Zelira Therapeutics has delivered the kind of funding headline small biopharma investors look for, the kind that can quickly shift the market’s “can it fund it?” debate into “how fast can it run its plan?”

On Friday, the company said it had signed definitive agreements to raise US$32,981,075 (before costs) directly into Zelira’s HOPE 1 SPV, bringing total equity issued by the SPV to US$36,558,000.

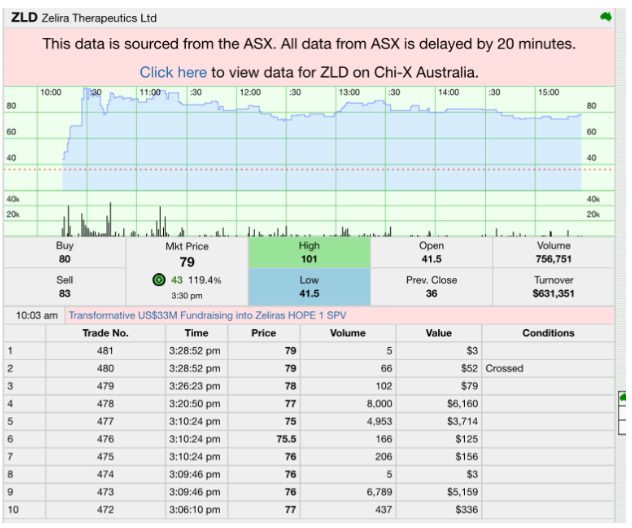

Zelira’s shares were last quoted at $0.75, up 0.39 cents (108.33%) on the session, with the move occurring alongside a 52 week range of $0.310 to $1.010 and a relatively small capitalisation profile of $8.92 million (based on the data supplied). The sharp jump suggests traders were repricing Zelira’s “path to the next clinical value inflection point”, rather than just responding to the size of the cheque.

ZLD Stock Price Data: Stocknessmonster

The critical nuance in Friday’s announcement is the structure. Zelira is not simply raising cash into the listed entity. The money is flowing into a dedicated special purpose vehicle set up to finance clinical trials and commercialisation of HOPE 1 in the United States.

In practical terms, that structure can do two things at once:

At closing, ThirdGate Capital is expected to hold 50.00% of the SPV on a fully diluted basis, with Zelira at 39.70%, existing investors at 5.42%, and a management incentive pool of 4.88%.

Zelira is positioning HOPE 1 as a potential treatment candidate for individuals living with autism, “including rare and underserved forms”, with the initial target indication described as Phelan-McDermid Syndrome (PMS) with comorbidity with autism.

The company says it completed a Pre-IND meeting with the US FDA in Q2 2024, and that the agency confirmed the initial target indication is appropriate for study under the proposed plan. The announcement also states the FDA agreed PMS qualifies as a rare disease, which would allow Zelira to seek Orphan Drug Designation and its associated incentives, including seven years of data exclusivity if granted.

For readers less familiar with US drug development, the “Pre-IND” step is effectively a roadmap discussion. It does not mean approval is close, but it can reduce ambiguity around what evidence regulators expect before a product can move into formal trials.

Zelira describes the funding as sufficient to complete an “accelerated regulatory pathway strategy” utilising the FDA’s 505(b)(2) pathway.

The 505(b)(2) route is often used when a sponsor can rely in part on existing information (for example, published literature or prior findings on similar compounds) rather than starting from a blank page. It is not a shortcut to approval, but it can be a more efficient regulatory framework compared with a fully novel, de novo pathway, depending on the facts of the product.

The significance here is less about labels and more about planning. The fundraising is being sold as enabling Zelira to move from regulatory preparation into active execution: filing, dosing, and running trials.

Zelira CEO Dr Oludare Odumosu framed the raise as a direct endorsement of the HOPE 1 thesis:

Source: ZLD ASX Announcement

He added that the funding should support the SPV’s regulatory strategy through the FDA process, and reiterated a commitment to delivering solutions for patients, families and clinicians, while also seeking to ensure value for shareholders.

ThirdGate’s Cynthia Parrish, a Senior Partner, said the firm’s confidence was built on the combination of “real world patient data” and a “clear regulatory pathway” established through the Pre-IND meeting, pointing to unmet need in PMS and autism spectrum disorder.

The appendix sets out a clear use of funds and governance structure. The SPV agrees to perform HOPE Phase 1/2 (US$17,690,400) and Phase 3 (US$14,067,200) clinical trials, exclusively with iNGENū as the contracted CRO, with fees of US$981,075 referenced in the table.

Board oversight is split across five directors at the initial closing:

That governance mix is worth noting because it signals the shift from “company controlled project” to “institutionally partnered execution”. In biotech, that can raise the bar on discipline and timelines, but it can also introduce new decision makers with their own risk tolerances.

The company outlines near-term focus items for the SPV:

Zelira’s Chairman Osagie Imasogie, appointed Executive Chairman of the SPV, said the team is “laser focused” on progressing the HOPE FDA clinical program, and referenced the earlier SPV investors (The 2011 Forman Investment Trust and Mr Malik Majeed) as crucial to reaching the current inflection point.

Zelira’s share price move is outsized, but the underlying reason is straightforward: the announcement addresses one of the most common pitfalls in early-stage healthcare stocks, funding uncertainty.

In biotech, the market often discounts promise until a company can demonstrate it has:

That said, investors should keep perspective. The SPV funding does not remove clinical risk. The outcomes will still be determined by trial execution, safety, efficacy signals, and the pace of the FDA process. But it does appear to provide the financial runway to reach those proof points.

Disclaimer - Skrill Network is designed solely for educational and informational use. The content on this website should not be considered as investment advice or a directive. Before making any investment choices, it is crucial to carry out your own research, taking into account your individual investment objectives and personal situation. If you're considering investment decisions influenced by the information on this website, you should either seek independent financial counsel from a qualified expert or independently verify and research the information.

Tags:

RECENT POSTS

TAGS

Subscribe to the Skrill Network Newsletter today and stay informed

Recommended Articles