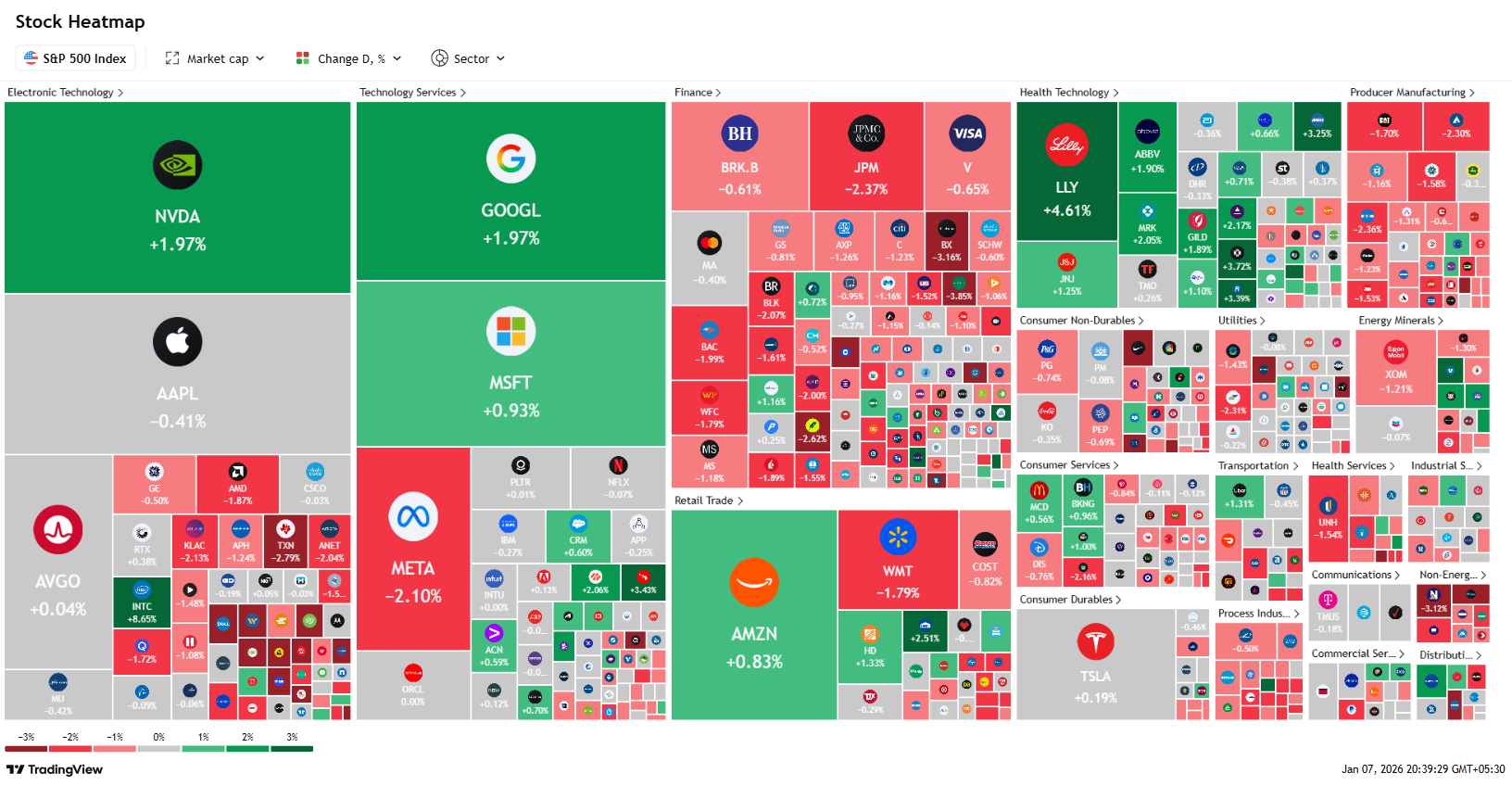

U.S. Markets traded cautiously on Wednesday, January 7, as Wall Street balanced strong momentum from record highs against fresh geopolitical uncertainty tied to Greenland and renewed shifts in global defense policy.

Futures on the S&P 500 and Nasdaq wavered after the benchmark index closed at an all-time high in the previous session, while Dow futures edged higher after the blue-chip index pushed past the 49,000 mark for the first time. Market participants were digesting weaker-than-expected U.S. private payrolls data alongside new geopolitical developments in Europe and the Arctic.

According to ADP, U.S. private employers added 41,000 jobs in December, undershooting expectations. ADP chief economist Nela Richardson said the data pointed to “a labor market losing momentum into year-end,” setting the stage for Friday’s closely watched U.S. jobs report.

At the same time, geopolitical risk has returned to the foreground.

Sorce: TradingView

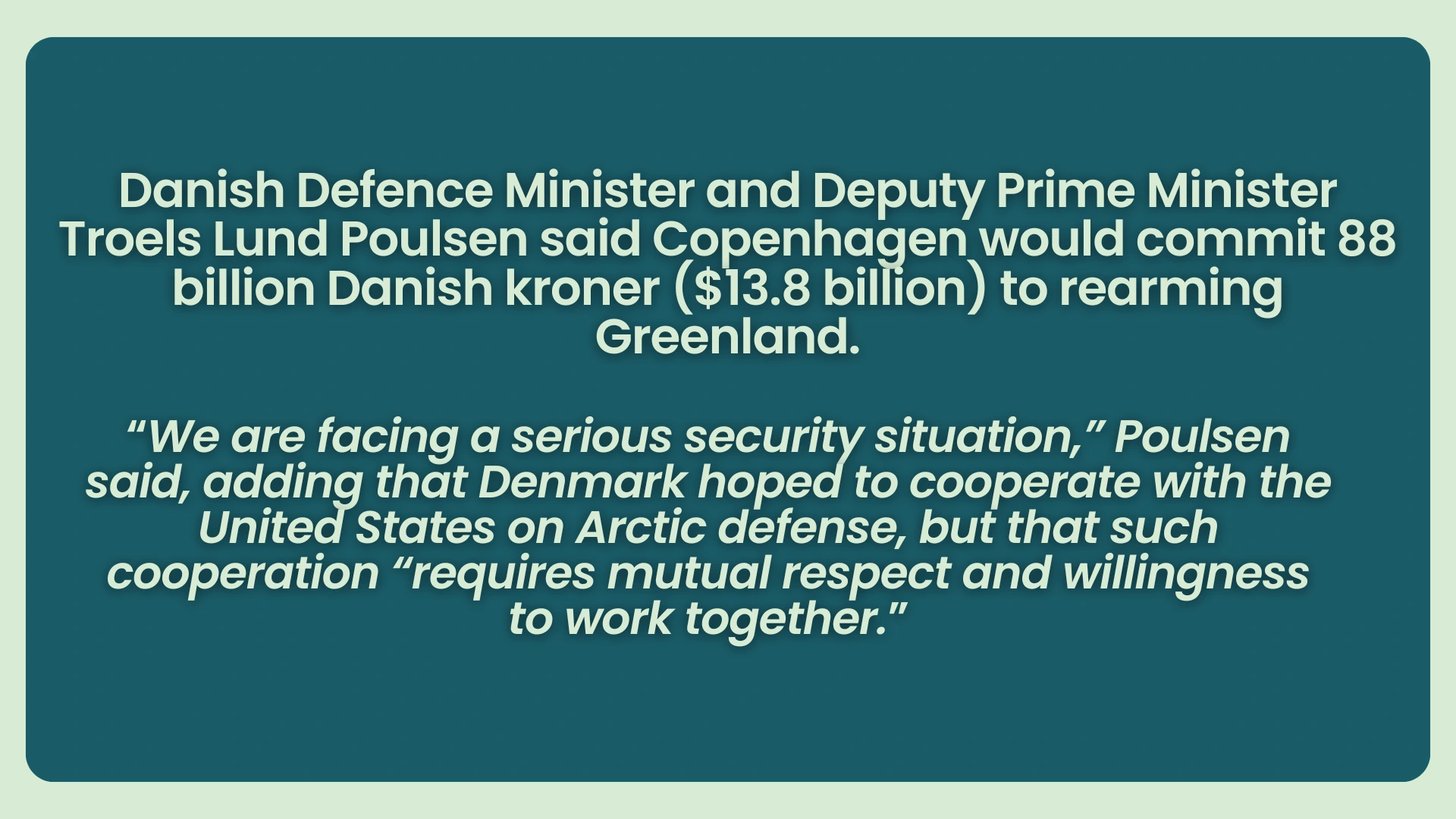

Global attention shifted sharply to Greenland following comments from U.S. President Donald Trump, who said Washington was considering “a range of options” to secure the Arctic territory, including potential military involvement.

White House press secretary Karoline Leavitt confirmed to CNBC that national security considerations were central to the administration’s thinking, as the U.S. weighs growing Russian and Chinese activity in the Arctic.

European leaders responded swiftly. Both Denmark and Greenland reiterated that the territory is not for sale, while Denmark announced a significant escalation in defense spending tied directly to Arctic security.

Source: CNBC, January 7, 2026

The announcement helped crystallize what markets had already begun to price in: a new, long-term defense spending cycle centered on Arctic security.

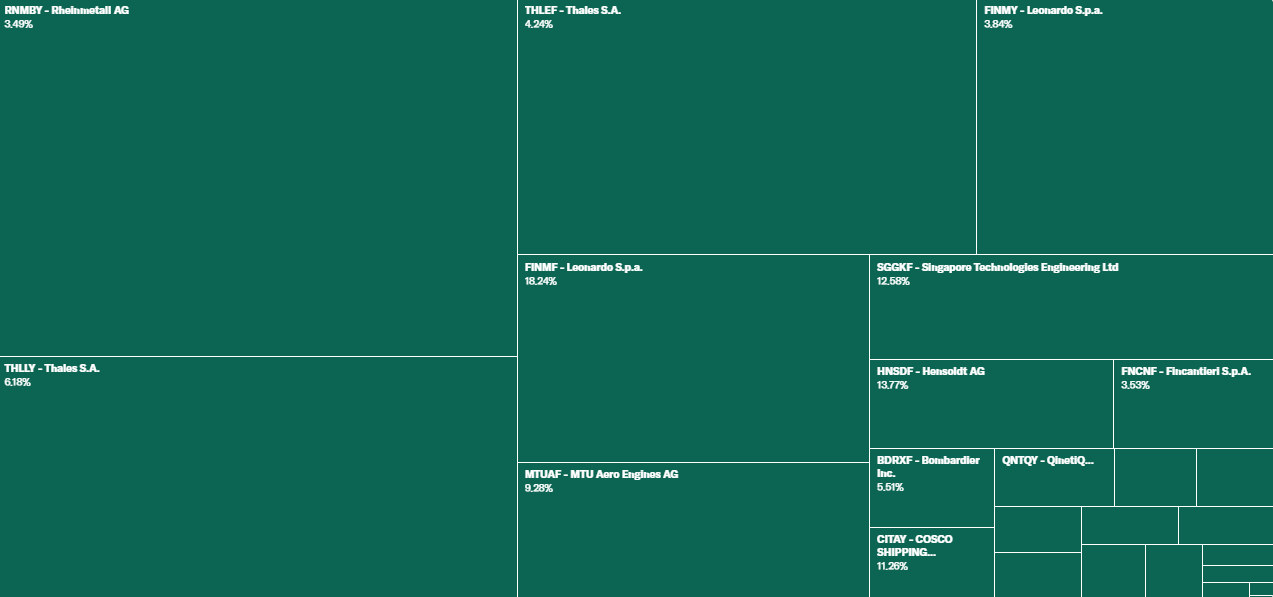

European equities were mixed overall, with the Stoxx Europe 600 trading slightly lower by mid-session. Beneath the surface, however, defense stocks continued to outperform.

The Stoxx Europe Aerospace and Defense index rose 1.6%, marking its fourth consecutive day of gains, according to market data.

Several European defense names posted sharp single-day moves, reflecting expectations of sustained procurement and modernization programs:

Avon Technologies surged over 40%, leading the sector

Leonardo climbed more than 18%

Hensoldt gained nearly 14%

MTU Aero Engines, Chemring Group, and Thales also advanced solidly

AEROSPAVE AND DEFENSE STOCKS - Source: YAHOO FINANCE

The rally reflects a clear market message: defense is no longer a short-term geopolitical hedge, but a structural theme tied to national security priorities.

The same narrative is playing out in the United States.

According to sector data, the U.S. aerospace and defense industry now carries a combined market capitalization of $1.72 trillion, with the sector up 54% over the past year, far outpacing the broader S&P 500.

Large U.S. defense primes such as Lockheed Martin, RTX, Northrop Grumman, and General Dynamics continued to attract steady buying, while smaller and mid-cap names saw sharper percentage moves.

Among the top movers on the day:

Momentus Inc. jumped over 29% on elevated volume

Avon Technologies and Leonardo posted double-digit gains

QinetiQ, Fincantieri, and BAE Systems also advanced

Yahoo Finance data shows the aerospace and defense industry has delivered 182% returns over five years, underlining how geopolitical risk has translated into sustained earnings visibility.

The current rally is being driven by a convergence of macro and micro forces:

First, geopolitical flashpoints are multiplying, from Eastern Europe to the Arctic, pushing governments to accelerate defense spending rather than defer it.

Second, Denmark’s Greenland decision reinforces a broader NATO trend: Arctic defense is now a priority, not a contingency.

Third, U.S. defense contractors are benefiting from long-dated contracts, higher backlog visibility, and bipartisan support for military modernization.

As President Trump framed it earlier this week, Arctic security is no longer optional. He has repeatedly argued that Greenland is vital to U.S. national security, citing increased activity by Russia and China in the region.

Outside defense, global markets remained mixed.

Asian markets were uneven, European indices were split, and commodities softened, with oil prices falling below $60 a barrel after Trump said Venezuela would send up to 50 million barrels of crude to the U.S.

Meanwhile, technology remained in focus at CES 2026, where comments from Nvidia’s Jensen Huang about “unserved demand” in AI data storage helped lift semiconductor sentiment, according to Bloomberg.

Still, defense stocks stood apart as one of the clearest themes of the session.

What markets are signaling is not just a reaction to headlines, but a recalibration of global priorities.

Greenland has become a symbol of a wider shift, where geography, energy routes, and national security intersect. For defense companies, that shift translates into higher budgets, longer contracts, and renewed strategic relevance.

As Denmark, the U.S., and NATO reassess Arctic security, markets are doing the same.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles