Silver has quietly become one of the strongest-performing commodities of 2025. While gold grabbed headlines, silver has done the heavy lifting, supported by a rare combination of industrial demand, investment interest, and constrained supply. As the market looks ahead to 2026, attention is increasingly turning to ASX-listed silver miners and developers that stand to benefit if the price momentum holds.

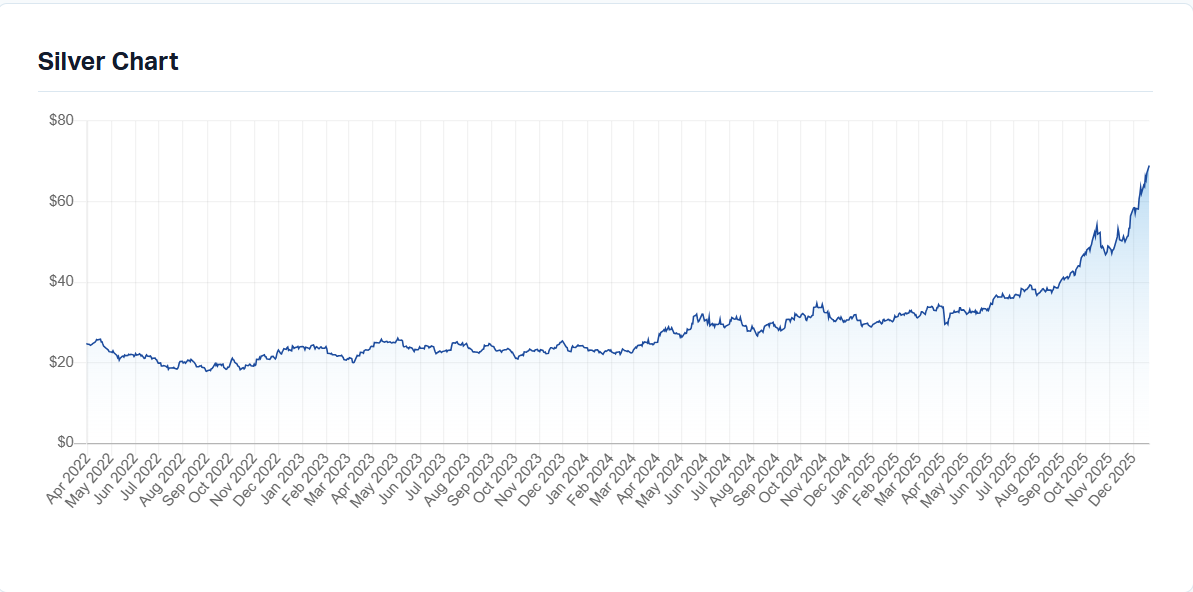

According to Market Index, silver was trading near US$69 per ounce on 22 December 2025, up more than 130 percent over the past year, marking one of the strongest rallies in decades. Analysts argue this is not simply a speculative spike, but the result of deeper structural forces reshaping the silver market.

Silver Price Chart | Source: MarketIndex

At a macro level, silver is benefiting from many of the same drivers as gold. These include geopolitical uncertainty, elevated government debt levels, and expectations that interest rates will remain structurally lower in real terms.

However, silver has an additional advantage. Unlike gold, more than half of silver demand comes from industrial uses.

The Silver Institute, in its 2025 World Silver Survey, forecasts that industrial demand will remain near record levels, driven largely by solar panel manufacturing, electric vehicles, electronics, and data infrastructure. The Institute also expects the global silver market to remain in a structural deficit for the fifth consecutive year.

Citi analysts noted in a September 2025 commodities outlook that silver’s smaller market size makes it “far more sensitive to incremental investment flows than gold,” adding that even modest shifts in investor allocation can have an outsized impact on price.

UBS echoed that view in its December 2025 precious metals update, stating that silver is increasingly being treated as a “higher-beta hedge against macro instability,” particularly when gold prices remain elevated.

At the micro level, supply remains constrained. Global mine production has struggled to grow meaningfully, partly because most silver is produced as a by-product of lead, zinc, copper, and gold mining. This limits the industry’s ability to respond quickly to higher prices.

Market cap: ~AU$400 million

Silver Mines caught the market’s attention on Monday, December 22, with its shares jumping 15 percent to $0.23 on heavy volume of more than 46 million shares, well above recent trading averages. The move followed a fresh ASX exploration update and came as silver prices continued to trade near multi year highs.

The company’s latest update focused on early stage drilling and geological review work at its Tuena Project in New South Wales, which Silver Mines acquired to complement its flagship Bowdens asset. While the results did not hinge on a single standout intercept, they reinforced the broader scale and continuity of mineralisation across the project area.

Managing Director Jo Battershill said the early work is confirming the company’s technical thesis.

“The Tuena Project has only been in the Silver Mines portfolio for a short time, but our technical team identified the area as having enormous potential for mineral discovery, and this has been validated by the recent prospectivity review,” Battershill said.

He added that the results justify further exploration, particularly given the strength of precious metal prices.

“When we look at what substantial drilling programs have uncovered in other historical mining centres across New South Wales, we believe additional exploration across Tuena is well warranted,” he said.

Silver Mines has re-emerged as one of the most closely watched domestic silver plays, helped by a 194 percent share price gain over the past year and renewed optimism around silver prices.

The company’s flagship Bowdens Silver Project, east of Mudgee in New South Wales, remains the largest undeveloped silver resource in Australia. As of December 2024, Bowdens hosts proven and probable reserves of 71.7 million ounces of silver, with total resources rising to 180 million ounces of silver and 426,000 ounces of gold.

While the project hit a regulatory setback in 2024, Silver Mines has since re-engaged with state authorities and provided all requested information for the redetermination of approvals. Recent drilling has continued to demonstrate grade and scale, including 116 metres at 245 g/t silver, reinforcing the project’s long-term viability.

SVL 1-YEAR PRICE CHART | Sorce: MarketIndex

Market cap: ~AU$375 million

Unico Silver shares surged today by 14.56% trading at A $0.905, showing hightened investor interest on Silver stocks.

Unico Silver has rapidly built scale in Argentina’s Santa Cruz province, consolidating the Cerro Leon, Joaquin, and Pingüino projects into a district-scale portfolio.

In September 2025, the company released an updated resource estimate showing 162 million silver equivalent ounces, including high-grade silver-gold mineralisation.

Drilling results reported throughout 2025 delivered multiple high-grade intercepts, including 437 g/t silver over 42.4 metres at La Morocha.

Canaccord Genuity initiated coverage in late 2025 with a speculative buy rating, citing Unico’s “rare combination of grade, scale, and exploration upside.”

USL 1-YEAR PRICE CHART | Sorce: MarketIndex

Market cap: ~AU$350 million

Along with USL and SVL, Andean Silver surged by 14.48% taking it to $ A2.53.

Andean Silver is advancing the Cerro Bayo silver-gold project in southern Chile, a past-producing operation with existing infrastructure.

An updated resource released in April 2025 lifted contained silver equivalent ounces to 111 million, with further drilling in late 2025 extending mineralisation beyond the current resource envelope.

In its October quarterly report, the company said its near-term focus is on infill and extensional drilling close to the processing plant to support a potential restart scenario.

Analysts at Bell Potter have described Cerro Bayo as a “capital-efficient restart opportunity,” noting the advantage of historical production and infrastructure.

ASL 1-YEAR PRICE CHART | Sorce: MarketIndex

Market cap: ~AU$230 million

Another example of surge in Silver stocks as Sun Silver rockets to $ A1.75, surging by 15.25%

Sun Silver is developing the Maverick Springs project in Nevada, one of the largest undeveloped silver resources in the United States.

In December 2025, the company announced a major resource upgrade, lifting inferred resources to 539 million silver equivalent ounces at an average grade of 71 g/t silver equivalent.

Managing Director Andrew Dornan said the project’s inclusion in high-level Australia-US strategic discussions highlighted silver’s growing recognition as a critical mineral.

UBS analysts have noted that large-scale, politically stable US-based silver projects could attract increasing strategic interest as supply chains become more security-focused.

SS1 1-YEAR PRICE CHART | Sorce: MarketIndex

Market cap: ~AU$9.4 billion

DPM was up by 3.93%, signaling Investors hedging towards big guns with heightened interest in small-cap miners.

Formerly Dundee Precious Metals, DPM Metals is now the largest silver producer listed on the ASX following its acquisition of Adriatic Metals in 2025.

The deal delivered full ownership of the Vareš project in Bosnia and Herzegovina, which entered commercial production in mid-2025. According to DPM’s Q3 production update, Vareš produced 717,400 ounces of silver in the quarter, with plans to ramp up processing capacity to 850,000 tonnes per annum by the end of 2026.

In its April 2025 reserve update, the Rupice deposit at Vareš reported probable reserves grading 228 grams per tonne silver, an upgrade from previous estimates.

Canaccord Genuity analysts described Vareš as “one of the highest-grade new silver operations globally,” noting that ramp-up execution will be a key value driver into 2026.

DPM 1-YEAR PRICE CHART | Sorce: MarketIndex

Looking ahead, most major banks remain constructive on silver, though they acknowledge volatility risks.

Citi expects silver to continue outperforming gold on a relative basis if industrial demand remains strong and investor interest persists. UBS, meanwhile, argues that silver’s persistent physical deficits make it one of the most asymmetrically positioned metals in the commodities complex.

For ASX investors, the key distinction lies between producers like DPM Metals, which offer immediate leverage to price, and developers and explorers such as Silver Mines, Unico, Andean, and Sun Silver, where value creation depends on execution, permitting, and continued exploration success.

Silver’s 2025 rally has been built on fundamentals, not hype. With deficits expected to persist and industrial demand showing no signs of slowing, analysts believe the metal remains well supported into 2026.

For investors, ASX-listed silver stocks offer a broad spectrum of opportunities, from established producers to high-upside developers. As always, execution and risk management will matter, but silver’s long-term narrative is increasingly difficult to ignore.

We’re heading into 2026 with no shortage of opportunities and stories to unpack. If this article helped along your investing journey, subscribe to our newsletter and stay in the loop.

Have a ripper holiday, stay safe, and we are keen to bring you the best investment research again in 2026.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles