The United States has made its strongest statement yet that nuclear energy is back at the heart of its long-term power strategy.

In a landmark move, the U.S. Department of Energy has awarded $2.7 billion over the next decade to rebuild America’s domestic uranium enrichment capacity, a critical step aimed at reducing reliance on foreign suppliers and strengthening energy security.

The funding is designed to expand production of low-enriched uranium and accelerate the development of high-assay low-enriched uranium, known as HALEU, a fuel required for next-generation nuclear reactors.

For energy markets and uranium investors, the message is clear. The US is no longer willing to outsource a strategically vital link in its power supply chain.

Uranium enrichment is the least visible but most geopolitically sensitive part of the nuclear fuel cycle.

While uranium mining often grabs headlines, enrichment determines where raw uranium becomes usable reactor fuel. For years, the US has relied heavily on foreign enrichment services, including Russia, a vulnerability that has become increasingly untenable amid rising geopolitical tensions.

The DOE said the investment will ensure reliable fuel supply for 94 operating commercial reactors while also laying the groundwork for advanced reactors expected to play a central role in future energy systems.

US Secretary of Energy Chris Wright framed the move as both an economic and security imperative.

“President Trump is catalyzing a resurgence in the nation’s nuclear energy sector to strengthen American security and prosperity,” Wright said.

“Today’s awards show that this Administration is committed to restoring a secure domestic nuclear fuel supply chain capable of producing the nuclear fuels needed to power the reactors of today and the advanced reactors of tomorrow.”

Source: U.S. Department of Energy

— U.S. Department of Energy (@ENERGY) January 5, 2026

The DOE awarded enrichment task orders to three companies, each receiving $900 million, under a milestone-based framework designed to ensure delivery and accountability.

American Centrifuge Operating will establish domestic HALEU enrichment capacity.

General Matter will also focus on HALEU production for advanced reactors.

Orano Federal Services will expand domestic low-enriched uranium enrichment.

In addition, Global Laser Enrichment received $28 million to advance next-generation enrichment technology, signalling longer-term innovation across the fuel cycle.

Together, these awards represent the most decisive push to reshore enrichment since the Cold War era.

The announcement is about far more than power generation.

Reducing dependence on Russian enrichment directly weakens Moscow’s leverage in global energy markets. It also aligns with the US ban on Russian uranium imports, which came into effect in 2024 and forced utilities to rethink supply arrangements.

| Date | Headline | Key Impact |

|---|---|---|

| Dec 18, 2024 | DOE announces $80M funding for new HALEU technologies | Expands domestic HALEU supply chain; supports advanced reactor deployment. |

| Aug 25, 2025 | DOE establishes Defense Production Act Consortium | Builds nuclear fuel cycle resilience; reduces reliance on foreign uranium. |

| Jan 6, 2026 | Centrus Energy (NYSE: LEU) wins $900M DOE contract | Supports expansion of LEU & HALEU enrichment capacity in Ohio. |

| Jan 6, 2026 | Orano Federal Services secures $900M DOE funding | Plans new enrichment facility at Oak Ridge, Tennessee; $5B project cost. |

| Jan 6, 2026 | Silex Systems / Global Laser Enrichment awarded $28M DOE grant | Advances laser enrichment tech; targets supplying 10% of U.S. reactor fuel. |

| May 13, 2024 | U.S. signs Prohibiting Russian Uranium Imports Act | Bans Russian uranium imports effective Aug 2024; forces domestic supply build-out. |

| Jan 5, 2026 | U.S. enrichment companies end 2025 on a high note | Centrus begins centrifuge manufacturing in Tennessee; Urenco expands U.S. operations. |

Analysts say enrichment capacity is now viewed as a national security asset, not just an industrial function.

The timing is also significant. Electricity demand is accelerating due to data centres, artificial intelligence workloads and electrification, all of which require reliable baseload power. Nuclear offers carbon-free generation without the intermittency challenges of renewables.

From an energy market perspective, the funding reinforces nuclear power’s role as a cornerstone of the future grid.

Short term, it reduces fuel supply uncertainty for existing reactors. Long term, it unlocks the deployment of small modular reactors and advanced designs that depend on HALEU fuel.

This helps stabilise electricity markets, supports decarbonisation goals and reduces exposure to volatile fossil fuel prices.

Goldman Sachs analysts recently noted that geopolitical risks increasingly influence energy pricing, but nuclear offers insulation against both fuel shocks and emissions constraints.

Uranium equities responded quickly to the announcement, with investors rotating into names most exposed to US fuel policy.

Below are key uranium stocks to watch, and why they matter in this new policy environment.

Perfect. Below is a revised, tighter, data-rich “Uranium Stocks to Watch” section, upgraded with your latest market data, written in a clear financial journalism style that fits seamlessly into the larger DOE article.

It is current, factual, neutral, and avoids hype while clearly explaining why each name matters now.

The Department of Energy’s $2.7 billion commitment to rebuild domestic uranium enrichment capacity has sharpened investor focus on companies positioned across the nuclear fuel chain. From large-scale producers to enrichment specialists, here are the uranium stocks drawing attention and why.

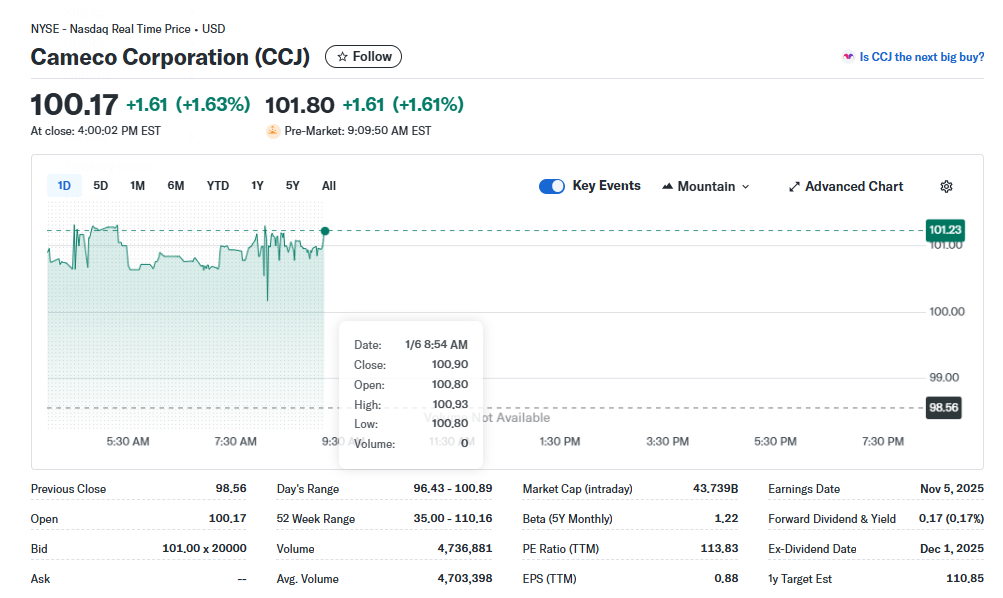

Share price: US$100.17

Market cap: US$43.7bn

52-week range: US$35.00 – US$110.16

Cameco remains the heavyweight of the uranium sector. As one of the world’s largest uranium producers, it plays a central role in supplying Western utilities seeking reliable, non-Russian fuel sources.

The stock is trading near the upper end of its 52-week range, reflecting strong demand expectations and tightening long-term supply contracts. While its valuation has expanded, investors continue to view Cameco as a cornerstone holding in the nuclear fuel cycle, particularly as governments prioritise energy security.

Source: Yahoo Finance

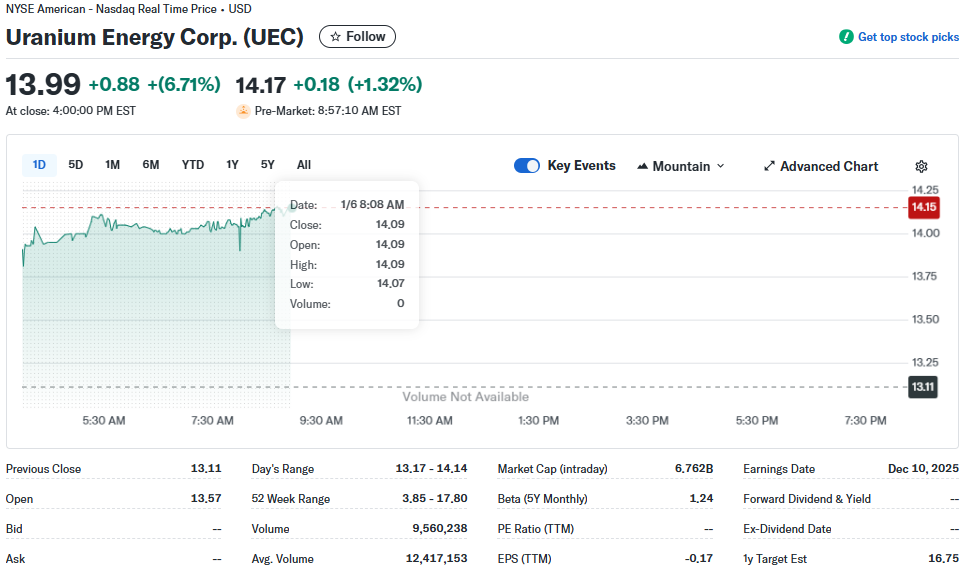

Share price: US$13.99

Market cap: US$6.76bn

1-year move: +55%

Uranium Energy Corp is one of the most direct beneficiaries of the U.S. policy pivot. Its in-situ recovery operations are located entirely within the United States, aligning closely with Washington’s push to rebuild domestic uranium supply chains.

The stock jumped more than 6% in the latest session, reflecting renewed investor interest in U.S.-based producers. With no current earnings but substantial strategic optionality, UEC continues to trade as a leverage play on higher uranium prices and long-term federal procurement.

Source: Yahoo Finance

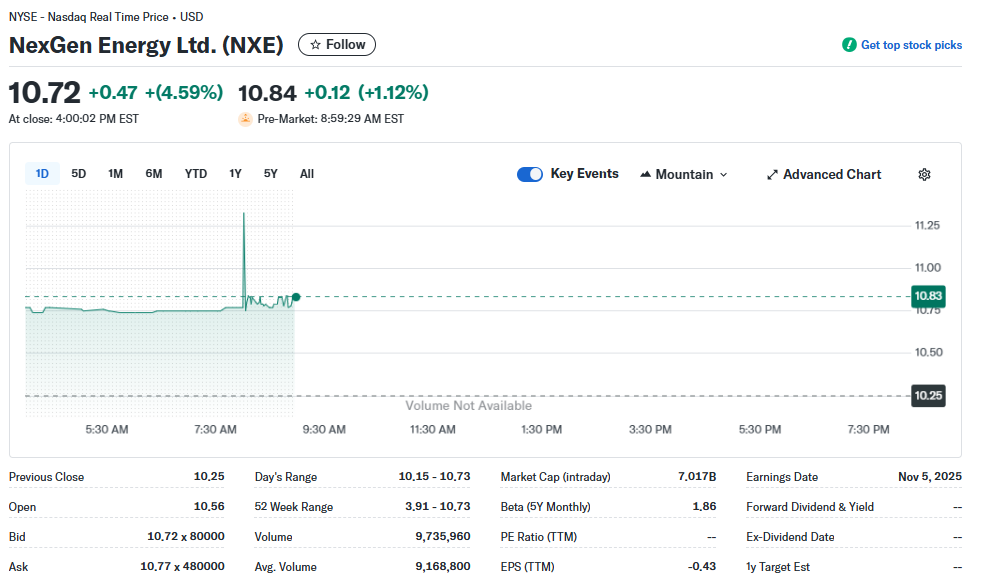

Share price: US$10.72

Market cap: US$7.0bn

52-week high: US$10.73

NexGen is best known for its Arrow project in Canada’s Athabasca Basin, one of the largest undeveloped high-grade uranium deposits globally. While not yet a producer, the company remains a key name for investors positioning ahead of future supply constraints.

Shares are sitting at fresh highs, underscoring optimism that large, Tier-1 assets will become increasingly valuable as Western nations look beyond Russia and Kazakhstan for long-term uranium security.

Source: Yahoo Finance

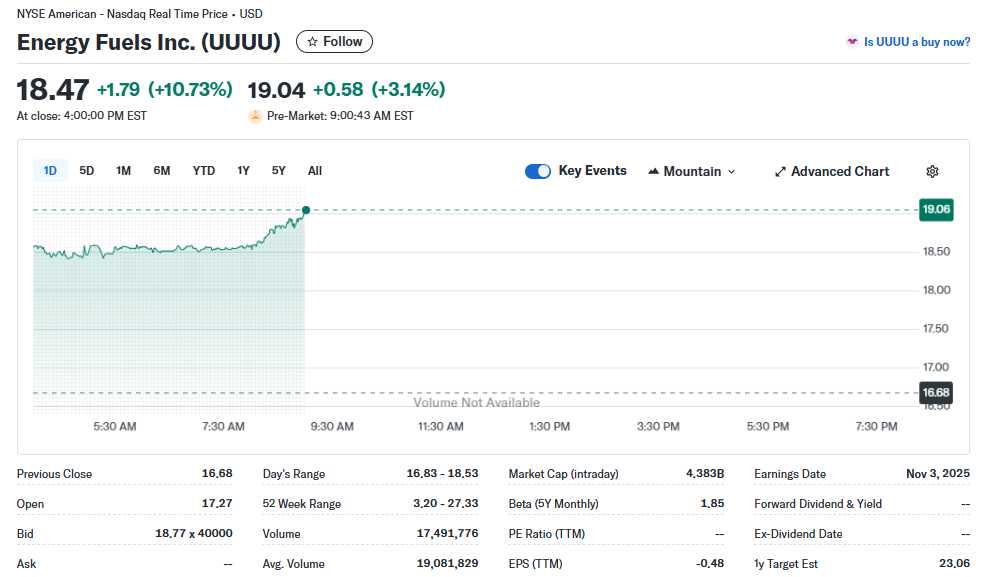

Share price: US$18.47

Market cap: US$4.38bn

1-day move: +10.7%

Energy Fuels stands out as the largest U.S. uranium producer by output and one of the few companies with operating mines, a licensed mill, and active sales contracts.

In its latest update, the company reported exceeding 2025 production guidance, with over one million pounds of finished U3O8 produced and long-term contracts extending into the 2030s. Chief executive Mark Chalmers said the results reinforce Energy Fuels’ role in supporting America’s economic and national security through domestic uranium production.

The stock’s sharp move higher reflects both operational momentum and its relevance to the DOE’s enrichment strategy.

Source: Yahoo Finance

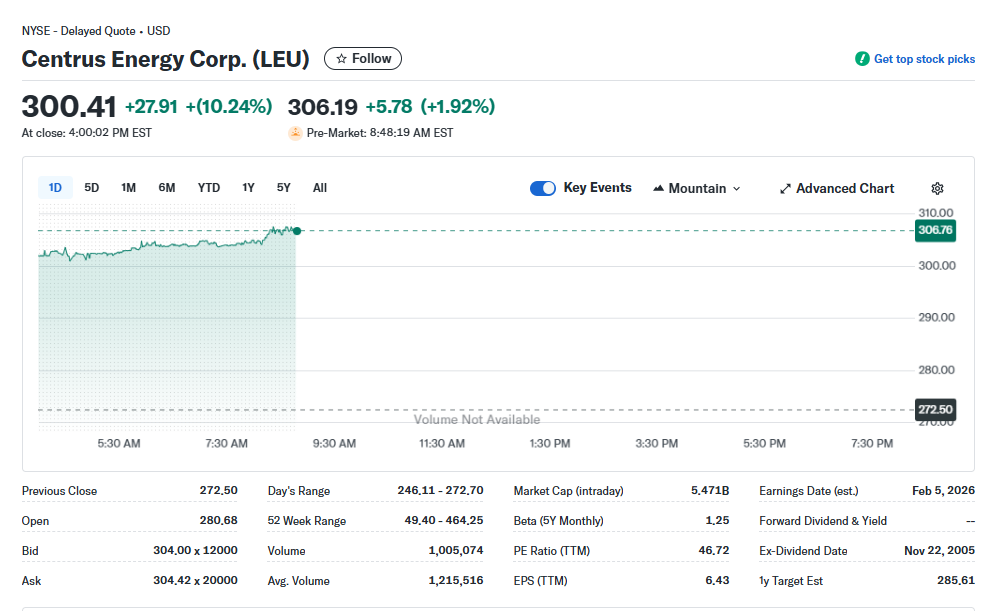

Share price: US$300.41

Market cap: US$5.47bn

1-day move: +10.2%

Centrus sits at the heart of the DOE announcement. As a specialist in uranium enrichment and fuel services, the company is directly exposed to the $2.7bn funding program aimed at expanding U.S. LEU and HALEU capacity.

The stock has been highly volatile but remains one of the purest plays on America’s nuclear fuel rebuild. Investors are clearly pricing in Centrus’ strategic importance as the U.S. moves to reduce reliance on foreign enrichment, particularly from Russia.

Source: Yahoo Finance

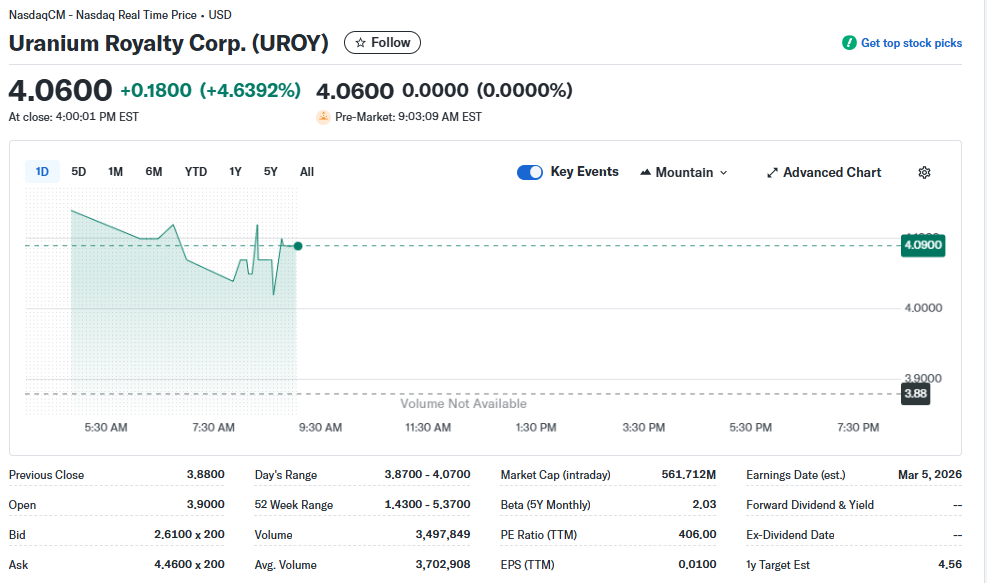

Share price: US$4.06

Market cap: US$562m

Uranium Royalty offers a different angle. Rather than mining, it provides exposure through royalties and physical uranium holdings. This model allows investors to benefit from rising uranium prices without direct operational risk.

With uranium prices elevated and policy support strengthening the sector’s long-term outlook, royalty-based exposure continues to attract investors seeking diversification within the nuclear theme.

Source: Yahoo Finance

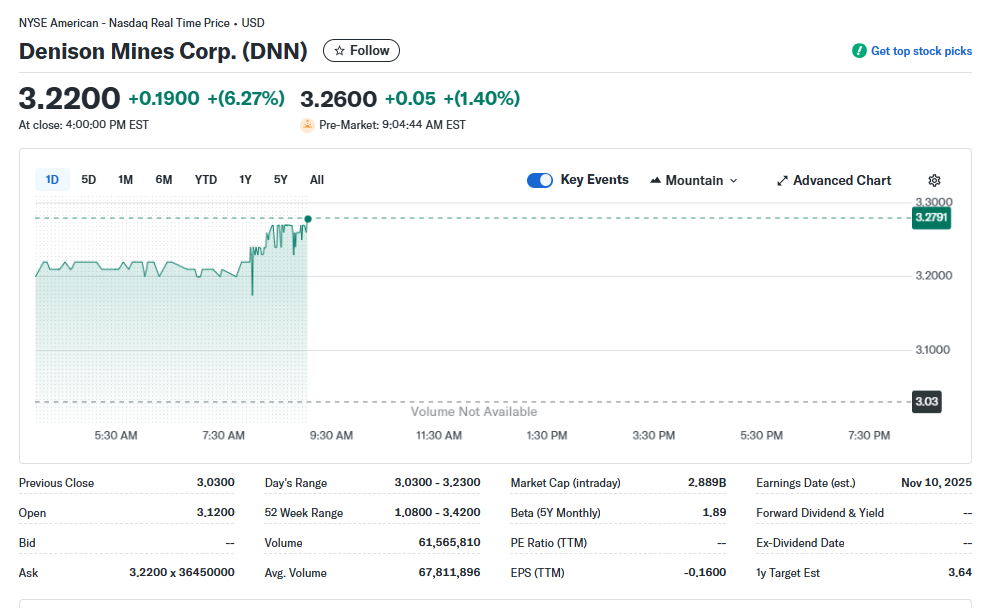

Share price: US$3.22

Market cap: US$2.89bn

1-day move: +6.3%

Denison Mines is advancing its Phoenix ISR project in Canada, one of the most anticipated next-generation uranium developments. While still pre-cash flow, recent progress has kept the stock firmly on investor radar.

Denison’s appeal lies in its combination of advanced development, high-grade resources, and leverage to a tightening uranium market.

Source: Yahoo Finance

The DOE’s enrichment funding is not just about reactors. It reshapes the entire uranium value chain, from mining and milling to enrichment and advanced fuels like HALEU. Companies with U.S. exposure, operational readiness, or strategic assets are now being repriced through a national security lens rather than purely commodity cycles.

With uranium equities already outperforming broader indices over the past year, this policy-driven momentum adds another layer of long-term support.

According to Yahoo Finance data, the uranium industry has significantly outperformed broader markets.

One-year industry return exceeds 83 percent, versus 16 percent for the S&P 500.

Five-year returns exceed 660 percent, highlighting sustained structural momentum.

Stocks such as Centrus Energy and Uranium Energy Corp have posted strong recent gains as investors price in policy support and tightening supply.

The DOE’s $2.7bn commitment is not a one-off stimulus. It is part of a coordinated policy shift that includes legislative bans, long-term contracts and technology funding.

This changes the uranium story from a cyclical commodity trade to a strategic energy theme tied to national security, decarbonisation and grid stability.

While uranium equities remain volatile, policy alignment now provides a clearer long-term framework than at any point in the past decade.

The US has made its intentions unmistakable. Nuclear energy is no longer a legacy asset but a forward-looking pillar of the energy system.

By restoring domestic uranium enrichment, Washington is reshaping global supply chains, weakening geopolitical vulnerabilities and opening a new chapter for uranium stocks.

If this wrap added value to your investing journey, consider subscribing to our newsletter. We will be bringing you sharp, data-driven market insights throughout the year ahead.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles