Red Mountain Mining’s latest antimony update landed with enough force to move the tape. The stock was quoted at $0.03, up 15.39%, at 2:20pm AEDT, with volume at 18,448,364 shares. The company’s one-year return sits at 233.33%, underscoring how quickly “critical minerals” narratives can re-rate small explorers when results cooperate.

The announcement centres on new rock-chip geochemistry from Oaky Creek, part of RMX’s 100%-owned Armidale antimony-gold project in the Southern New England Orogen of northeast New South Wales.

The standout numbers came from grab samples taken across the southern half of a 1.2km-long soil anomaly at Oaky Creek North:

RMX adds an important contextual datapoint: 11 of 13 samples collected from the Oaky Creek North soil anomaly returned above 1.9% Sb. For early-stage exploration, that kind of hit-rate is typically read as “not a one-off rock,” but a sign the system may be repeatable along trend, at least at surface.

The company also noted a pathfinder association: many samples carried anomalous arsenic and detectable gold, including two samples above 0.1 g/t Au (100 ppb). RMX argues this Sb-As-Au association is consistent with its target model: an orogenic vein-style antimony-gold system.

Source: RMX ASX Announcement

High-percentage antimony results from rock chips are not the same thing as a resource. They are selective samples, often chosen because they look mineralised. RMX is explicit that rock-chip sampling is exploration in nature and not for resource determination.

But rock chips can still be very useful for one reason: they help confirm the system is real and guide where to spend the next exploration dollar.

In RMX’s case, the company is using these results to support two bigger claims:

In plain English: RMX is trying to move from “this looks exciting on surface” to “here are the specific targets we can test with a drill rig.”

RMX repeatedly references Larvotto Resources’ Hillgrove project as an analogue, describing Hillgrove as Australia’s largest antimony deposit, located east of the Armidale project. RMX also notes Hillgrove as the 8th largest antimony deposit globally.

The key idea behind the analogue is straightforward: if the geological setting and mineralisation style line up, it can strengthen the case that the right “ingredients” exist. But it is still an analogue, not proof.

What RMX is concretely doing is targeting:

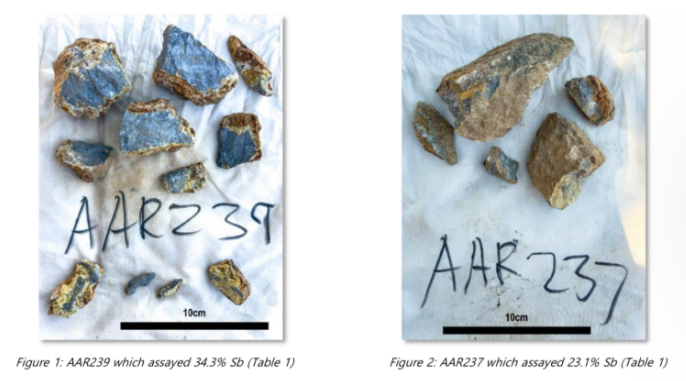

The stibnite focus matters because stibnite is the primary ore mineral for antimony. RMX even includes imagery in the release showing oxidised massive stibnite float for the top sample.

The company’s forward plan is unusually specific for an early-stage sampling update:

Auger assays are pending

RMX says assay results for the December 2025 auger program at Oaky Creek North and South are expected this month (January 2026), with additional field work planned to complete the auger program.

The December rock chips were collected during the first phase of a 50m x 20m spaced hand auger soil program designed to tighten the previous grid and “better constrain” targets.

RMX anticipates the auger program (including results) will be completed before the end of Q1 2026, and that it will define multiple targets for drill testing during H1 2026.

RMX plans a high-resolution airborne magnetic-radiometric survey this quarter to improve structural mapping and define additional antimony and gold targets across the wider tenement.

One reason antimony has been moving up the priority list globally is that it is used in flame retardants, alloys, and certain defence and industrial applications, and supply chains can be concentrated. RMX leans into that thematic tailwind by pointing to government policy: it says the Australian Government has prioritised antimony in its A$1.2 billion Critical Minerals Strategic Reserve and Strategy, framing it as “policy validation” for RMX’s antimony projects.

For readers new to the space, the practical takeaway is this: policy does not create deposits, but it can influence the availability of funding, strategic interest, and downstream partnerships, especially if a project shows credible scale.

This is a strong surface geochemistry update, and the market reaction suggests it was taken seriously. Still, the key uncertainties remain the usual ones for explorers:

RMX’s stated path is sensible: tighten the geochemical picture, overlay better geophysics, and then drill the highest-confidence targets.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles