Australia’s lithium heavyweight PLS Group Ltd (ASX: PLS) has taken another strategic step in reinforcing its global supply chain position, announcing a multi-year offtake agreement with battery materials producer Canmax Technologies. The deal, which includes a US$100 million interest-free prepayment and a pricing structure designed to protect against market volatility, signals continued long-term confidence in lithium demand despite cyclical price swings.

Under the agreement, PLS will supply 150,000 tonnes per annum of spodumene concentrate for an initial two-year period beginning in calendar year 2026, with the option to extend the contract for an additional year. The supply will come from the company’s flagship Pilgangoora Operation in Western Australia, widely recognised as one of the world’s largest independent hard-rock lithium assets.

The structure of the contract stands out in the current lithium market environment. A price floor of US$1,000 per tonne provides downside protection against potential market softness, while the pricing mechanism remains linked to prevailing market prices, ensuring PLS retains full upside exposure if lithium prices strengthen.

Perhaps the most immediate impact of the agreement lies in the US$100 million unsecured, interest-free prepayment, which will be repaid through product deliveries. The financing component not only boosts near-term liquidity but also reflects growing commercial confidence among battery supply chain partners in the long-term demand outlook for lithium.

PLS Managing Director and CEO Dale Henderson described the arrangement as a vote of confidence in the company’s operational scale and product quality. He said:

“This agreement builds on our established relationship with Canmax and reflects both the quality and consistency of Pilgangoora’s spodumene and PLS’ proven capability as a reliable, large-scale operator. The US$100M interest-free prepayment and floor price structure demonstrate strong commercial confidence in our product and performance, while preserving full exposure to price upside.”

Henderson added that the agreement strengthens the company’s liquidity position while maintaining operational flexibility, allowing the company to respond to changing market conditions without over-committing production volumes.

The timing of the deal is particularly notable. Lithium markets experienced volatility over the past two years as supply expansions temporarily outpaced electric-vehicle demand growth. However, analysts increasingly expect the sector to move toward balance again as EV adoption accelerates and battery manufacturing capacity continues to expand globally.

By locking in supply agreements that combine financial support and flexible pricing structures, PLS is positioning itself to navigate the commodity cycle more smoothly than many smaller producers. The price floor mechanism offers stability during downturns while ensuring that the company remains fully leveraged to any upside rally driven by tightening supply.

Industry observers often describe such agreements as “cycle-resilient contracts,” designed to protect producers’ margins during weaker pricing periods while strengthening long-term customer relationships.

The contract will be fulfilled using production from the Pilgangoora Operation, which remains the cornerstone of PLS’s global lithium strategy. With both the Pilgan and Ngungaju processing plants operating within the broader project, the company retains flexibility to allocate production depending on operational efficiency and market demand.

PLS also noted that sufficient uncontracted capacity exists at the Pilgan plant to meet the Canmax supply commitments, meaning the agreement does not constrain existing customer relationships or production planning.

Beyond Australia, the company continues to expand its footprint across the battery materials value chain, including partnerships in South Korea and Brazil, reinforcing its ambition to remain a major global lithium supplier throughout the energy transition.

The agreement also reflects a broader shift taking place across the global lithium ecosystem. Battery manufacturers and material processors are increasingly securing long-term supply deals directly with mining companies to reduce exposure to raw material shortages and price spikes. Such arrangements are becoming essential as electric-vehicle adoption accelerates worldwide and supply chains tighten.

For Canmax, one of the world’s key producers of lithium-ion battery materials, the deal ensures stable access to high-quality spodumene concentrate. For PLS, the arrangement diversifies its customer base and strengthens long-term revenue visibility, particularly important during periods of price volatility.

CEO Henderson emphasised this strategic dimension, noting that the agreement “deepens our partnership with Canmax, further diversifies our customer base and reinforces PLS’ position as a leading, reliable supplier at scale to the lithium materials market.”

Source: Company ASX announcement

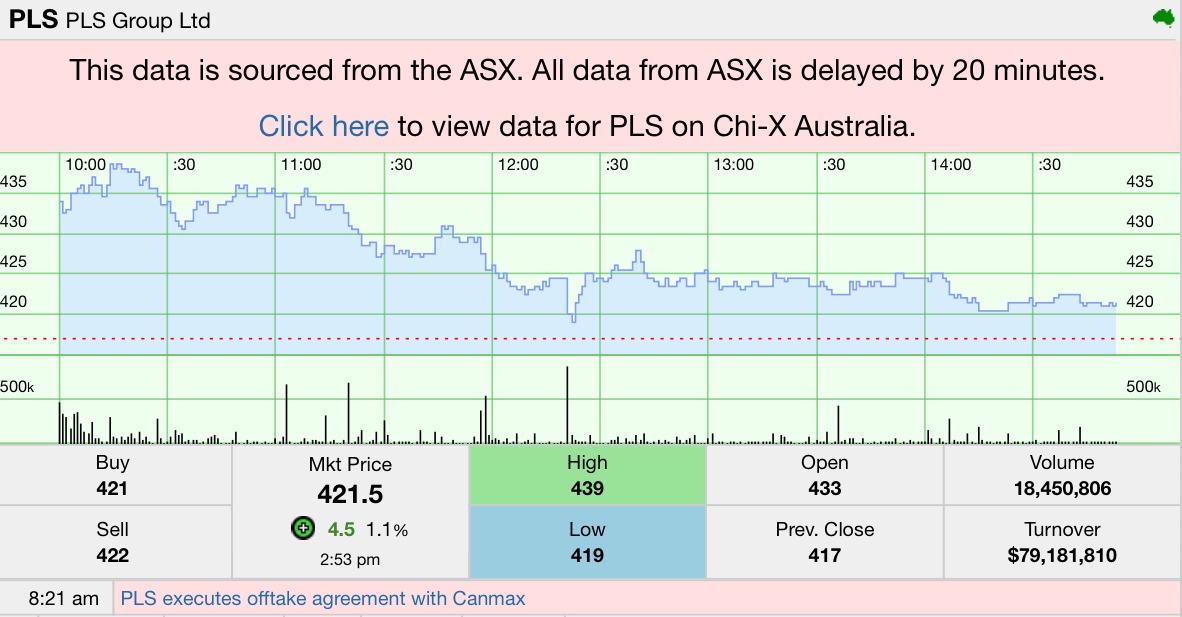

PLS shares were trading around A$4.21 on February 10, 2026, with the company maintaining a market capitalisation exceeding A$13 billion. Over the past year, the stock has delivered strong performance, reflecting improved lithium price sentiment and continued production growth from its core operations.

While short-term lithium price volatility remains a factor for the sector, the growing use of prepayment-linked offtake agreements across the industry indicates that major battery supply chain participants continue to position for long-term demand expansion.

Source: StocknessMonster

Looking ahead, the Canmax agreement provides PLS with a combination of financial strength, pricing protection, and operational flexibility. In a sector known for commodity-cycle swings, such structures can provide stability while preserving exposure to growth opportunities.

As global electrification accelerates and battery manufacturing capacity expands, producers capable of combining scale, long-term partnerships, and disciplined contracting strategies are likely to remain among the strongest performers in the lithium industry.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles