Shares of Magnetic Resources NL (ASX: MAU) surged sharply on Monday after the company confirmed it had entered into a binding scheme implementation agreement with Genesis Minerals, paving the way for a potential A$639 million acquisition.

Source: StocknessMonster

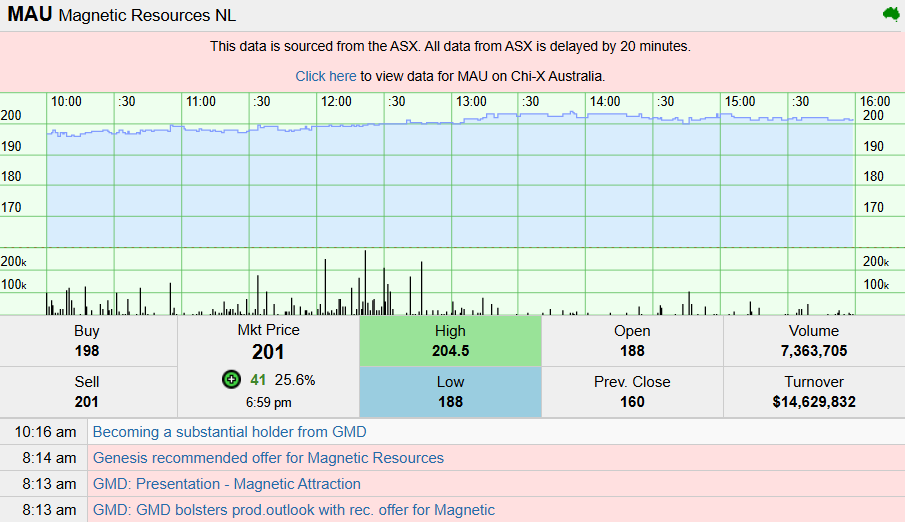

At the time of writing this article, MAU shares were up by 25.6%, trading at A $2.01

The proposed transaction offers Magnetic shareholders A$1.40 in cash plus 0.0873 Genesis shares for each Magnetic share, implying a value of approximately A$2.00 per share, a premium of about 25% to the recent closing price and roughly 35% above the one-month average trading level.

The market reacted swiftly, pushing MAU shares higher during trading as investors priced in the takeover premium and the strategic significance of the deal.

At the heart of the proposed acquisition is Magnetic’s flagship Lady Julie Gold Project in Western Australia’s Laverton region, which hosts a mineral resource of roughly 2.2 million ounces grading around 1.8g/t gold.

The project sits close to Genesis’ existing Laverton processing infrastructure, creating potential cost savings and operational efficiencies if the integration proceeds. By combining assets, Genesis aims to expand its regional footprint and strengthen long-term production growth, while Magnetic shareholders gain exposure to a larger producing gold company.

Genesis Executive Chair Raleigh Finlayson described the deal as a value-creating combination, stating:

“This transaction creates substantial value for both groups of shareholders, delivering genuine synergies while combining the right assets with the right people.”

Magnetic Managing Director George Sakalidis also highlighted the strategic logic of the offer, noting that collaboration with an experienced operator could accelerate development of the company’s discoveries and unlock value for shareholders.

Source: MAU ASX Announcement

If approved, Magnetic shareholders will receive a mix of cash and shares, allowing them to either realise immediate value or maintain exposure to the long-term development potential of the Lady Julie project through Genesis equity ownership.

The scheme remains subject to shareholder, regulatory and court approvals, with completion targeted around mid-2026.

The transaction reflects a continuing consolidation trend in the Australian gold sector, where producers are increasingly seeking nearby development projects that can feed existing processing plants and extend mine life without the need for costly new infrastructure.

For Magnetic Resources, the announcement marks a major turning point, transforming the company from a standalone developer into a potential strategic asset within a larger gold production platform.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles