• Trek Metals reports promising soil sampling anomalies at the Lawn Hill Project

• Follow up mapping and sampling to validate new manganese targets

• Stock jumps 35.71 percent to 5.7 cents on strong volume

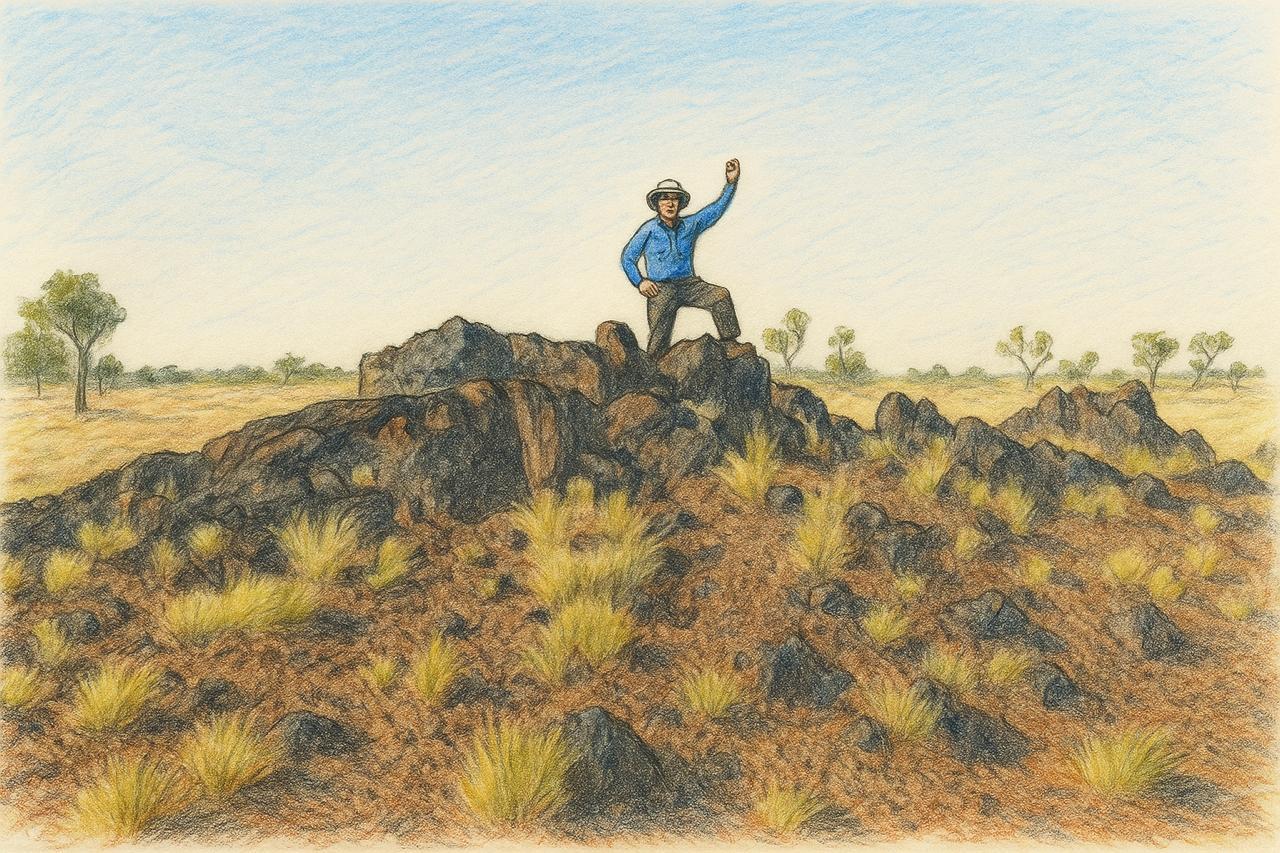

Trek Metals (ASX: TKM) has identified a series of promising manganese anomalies at its Lawn Hill Project in Queensland, marking an important early step in the company’s expanding exploration footprint within a historically mineral rich region. The results come from the latest phase of soil sampling, which outlined multiple geochemical zones aligned with known manganese trends and uncovered new prospective areas that had not been previously mapped.

The anomalies, which occur along structural corridors already associated with surface manganese occurrences, provide Trek with a clearer picture of the project’s mineralised potential. The company now plans to follow up with detailed field mapping and targeted rock chip sampling to verify the scale and significance of these new targets before advancing toward drilling.

Investor interest surged on the update, with Trek’s share price climbing 35.71 percent to 5.7 cents, placing the stock among the strongest performers on the ASX for the day.

The latest update outlines the identification of soil sample anomalies that the company believes could represent near surface manganese mineralisation. The targeted areas lie along geological trends already known to host manganese occurrences within the Lawn Hill region, which has a history of manganese production and prospectivity.

According to Trek, these results justify a program of detailed field assessment, including geological mapping and rock chip sampling, to determine the significance of the anomalies. While soil anomalies are an early stage indicator, they represent a positive step forward in establishing the presence of mineralised structures.

Trek emphasised that previous work at the project confirmed manganese outcrops in multiple areas, and the new anomalies add confidence to the interpretation that the system may be more extensive than initially estimated. The company intends to refine its targeting before committing to drilling.

Trek Metals Chief Executive Officer said the new data validates the company’s systematic approach to exploration at Lawn Hill. He added that the latest results give the team a clear pipeline of targets to follow up and help build the geological understanding of the project area.

He said, “Our soil sampling program has delivered encouraging early results that align with known manganese trends in the region. The anomalies identified give us a strong foundation for our next phase of exploration, and we are looking forward to further mapping and sampling to verify these targets. Lawn Hill continues to show potential and we remain committed to advancing our exploration in a disciplined and methodical way.”

Trek’s latest update arrives at a time when manganese is slowly regaining attention in the critical minerals space. Although lithium has dominated headlines, manganese plays a growing role in modern battery chemistries, particularly in high energy density formulations that aim to reduce reliance on cobalt.

Analysts note that demand for high purity manganese is expected to rise with the continued expansion of electric vehicle charging infrastructure. Several major automakers have publicly flagged manganese enhanced cathodes as part of their long term battery strategy due to their lower cost structure and stable supply chains.

While the manganese market has experienced volatility in recent months due to uneven steel production across Asia, many market observers believe demand for battery grade manganese will underpin long term growth. Companies with early stage exposure such as Trek Metals tend to draw investor interest when sentiment shifts in favour of critical minerals.

The positive share price reaction to Trek’s update also reflects a wider improvement in risk appetite across the Australian resources sector. While global markets remain sensitive to macro data, the ASX materials index has stabilised in recent sessions as investors rotate back into miners linked to energy transition supply chains.

Against this backdrop, junior explorers with meaningful news flow tend to outperform. Trek’s significant intraday rise places it among the best performing micro cap resource stocks of the session. Investors appear encouraged by the alignment between technical progress and a favourable commodities narrative.

The company’s next priority is to complete ground truthing of the anomalies reported in the soil sampling program. This will involve field teams working to determine whether the geochemical signatures correspond with surface expressions of mineralisation.

If confirmed, Trek will refine its drill targeting plan for a potential inaugural drilling campaign at Lawn Hill. The systematic progression from soil sampling to mapping and drilling is consistent with the company’s exploration strategy and allows the team to assess each target on merit.

Given the scale of the Lawn Hill area and the number of geological corridors identified, analysts expect Trek to maintain a steady pipeline of exploration updates into 2026. This cadence of news will remain important for investor engagement, particularly in a competitive junior exploration environment.

Trek Metals’ latest results underscore the importance of consistent early stage exploration work in proving up prospective ground. While the anomalies do not yet confirm manganese resources, they strengthen the company’s geological model and provide a clear direction for ongoing fieldwork.

The company remains in the early stages of unlocking value at Lawn Hill, and the next several months of mapping results will play a critical role in shaping its exploration trajectory.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles