Life360 (ASX: 360) has delivered the kind of update growth investors love to see: the user base is rising, more of those users are converting into paying subscribers, and management now expects the year just ended to come in ahead of its own guidance.

In an ASX release today, the family safety and location app maker said Q4 2025 monthly active users climbed to 95.8 million, marking the strongest fourth quarter user growth in its history. Paying Circles, Life360’s core subscription metric, hit 2.8 million in the quarter, while full year 2025 net additions reached 576,000, also a record.

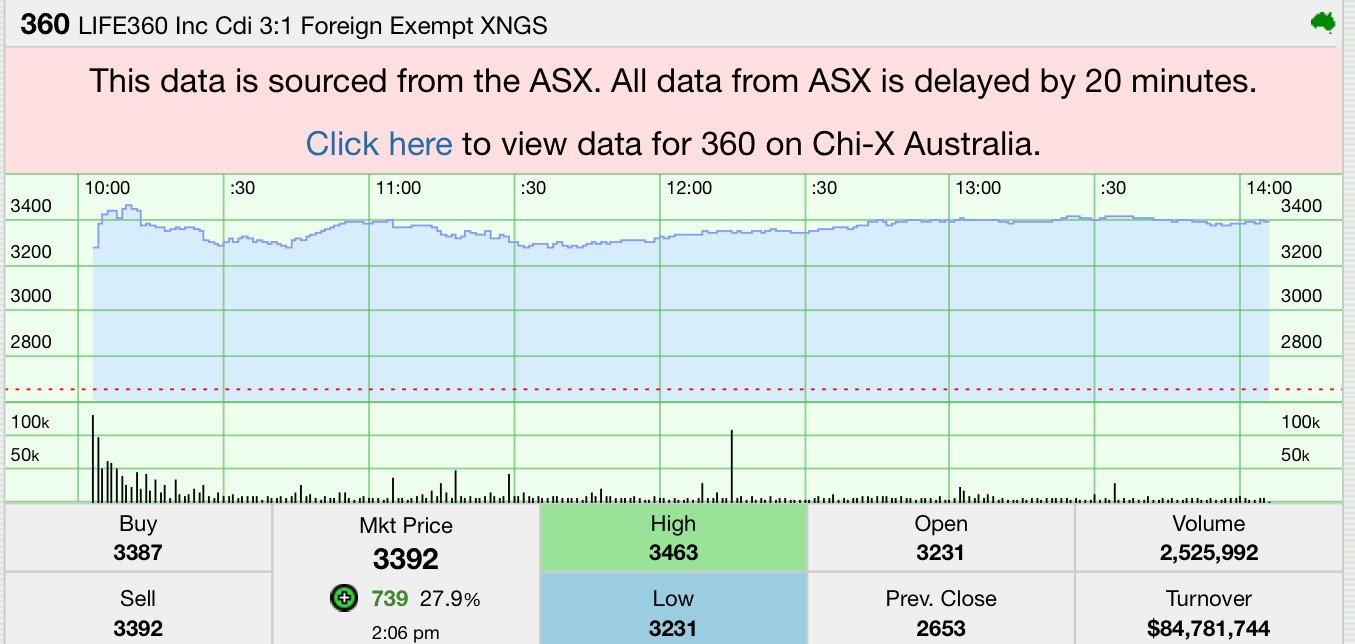

Life360 shares on the ASX traded sharply higher, up 27.25% to $33.76 by 1:58pm AEDT, with 2.49 million shares changing hands (price data provided). That jump fits the tone of the update: momentum appears to be widening rather than fading.

Source: Stocknessmonster

Life360’s growth engine is running on two tracks: adding users, then converting a portion into paying households.

On users, the company split the quarter cleanly between its home market and the rest of the world:

That second line matters. It suggests Life360 is not relying solely on the US for growth, and it hints that the product’s “family safety” pitch is traveling well across markets, even as consumer apps fight for attention and subscription fatigue becomes a real thing.

On paying users, the company reported:

Subscription growth is not just holding up, it is accelerating in key places. The international Paying Circles growth rate is particularly notable because it implies monetisation is improving outside the US, where pricing, payment behaviour, and local competition can be tougher.

Management’s language was upbeat but specific, focusing on conversion and consistency rather than hype.

Life360 CEO Lauren Antonoff said:

“Life360 continues to deliver strong, consistent growth across both our user base and paid subscriber base. Q4 2025 represents our strongest operational performance in company history, with record user additions and record subscriber growth. The quality of our growth continues to improve, with newly acquired users converting to paid subscribers at record rates. While we typically see variation quarter-to-quarter, our Q4 2025 and full year 2025 results demonstrate that our growth trends remain intact and consistent, a reflection of the value families place on staying connected and safe. As we look to 2026, we expect overall MAU growth of approximately 20%. As previously indicated, we plan to invest in strategic growth initiatives, while continuing on the path to expand AEBITDA margins.”

There are two phrases worth circling.

First: “converting to paid subscribers at record rates.” Life360 is effectively saying the users it is acquiring now are better matched to the subscription product, whether because marketing is sharper, onboarding is smoother, or the bundle of features is getting clearer.

Second: “invest… while continuing… to expand AEBITDA margins.” That is the balancing act growth investors want to hear about: still spending to grow, but with a plan to keep improving profitability at the same time.

Life360’s preliminary unaudited numbers point to a stronger finish to 2025 than it previously guided.

The company now expects:

Those are meaningful margins for a consumer subscription business that is still scaling internationally. It also provides a counterpoint to the common bear case on app-based companies: that growth can be bought, but profitability is harder. Life360 is arguing it can do both, at least at this stage of its curve.

A stock does not jump more than 25% on a quiet “we did fine” update. This move looks tied to three things in the release.

Life360 said it will provide comprehensive 2025 results and detailed 2026 guidance on March 2, 2026 (PT) / March 3, 2026 (AEDT), including an investor conference call with the CEO and CFO.

Between now and then, there are a few natural questions the market will likely press:

Based on the trading data provided:

Life360’s update reads like a company that is still in expansion mode, but increasingly focused on turning scale into a more predictable earnings profile. The headline numbers are strong, but the more important message is underneath them: user growth is broad-based, subscription growth is compounding, and profitability is moving in the right direction, even as the company keeps spending to build.

That combination is not common, which is why the market moved first and asked questions later.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles