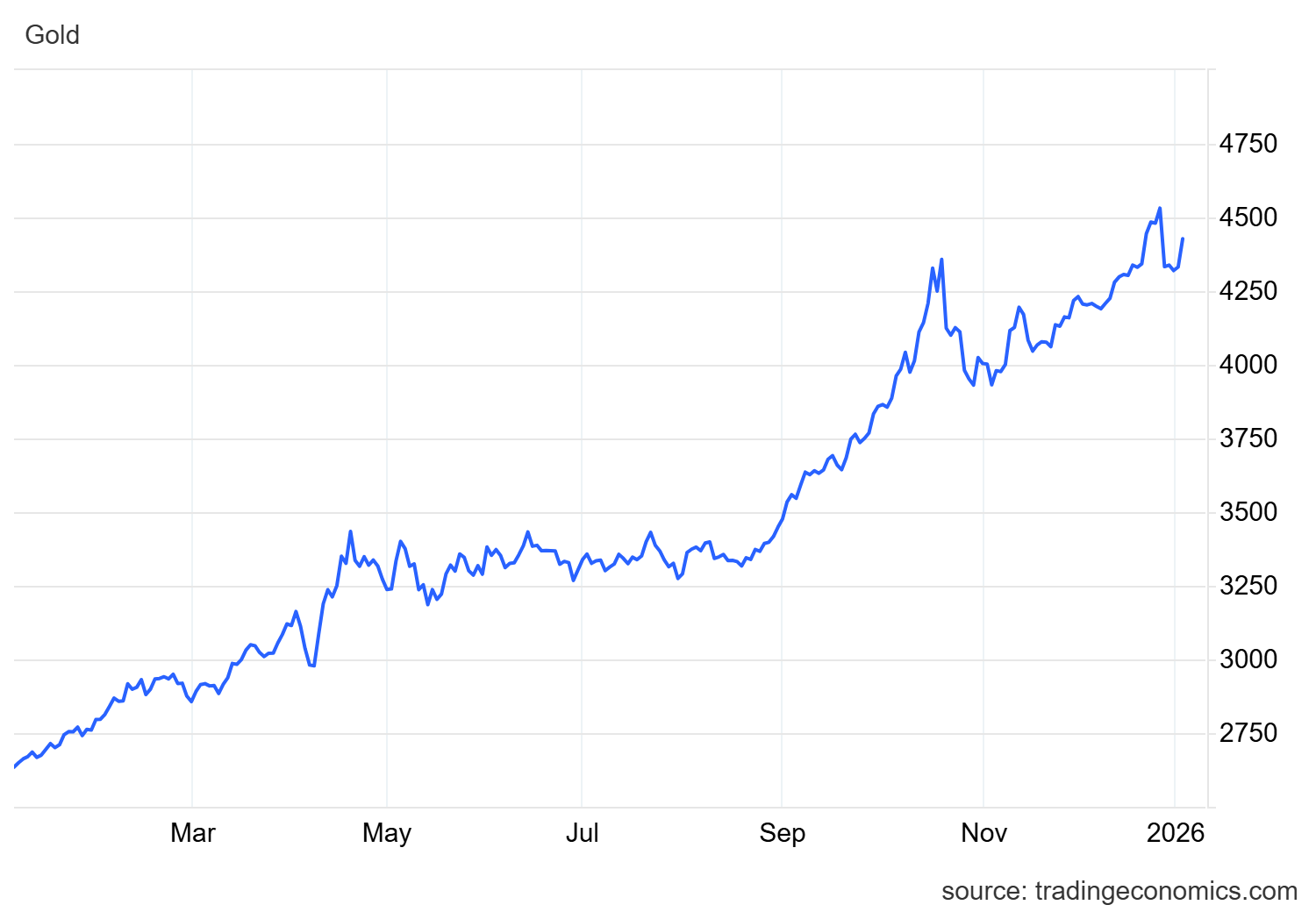

Spot gold was last trading at US$4,426.88 an ounce, up 2.19 percent, while silver climbed to US$75.893 an ounce, reflecting continued strength across the precious metals complex. The move extends a powerful rally that saw both metals deliver standout performances through 2025.

The immediate catalyst was geopolitical. Over the weekend, the US confirmed it had detained Venezuelan President Nicolás Maduro, escalating tensions in a region already strained by years of sanctions and economic instability.

Markets responded swiftly, pushing investors toward assets perceived as stores of value.

Historically, gold tends to rally when geopolitical uncertainty rises, and Monday’s move fits that pattern closely.

Tim Waterer, Chief Market Analyst at KCM Trade, said the latest developments had reawakened safe-haven demand.

“The events in Venezuela have reignited safe-haven demand, with gold and silver among the beneficiaries as investors look to protect against geopolitical risks,” Waterer said.

Beyond the headlines, several structural forces are reinforcing gold’s strength.

First, central bank demand remains robust. After posting its strongest annual gain since 1979 in 2025, gold continues to benefit from sustained purchases by central banks seeking to diversify reserves away from the US dollar.

Second, interest rate expectations remain supportive. While inflation has moderated in some regions, markets continue to price in further rate cuts across major economies in 2026. Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold.

Third, currency weakness is amplifying demand. The Australian dollar slipped to around 66.7 US cents, while the euro also weakened against the US dollar, making gold more attractive to investors outside the US.

Finally, Venezuela’s gold reserves add another layer of concern. Venezuela is believed to hold around 161 metric tonnes of gold, valued at roughly US$22 billion at current prices. Any uncertainty surrounding ownership, access or future sales of those reserves adds to global market anxiety.

Silver has followed gold higher, trading near US$75.90 an ounce, although market participants remain cautious given how far prices have already run.

The metal surged 147 percent in 2025, far outpacing gold, supported by a mix of safe-haven demand and strong industrial consumption tied to renewable energy, electric vehicles and data infrastructure.

However, some analysts warn that silver may be entering overheated territory.

Amit Goel, Chief Global Strategist at Pace 360, pointed to movements in the gold-silver ratio as a signal of potential near-term risk.

“When the gold-silver ratio falls below 80, silver prices begin to enter the overbought zone,” Goel said.

“At current levels, the ratio is around 60, indicating that silver rates are in the overbought zone. One should avoid buying the white metal in the current market scenario.”

That caution does not negate silver’s longer-term fundamentals, but it does highlight why price swings may remain sharp in the weeks ahead.

Beyond traditional drivers, market experts are also watching the growing role of non-state and corporate buyers.

Recent disclosures suggest that digital finance firm Tether has accumulated more than 100 tonnes of physical gold, funded not through token issuance but from corporate profits.

Market participants say this trend reinforces gold’s structural demand floor.

Gold is increasingly being viewed by corporations and technology-driven financial firms as a strategic reserve asset, echoing the behaviour of central banks over the past decade. This shift reduces downside risk during price corrections and adds another layer of long-term support.

The surge in precious metals quickly flowed through to equity markets.

Gold miners and silver stocks featured prominently among top performers, particularly in Australia, where investors rotated into resource names offering leverage to higher metal prices.

In contrast, sectors exposed to consumer spending, technology and growth narratives lagged as risk appetite softened. Investors trimmed exposure to discretionary and tech stocks, preferring assets perceived as defensive or inflation-protective.

Energy stocks were notably mixed, reflecting the divergence between oil and precious metals.

Despite the geopolitical escalation, oil prices moved lower. Brent crude slipped to around US$60 a barrel, while WTI traded near US$56.70.

Analysts say the explanation lies in supply fundamentals rather than geopolitics.

Goldman Sachs analysts noted that Venezuela’s current oil production, estimated at around 900,000 barrels per day, limits its influence on global supply.

“We see ambiguous but modest risks to oil prices in the short run from Venezuela depending on how US sanctions policy evolves,” Goldman Sachs analysts led by Daan Struyven said.

The bank left its 2026 oil forecasts unchanged, pointing to ample global supply and spare capacity. Any recovery in Venezuelan production, they added, would likely be gradual and require substantial investment.

The surge in gold and silver highlights how quickly sentiment can shift when geopolitics intersect with already supportive macro conditions.

For gold, the rally is underpinned by multiple long-term drivers, including central bank buying, currency weakness, lower real rates and emerging corporate demand.

Silver’s outlook remains constructive but more volatile, particularly after its outsized gains last year.

For now, precious metals are once again doing what they have done for centuries, offering a refuge when uncertainty rises.

If this article added value to your investing journey, consider subscribing to our newsletter. We will be bringing you sharp, data-driven market insights throughout the year ahead.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles