Sunshine Metals (ASX: SHN) has delivered substantial exploration updates, reporting a fresh set of high-grade gold and silver results from its Liontown project in North Queensland. The latest drilling outcomes, released to the ASX on Wednesday, reinforce Liontown’s reputation as a shallow, high-grade system and arrive just weeks before the company is due to complete its initial Mining Study.

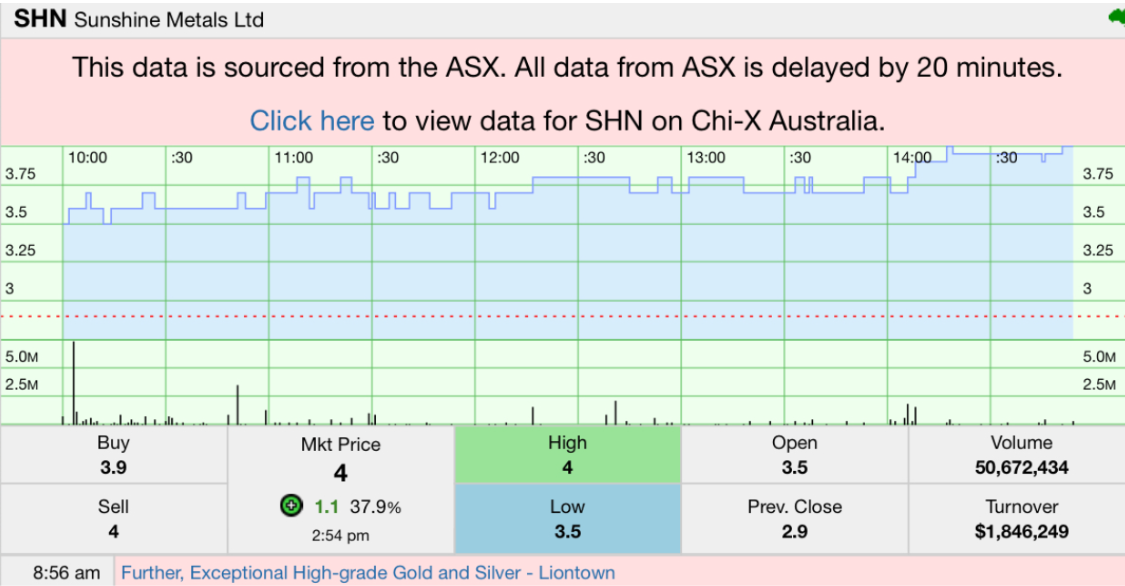

The announcement triggered strong interest across the market, with Sunshine Metals shares rising more than 36 percent by mid-afternoon, reflecting both the scale of the grades reported and the growing sense that Liontown may be shaping up as a near-term development opportunity rather than a long-dated exploration story.

The new results come from Sunshine’s ongoing grade control drilling program at Liontown, part of its broader Ravenswood Consolidated Project near Charters Towers. Grade control drilling is typically carried out at close spacing and near surface to better understand the consistency and quality of mineralisation before mine planning.

Among the standout intercepts reported were:

To put that into perspective, open-pit gold mines can often be economically viable at grades below 1 gram per tonne. Sunshine’s results are not only well above that threshold, they are also shallow, which typically translates into lower mining costs.

The company noted that silver grades were also unusually strong, with several intersections reporting silver values in the hundreds, and in some cases thousands, of grams per tonne. In one instance, silver values exceeded laboratory measurement limits, underscoring the intensity of mineralisation encountered.

Sunshine Metals Managing Director Dr Damien Keys did not underplay the importance of the results.

“You do not see results like this every day,” Dr Keys said. “Our grade control drilling is often outperforming the underlying resource model in terms of thickness and grade.”

He added that the company is seeing particularly strong gold equivalent grades where two mineralised structures intersect, an area that was historically mined around but never fully exploited.

“These results occur near the intersection of two projected mineralised horizons,” Dr Keys said. “While the two mineralised positions were mined historically, the intersection itself is unmined and will be a zone of significant resource upside in future models.”

For readers less familiar with mining geology, intersections of mineralised structures are often prized because they can act as conduits for metal-rich fluids, resulting in higher grades and thicker zones of ore.

One of the most important aspects of Sunshine’s update is how close to the surface much of the mineralisation sits. Several of the strongest gold and silver hits begin within the top 20 metres of rock.

From a development standpoint, shallow mineralisation is generally cheaper to extract and can be mined earlier in a project’s life, improving project economics. Sunshine believes these latest results will have a meaningful impact on the Liontown Mining Study, which is scheduled for completion in February.

The current Mining Study is assessing an initial resource of 108,000 ounces of gold at an average grade of 4.37 grams per tonne, alongside 803,000 ounces of silver. Sunshine has already flagged that both the study and the underlying resource model will be updated again in March, once all drilling results from the current program are incorporated.

Liontown is not a greenfields discovery. The area was historically mined as the Carrington Gold Mine in the early 1900s, producing around 28,000 ounces of gold at very high grades. What has changed is the application of modern exploration techniques, tighter drilling, and a clearer understanding of the broader mineral system.

The company’s Mining Study is focusing on gold-dominant zones that make up roughly 13 percent of the total Liontown resource tonnes. Importantly, previous metallurgical test work has shown strong gold recoveries, with more than 90 percent of gold recovered using standard processing methods.

For a broader audience, metallurgy results like these suggest the gold can be extracted efficiently using established technology, reducing technical risk.

The market responded swiftly to the announcement. Sunshine Metals shares last traded at 4.0 cents, up 36.2 percent on the day, with more than 49 million shares changing hands. Over the past year, the stock has risen more than 400 percent, reflecting renewed interest in high-grade Australian gold stories amid elevated bullion prices.

At current levels, Sunshine Metals has a market capitalisation of approximately $102 million, positioning it firmly in the small-cap mining space but with increasing visibility following a string of strong exploration updates.

Sunshine has outlined a busy schedule over the coming months. Key milestones include:

Dr Keys said the company is looking forward to updating the market as these milestones are delivered.

“Being shallow and high-grade, these results will have a strong impact on the initial Mining Study when it is subsequently updated,” he said. “We look forward to presenting the study and further drill results in coming weeks as 2026 shapes as a huge year for Sunshine.”

Sunshine’s update comes at a time when gold prices remain elevated and interest in high-grade, near-surface deposits is strong. While the company remains in the study and drilling phase, the consistency of results at Liontown is gradually shifting the conversation from exploration potential to development optionality.

As always in mining, much will depend on execution, final study outcomes, and broader market conditions. For now, Sunshine Metals has delivered tangible, data-backed progress that gives the market plenty to assess as it heads into the next phase of its Liontown story.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles