If you follow small-cap gold mining companies, today’s Sunshine Metals (ASX: SHN) update is the kind that makes people sit up. The company’s first results from a 14-hole diamond program at Francis Creek (part of the Sybil project in Queensland’s Ravenswood district) have delivered a record high-grade hit—and it’s shallow. For a project that hasn’t seen this style of drilling in ~20 years, that’s a notable development.

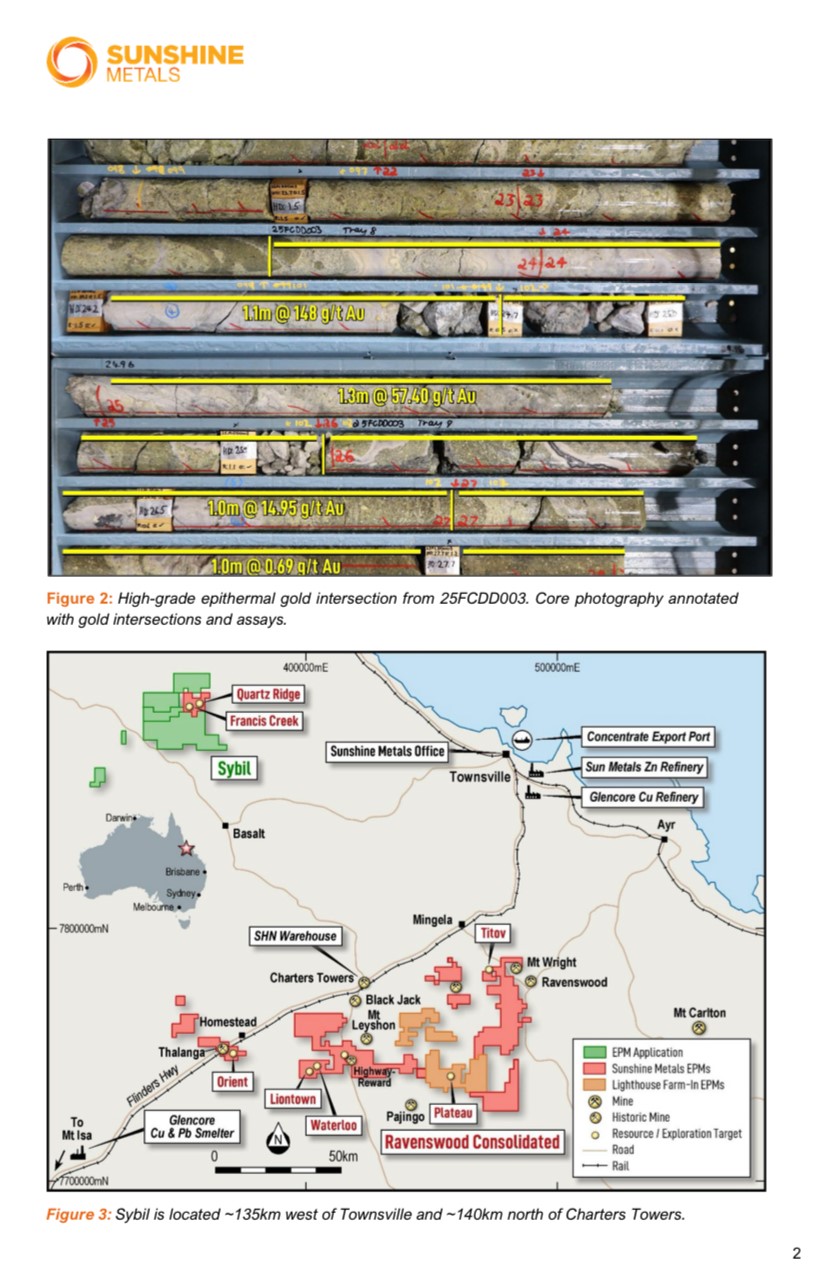

Let’s start with the headline: 4.40m @ 57.51 g/t gold from 23.6m, including 1.10m @ 148.0 g/t gold in hole 25FCDD003.

That’s not just good; it’s the highest-grade interval ever drilled at Sybil. Assays also include 3.80m @ 6.12 g/t from 22.6m (25FCDD002), 6.00m @ 2.38 g/t from 58.6m (25FCDD006), 1.42m @ 5.57 g/t from 33.0m (25FCDD005) and 0.50m @ 19.90 g/t from 14.5m (25FCDD001).

Six holes are in, seven more are drilled and/or at the lab, and the final hole of the program is currently underway. Full assay suite is expected in early November.

Source: SHN ASX Announcement

Source: SHN ASX Announcement

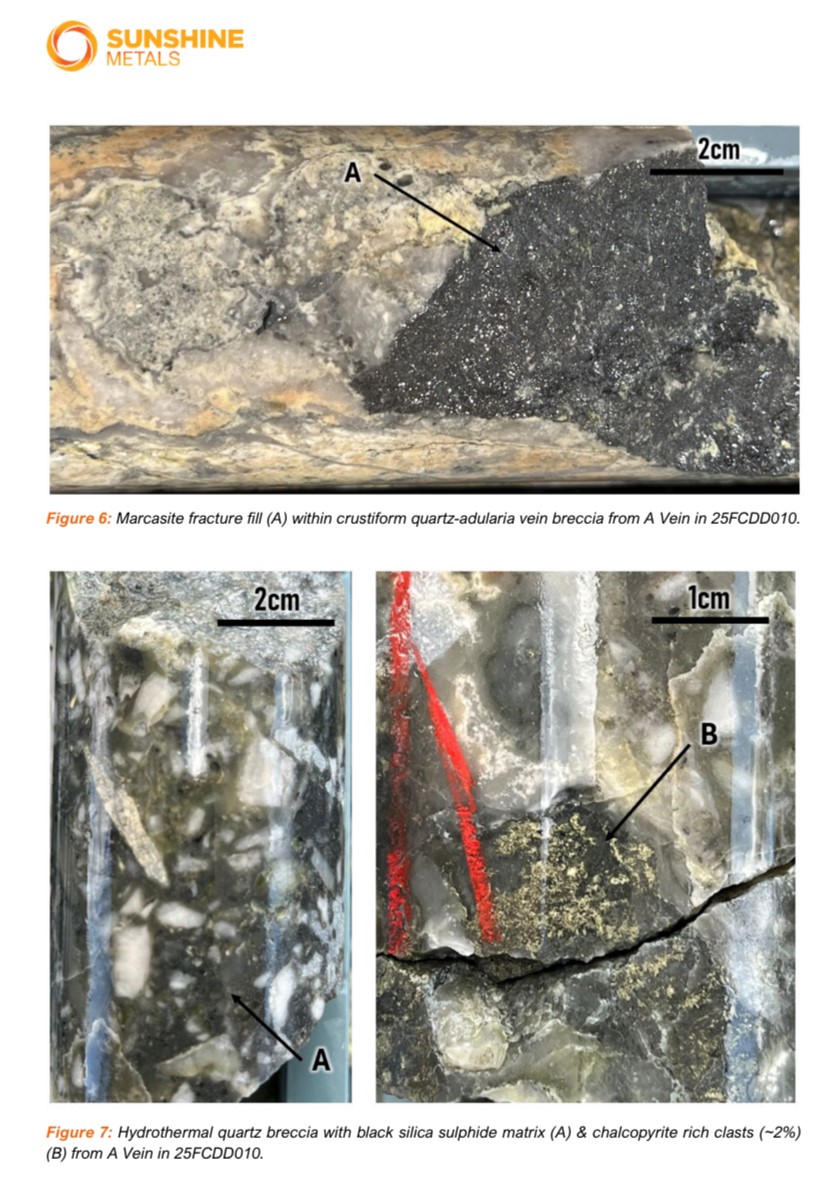

A few structural details help frame why the team is excited. The program has repeatedly hit the A Vein (the main host of high grades), a newly interpreted Splay Vein between A and Main, and the Main Vein itself in several holes. The vein textures—think colloform/crustiform banding, adularia needles, ginguro-style sulphide bands—are textbook boiling-zone indicators in low-sulphidation epithermal systems. In this style of deposit, being in the boiling zone is often where gold grades peak.

Sybil is ~135 km west of Townsville and ~140 km north of Charters Towers. It’s part of Sunshine’s broader Ravenswood Consolidated Project, a district that has punched well above its weight historically in both gold and VMS (zinc-copper-lead-silver-gold) systems.

Sunshine’s case is simple: Sybil shows multiple epithermal veins at shallow depth, underexplored for decades, and geologically analogous to Pajingo—a ~4 Moz low-sulphidation epithermal system that helped put the region on the map. Today’s textures and grades strengthen that comparison.

“We are thrilled to have drilled the best ever Sybil intersection at the start of our first drill program. The drilling has been turning out some incredible vein textures, mineral associations and has provided invaluable structural orientation information. The similarities to the 4Moz Au Pajingo epithermal system are becoming more striking. We look forward to reporting on the remaining results in early November 2025.” — Dr Damien Keys, Managing Director.

1) Shallow, high-grade = optionality. Intersections at ~20–30m depth are inherently easier (and cheaper) to drill and, if continuity emerges, simpler to scope for near-surface development concepts. Sunshine’s past work at Liontown (a separate but nearby VMS/gold system) shows the company is already comfortable thinking about study pathways in this district. Today’s Sybil results add a pure gold lever to that regional story.

2) Vein predictability and new structures. Sunshine says the A Vein is proving “quite predictable,” and the Splay Vein has been “routinely intersected.” That’s key for targeting. Epithermal systems can be nuggety, but structural predictability—plus consistent textures—gives geologists a map to chase. The Main Vein has been hit in five holes this round, and the final hole (25FCDD014) is testing beneath a shallow 4m @ 11.6 g/t historic intercept (FCP30). It’s an intelligent way to vector deeper where grades may thicken or coalesce.

3) “Boiling zone” confirmation. The photographed core (adularia, moss textures, black silica/sulphide bands, marcasite) is classic for the precious-metal window of an epithermal system. In plain English: they’re drilling in the right part of the system for gold. The open question is continuity—do these shoots knit together along strike and down dip into mineable widths? That’s what the remaining assays and follow-up program will test.

4) Pajingo analogy—useful, not a promise. Sunshine is careful to frame Pajingo as an analogue based on age, host rocks, structure, textures and regional setting. Analogies are guides, not guarantees, but when your core looks the part and your first assays pop, the comparison becomes more than marketing. The next step is building a coherent lode model that can be drilled to resource standards.

By 12:21pm AEDT, SHN traded at A$0.023 (+15%) on 15.51m shares. The 52-week range sits at A$0.005–0.024, and the company clocks a ~A$57.4m market cap with 2.50bn shares on issue. For a micro-cap, that’s a lot of leverage to drill data—moves can be sharp in both directions as assays land.

Newer investors: this is normal for early-stage gold explorers. Position sizing and patience matter as the geological picture evolves. (Company snapshot.)

Sunshine is upfront that downhole widths are reported (true widths not yet known) and that visual/texture logging, while encouraging, isn’t a substitute for assays. Epithermal veins can be variable over short distances; linking shoots into continuous, mineable lodes takes time and tight drill spacing. The prize is real—shallow, high-grade epithermal gold in a tier-one mining district—but so is the work required to prove it.

Sunshine Metals just put Sybil back on the exploration map. A record-grade, shallow hit with classic epithermal textures, plus a predictable vein architecture and new structural targets, is exactly the kind of start investors hope for in a first-pass diamond program.

The early November assay batch is now the key near-term catalyst. If more holes echo today’s theme—high grade, shallow depth, repeatable structures—the conversation quickly shifts from discovery signs to resource path.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles