A sweeping new economic agreement between Japan and the United States is beginning to take shape, with Japan committing an initial $36 billion investment as the first step in a broader $550 billion bilateral trade and infrastructure pact designed to reshape global supply chains and trade relations.

The first tranche of funding is focused on large-scale infrastructure and industrial projects across the United States, reflecting a growing global trend in which economic alliances are increasingly built around capital investment in strategic industries rather than traditional tariff negotiations alone.

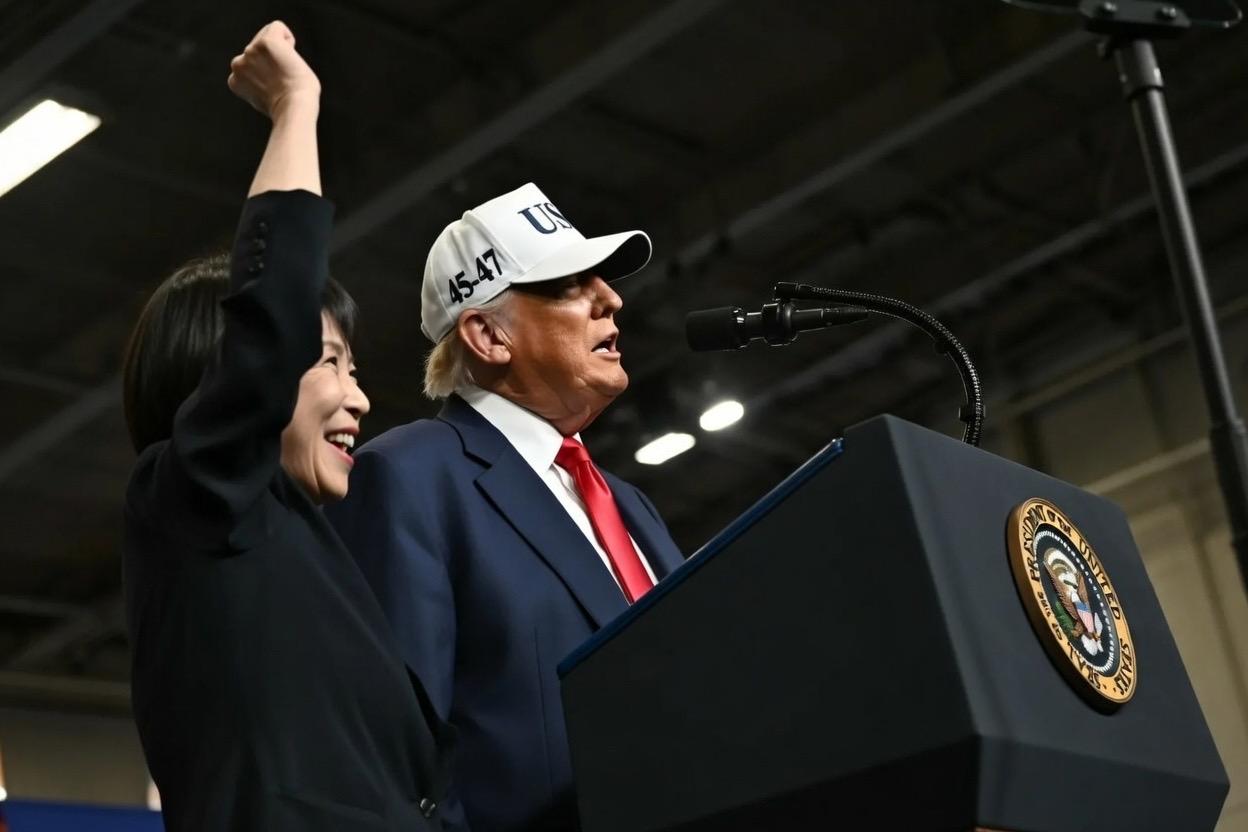

— Rapid Response 47 (@RapidResponse47) February 17, 2026

Under the framework, the United States agreed to reduce previously threatened tariffs on Japanese exports, particularly automobiles, to 15% instead of 25%, while Japan committed to funding long-term infrastructure projects selected jointly by both governments.

The initial $36 billion package will be directed into three cornerstone projects spanning energy generation, export infrastructure, and semiconductor-related manufacturing.

The largest component is a $33 billion natural gas power project in Ohio, designed to produce roughly 9.2 gigawatts of electricity, enough to supply millions of homes and support the rapidly expanding network of artificial intelligence data centers across the country.

Policymakers see the plant as a key step in addressing the growing electricity demand created by AI computing and cloud infrastructure.

A second project involves a $2.1 billion crude export terminal in Texas, expected to significantly increase U.S. oil export capacity and strengthen energy trade links between the two nations.

A third investment, valued at $600 million, will fund a synthetic diamond manufacturing facility in Georgia, aimed at producing industrial materials used in semiconductor cooling and advanced electronics manufacturing.

Taken together, the projects reflect a strategic focus on energy security, technology supply chains, and export capacity, areas increasingly viewed as critical to economic competitiveness and national security.

The agreement represents a departure from traditional trade deals centered primarily on tariffs and quotas. Instead, analysts describe the arrangement as a form of investment-led trade diplomacy, where capital commitments are exchanged for improved market access and long-term economic cooperation.

In this case, Japan’s capital commitments help secure lower tariffs for its export-driven industries while also strengthening its long-term access to U.S. energy supplies and technology partnerships.

For the United States, the arrangement channels foreign capital into large domestic infrastructure projects without requiring equivalent levels of federal spending.

Most of the broader $550 billion commitment is expected to be financed through loans, loan guarantees, and investment vehicles backed by the Japan Bank for International Cooperation, rather than direct government cash transfers.

This financing approach spreads the investment over multiple years while keeping fiscal costs manageable for both governments.

A distinctive feature of the pact is its profit-sharing mechanism, which allocates project earnings between the two countries over time.

Profits are expected to be split evenly until Japan recovers its principal investment and agreed returns. After that point, a larger share of future profits will flow to U.S. stakeholders, reflecting the host-country ownership of the infrastructure assets.

Such structures are increasingly common in cross-border infrastructure partnerships, particularly where strategic sectors such as energy, logistics, and advanced manufacturing are involved.

Economists note that these arrangements are less about short-term financial returns and more about long-term economic integration and supply chain stability.

The launch of the investment tranche comes at a time when major economies are rethinking globalization in response to geopolitical tensions and supply chain disruptions.

Governments are increasingly prioritizing “friend-shoring,” directing trade and investment toward allied nations to reduce reliance on less stable regions.

For Japan, whose economy remains heavily dependent on exports, securing stable access to the U.S. market remains a critical policy objective.

For the United States, the agreement provides an influx of foreign capital into infrastructure and industrial sectors without adding significantly to federal debt.

Industry analysts suggest the partnership could serve as a template for future bilateral agreements, particularly as countries compete to attract investment into energy transition projects, semiconductor manufacturing, and advanced technology infrastructure.

While the initial $36 billion investment represents only a small portion of the overall commitment, it signals the operational start of one of the largest economic cooperation frameworks announced in recent years.

As additional projects are rolled out over the coming years, the agreement is expected to deepen financial, industrial, and trade ties between the two economies, potentially reshaping how international trade partnerships are structured in the decades ahead.

Source: Government fact sheets, international media reports including Bloomberg, Reuters, Nikkei, and official policy announcements released February 2026.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles